For the foreseeable future, the Permian Basin is the Alpha and the Omega of unconventional oil and gas production, producing more than 2.5 MMbbl/d so far in 2017, according to the Energy Information Administration (EIA). But operators are not sleeping on other major plays, namely the Haynesville and the Eagle Ford.

According to the EIA, production in the Eagle Ford has climbed back to more than 1.2 MMbbl/d for the first time since early 2016, and Baker Hughes, a GE company (BHGE), reported that the Eagle Ford rig count has increased more than 83% over the past year, from 37 active rigs in 2016 to 68 by the end of September. Through late September Eagle Ford production has eclipsed 320.8 MMboe, although still far below its 2015 peak of about 584 MMbbl/d, according to the EIA. However, production in the Eagle Ford took a hit when many wells were taken offline as Hurricane Harvey impacted the Gulf Coast, and particulary south Texas, in August and September.

In the Haynesville gas production has increased 4 MMcm/d (143 MMcf/d) monthover- month, according to the EIA. In addition, BHGE reported that the Haynesville rig count also has seen a steady climb from 19 rigs in September 2016 to 45 in September of this year. Through September, the Haynesville has produced 212 Mcm/d (7.5 MMcf/d), according to the EIA.

This graph shows the top oil producers by barrels of oil equivalent through September in the Eagle Ford. EOG Resources has been the play’s top performer, producing more than 41 MMboe as of September. (Source: Hart Energy Mapping & Data Services)

This graph reflects the companies operating in the Eagle Ford that average the highest production per well. As of September, Devon Energy has produced an average of 30 Mboe for its wells. (Source: Hart Energy Mapping & Data Services)

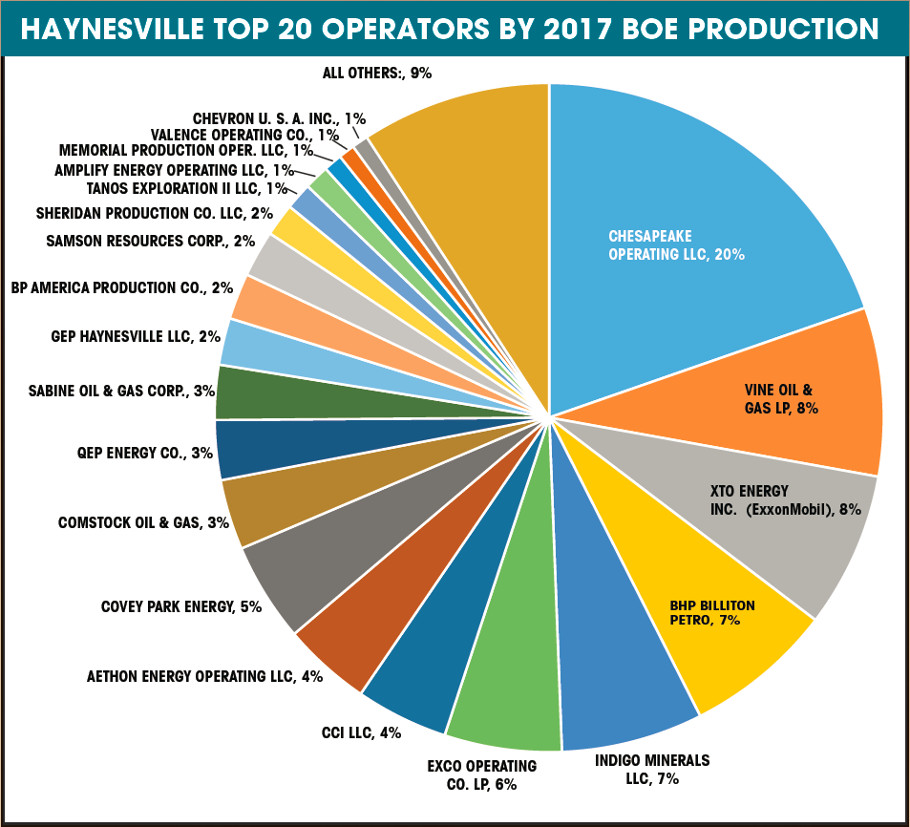

This graph shows the top oil and gas producers by barrels of oil equivalent through September in the Haynesville. Chesapeake Energy Corp. has been Haynesville’s top performer, producing more than 28 MMboe as of September. (Source: Hart Energy Mapping & Data Services)

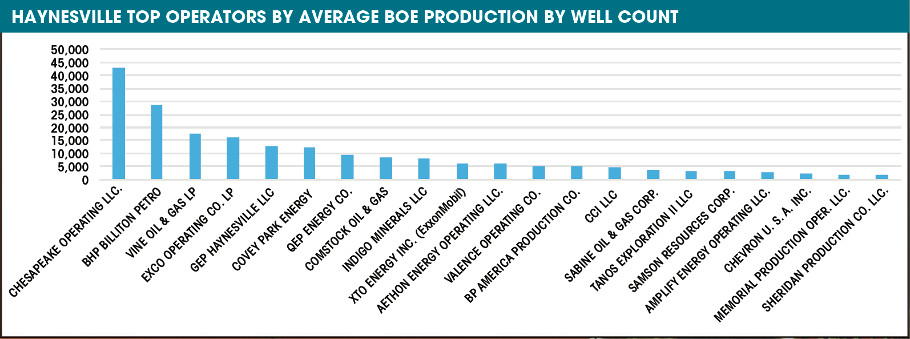

This graph reflects the companies operating in the Haynesville that average the highest production per well. As of September, Chesapeake Energy has an average production of 43 Mboe from more than 600 wells. (Source: Hart Energy Mapping & Data Services)

Recommended Reading

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.

Mitsubishi Makes Investment in MidOcean Energy LNG

2024-04-02 - MidOcean said Mitsubishi’s investment will help push a competitive long-term LNG growth platform for the company.

Texas Pacific Land Approves Three-for-one Stock Split

2024-03-10 - Each stockholder of record as of March 18 will be distributed two shares for each share owned.