(Source: Hart Energy; Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

The Rig Cascade is Underway

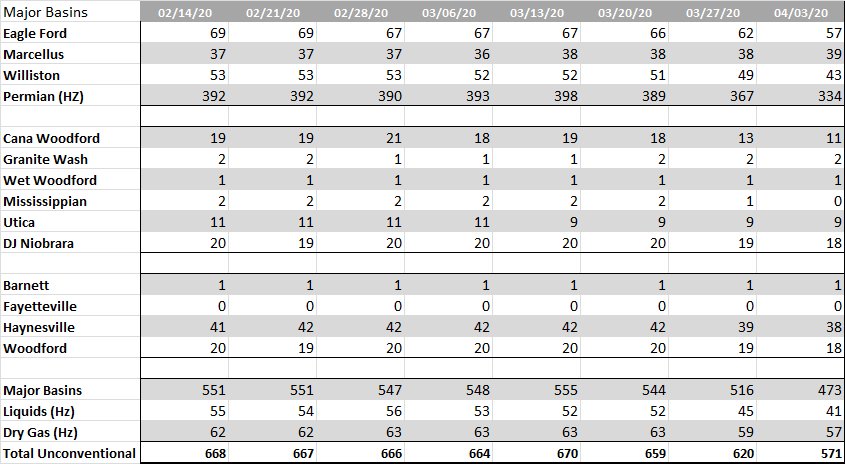

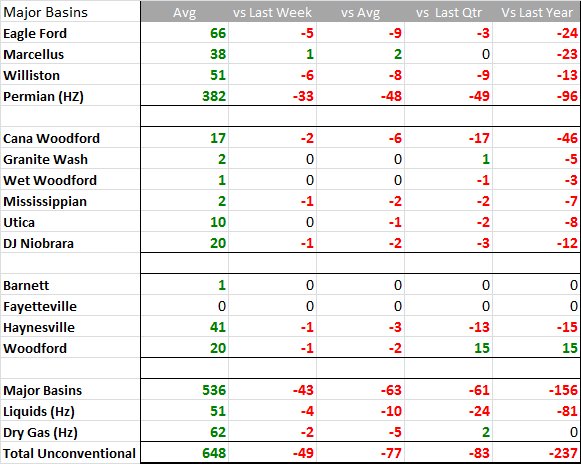

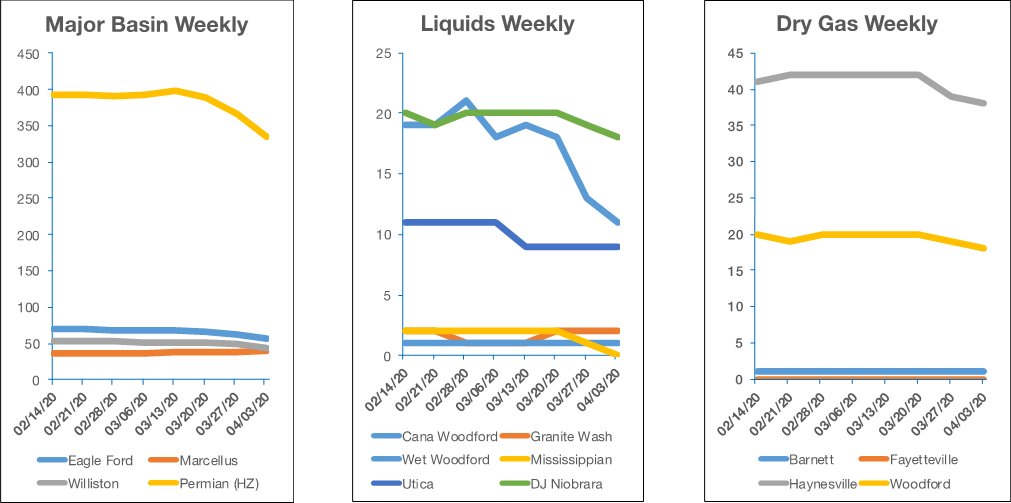

This week, and just like that, the rig cascade got underway. Hart Energy’s Unconventional Activity Tracker fell 49 units over the last week, or seven rigs per day.

Tight formation rig count is down 97 units since February 14, and 237 units versus last year. In fact, rig count fell to the lowest level since January 2017 and then it was on the way up after the 2016 collapse—that mobilization effort was one of the industry’s great achievements, especially so on the well stimulation side.

As for the current rig cascade well, we’re just getting started in a process that will play out over the next 90 days. Previous downturns have seen rigs released at the rate of more than 10 per day during the most difficult periods in the episodic severe retrenchments that have beset oil and gas over the last 30 years. If you’ve been in the industry that long, you’ve witnessed six major downcycles.

You’ve witnessed four, including this one, if you’ve been in oil and gas during the shale era. And that’s just since 2009.

The ultimate carnage will be devastating for oil field services in terms of activity volume even if the nominal carnage is not as bad this time as in previous cycles. After all, there were fewer rigs in the market this go-around, thanks to the leverage of pad drilling, which provided more wells per rig per year. Those efficiency gains have been stellar. None make a difference at $25 oil.

Drilling contractors who had wisely created contracts that provided them net free cash flow even in a reduced rig employment environment are going to see more rigs released—the great cascade is just getting underway among public E&Ps—and will give back whatever the difference is between top line revenue and daily operating cost before this comes to a close. Not that those concessions will do operators any good. When Whiting Petroleum filed for bankruptcy protection, that was the starter’s gun in the new race for survival where E&Ps that fall behind will be left behind and destined for a legacy as asterisks in the historical footnotes of the severely contracting publicly-held E&P equity market in the post-2020 cycle.

For now, the big race is against full petroleum storage. Even if the federal government refills the Strategic Petroleum Reserve brimful, it amounts to just seven or eight weeks’ worth of product. At that point, and this is beginning now, storage will be full, pipelines Thanksgiving Day-turkey stuffed with liquid and offshore storage in the form of tankers largely and expensively oversubscribed. So fasten your seatbelts. We’ll see each other, or at least those who remain, on the far side of the cycle.

Weekly

Trends

Quarterly

Hart Energy’s exclusive rig counts measure drilling intensity. Our counts exclude units classified as rigging up or rigging down, and also exclude rigs drilling injection wells, disposal wells or geothermal wells. The result is our most accurate assessment of rigs on location working on oil or gas programs as of the sample date. While our process results in a rig tally that is lower than the published numbers from the non-proprietary rig-tracking agencies, Hart Energy believes our product presents the most accurate picture of what is actually occurring in the field.

Recommended Reading

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

XGS Energy Secures $9.7MM in New Financing

2024-01-23 - XGS Energy's latest funding round will demonstrate the commercial readiness and scalability of its new thermal reach enhancement technology.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Halliburton Posts High Operating Margins for 2023

2024-01-24 - Halliburton’s CEO Jeff Miller says service intensity contributes to ongoing strong oilfield service fundamentals.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.