Overall U.S. Rig Count Up Slightly

Enverus reported that U.S. drillers this week added oil and natural gas rigs for the second time in three weeks as a recent increase in energy prices from coronavirus-linked lows prompted some to return to the wellpad.

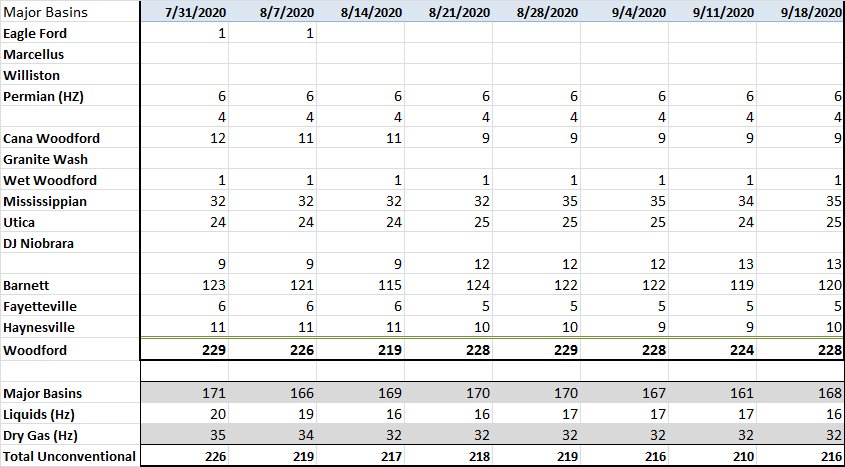

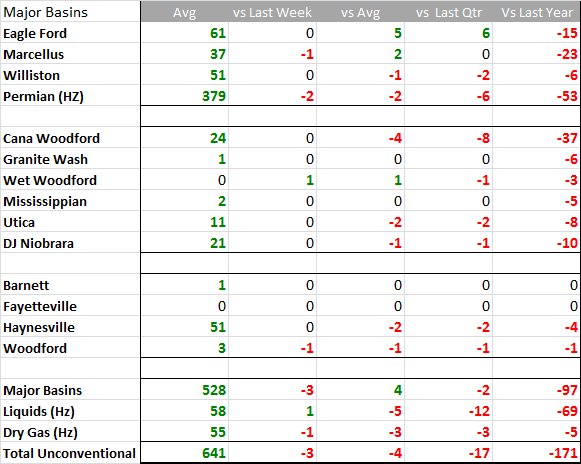

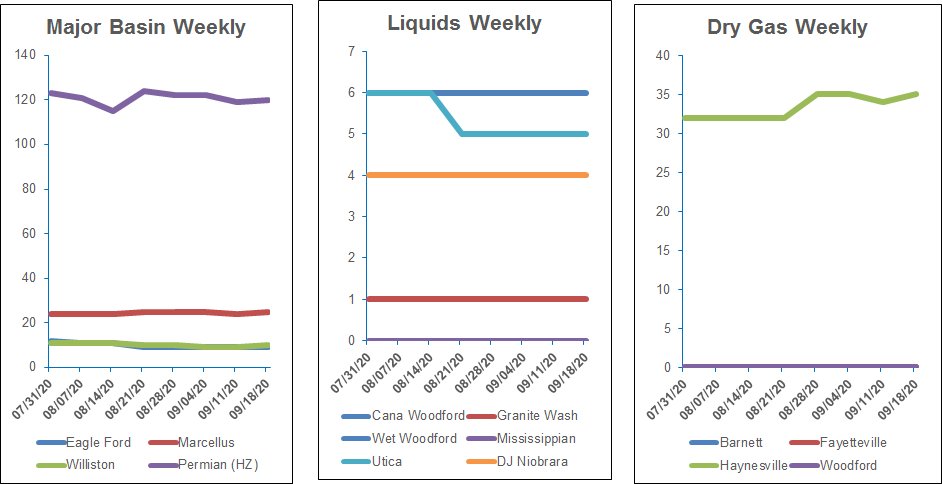

The Anadarko Basin lost six rigs, the Marcellus/Utica lost four and the Denver-Julesburg Basin lost one. Outside of major onshore basins, however, nine rigs were added in the last week.

The U.S. rig count is up 3% in the last month but down 68% year-over-year. The count has been below 300 since June 3. Third-quarter levels to date have averaged 280 and stayed within a 29-rig range, indicating a stable level of activity for the quarter—but not a recovery.

Even though U.S. oil prices are still down about 33% since the start of the year due to the demand effects of coronavirus, crude futures have gained 118% over the past five months to around $41/bbl on Sept. 18 on hopes global economies and energy demand will snap back as governments lift more lockdowns.

Analysts said those higher oil prices have encouraged some energy firms to start drilling more and expect that activity will begin/continue inching higher into (year-end 2020) and remain optimistic that September may represent the trough. U.S. financial services firm Cowen & Co. said that some E&Ps issued early estimates for 2021 that so far point to 8% drop in spending next year versus 2020.

Trends

Recommended Reading

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.