Rig count rises slightly, crude futures show five-month gain

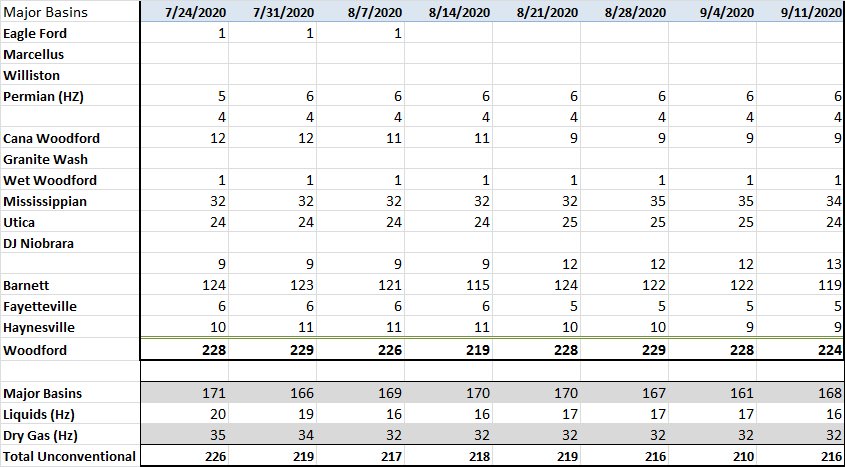

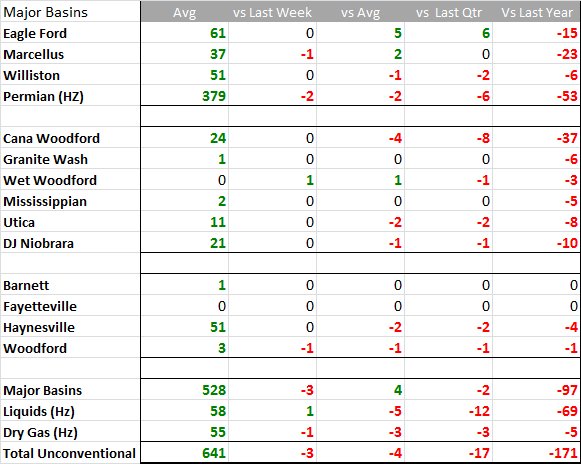

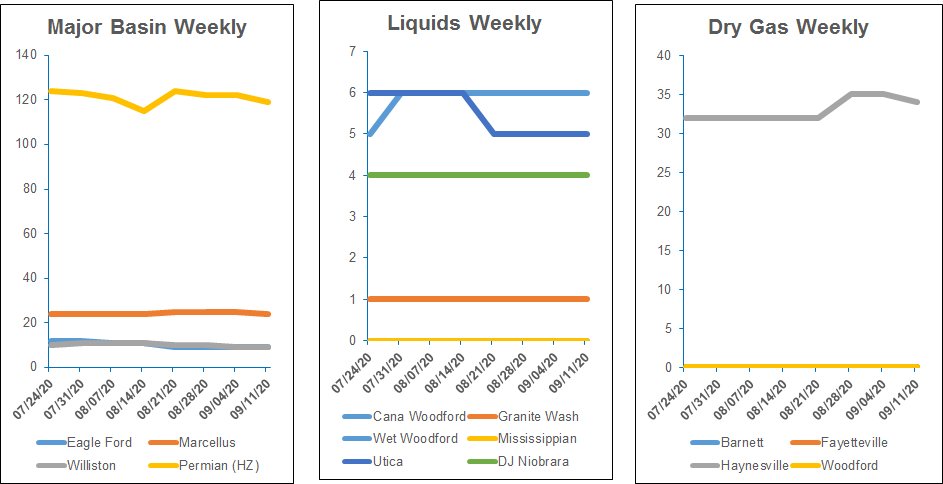

In the last week, the U.S. rig count, according to Enverus, rose by seven to 284, as of Sept. 9. The count of oil and gas rigs operating in the U.S. is down 1% in the last month and down 69% year-over-year.

Weekly increases have been noted in the Gulf of Mexico region, the Anadarko Basin and Appalachia.

Baker Hughes reported that U.S. crude oil production is expected to fall 870,000 bbl/d to 11.38 million bbl/d in 2020, a less steep decline than the 990,000 bbl/d that was forecast in August.

Even though U.S. oil prices are still down about 38% since the start of the year from lower demand due to coronavirus, U.S. crude futures have gained 100% over the past five months to around $37/bbl on Sept. 11, mostly on hopes global economies and energy demand will snap back as governments lift lockdowns.

Analysts said higher oil prices have encouraged some energy firms to start adding units in recent weeks but most firms still plan to keep cutting costs.

U.S. financial services firm Cowen & Co. said the independent E&P companies it tracks plan to cut spending by about 47% in 2020 versus 2019. Cowen also said that some E&Ps issued early estimates for 2021 that so far point to an 8% drop in spending next year versus 2020.

Trends

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

Duke Energy Appoints Harry Sideris to President

2024-03-15 - Steve Young, executive vice president and chief commercial officer, will retire from Duke Energy on June 30.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.