The sun sets on the piney woods near Greenwood, La., where Comstock Resources is drilling a Haynesville well in December 2017. (Source: Tom Fox/Hart Energy)

[Editor's note: A version of this story appears in the December 2018 edition of Oil and Gas Investor. Subscribe to the magazine here.]

In recent years, the Haynesville Shale has reinvented itself as new operators entered the play with significant funding from private equity. These new entrants earnestly applied new completion techniques and longer laterals, imitating practices honed in plays like the Eagle Ford.

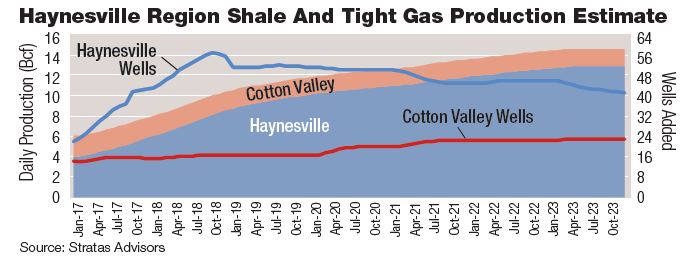

Haynesville region gas production is expected to rise to 11.7 billion cubic feet per day (Bcf/d) by year-end 2019, an increase of 13% from Stratas Advisors’ 10.4-Bcf/d 2018 estimate. Longer laterals, greater stage counts and higher proppant loading will continue, and Haynesville activity will remain robust on flat to rising prices.

The Haynesville represents the lion’s share of activity. For now, the Cotton Valley is expected to remain relatively stable as the majority of current Cotton Valley operators are either focused on other opportunities or lack scale.

The Haynesville represents more than a third of recent regional activity. The top five operators in the play account for more than 60% of activity. Most of these companies are well-known in energy circles, like Chesapeake Energy Corp. (NYSE: CHK), BP Plc (NYSE: BP) and Exxon Mobil Corp. (NYSE: XOM). However, there are some relatively new names too. Companies such as Covey Park Energy LLC, GEP Haynesville LLC and Vine Oil & Gas LP are recent additions to the Haynesville story.

Geographically, Haynesville activity remains centered in Caddo, De Soto and Red River parishes in Louisiana and in Panola and San Augustine counties in Texas. In recent years, over 60% of activity has occurred in those three parishes. Wells in these areas have seen normalized proppant loads increase by 78%, averaging 3,200 pounds per foot in 2017 compared with 1,840 pounds per foot in 2015.

On the Texas side of the Haynesville, a different story unfolded. Average normalized fluid volumes increased 51% over the same time period to more than 3,400 gallons per foot. Meanwhile, the amount of normalized proppant has fallen 18% to approximately 1,550 pounds per foot. Lower proppant volumes along with increased fluid volumes led to peak rates of 1,575 barrels of oil equivalent per day (boe/d), an increase of 24% from the 1,270 boe/d notched previously.

While conventional wisdom tends to think “bigger is better,” this is not always the case, as seen on the Texas side of the play. Natural fractures and bottomhole pressure can result in differing recipes within the same play.

Turning briefly to the Cotton Valley and nearby plays, Range Resources Corp. (NYSE: RRC) through its Memorial Resource Development Corp. acquisition, by far, is the most active operator in the Cotton Valley. Indigo Natural Resources LLC, Tanos Exploration LLC and Rockcliff Energy LLC are also quite active in the Cotton Valley. Other regional activity has centered in East Texas.

As with most plays, operators strived to maximize the amount of production for every dollar spent in the ground. In the Haynesville, in 2009, top operators were spending on average $6.3 million on wells with 5,000-foot laterals and EURs of about 6 Bcf. This translates to $1,260 per foot of invested capital and 1.2 MMcf per foot of gas.

Today, operators spend approximately $12.6 million on 10,000-foot laterals, generating EURs of about 22 Bcf. This combination results in $1,360 per foot of capital invested and 2.2 MMcf per foot of gas. Taking this a step further, the changes made during the past nine years improve capital efficiency by some 40% for the Haynesville.

The marriage of private equity and seasoned management teams was a key driver behind these improvements. The Blackstone Group LP (NYSE: BX) and Vine, Denham Capital and Covey Park, and GEP, a joint venture formed by GeoSouthern and a unit of Blackstone, plied their crafts with diligence and commitment. While these names may be new, the assets they operate are familiar.

Vine took possession of assets formerly operated by Royal Dutch Shell Plc (NYSE: RDS.A). Meanwhile, Covey Park took over assets from EP Energy Corp. (NYSE: EPE), and GEP assumed ownership of assets owned by Encana Corp. (NYSE: ECA). Hence, these firms held true to a tried and true maxim, zip code matters. Anyone engaged with shale back in the dawning days surely remembers that Shell, Encana and El Paso (now EP Energy) posted rock-solid results.

Today, top operators account for over 80% of completed wells in the Haynesville. Gazing into our metaphorical crystal ball, images of BP, Chesapeake, Covey Park and others tackling new well designs dance in our heads. These and other operators in Louisiana and Texas surely sent their wish lists in early, loaded with goodies like new bits and geosteering and BHAs, among other things.

Recommended Reading

Google Exec: More Collaboration Needed for Clean Power

2024-04-17 - Tech giant Google has partnered with its peers and several renewable energy companies, including startups, to ramp up the presence of renewables on the grid.

US Geothermal Sector Gears Up for Commercial Liftoff

2024-04-17 - Experts from the U.S. Department of Energy discuss geothermal energy’s potential following the release of the liftoff report.

Hirs: Aspirations Meet Reality—The Undisclosed High Cost of the Energy Transition

2024-04-16 - The nation is trying to keep up with the growth of renewable power resources, but before transmission lines can be built, the power plants must first have interconnects with the grid.

Nova Clean Energy Acquires BNB’s 1-GW HyFuels Portfolio in Texas

2024-04-16 - Covering about 25,000 acres on the Texas Gulf Coast, HyFuels’ power supply will be split evenly between wind and solar energy.