Rig Count Increases 13% Over the Last Month

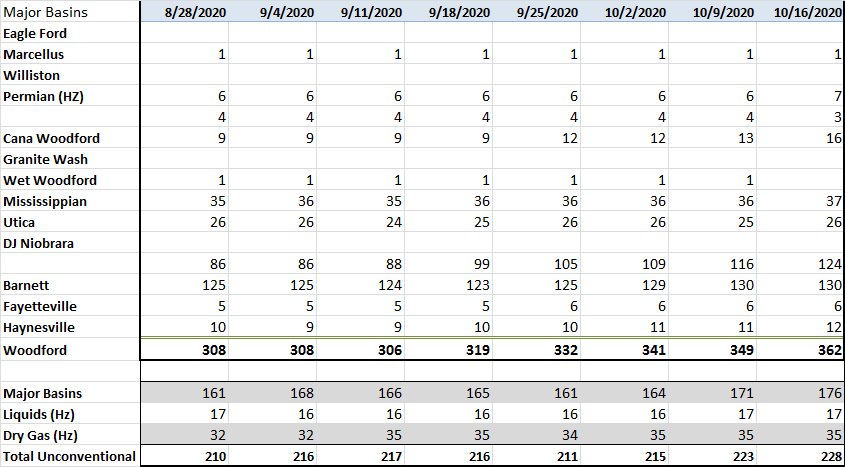

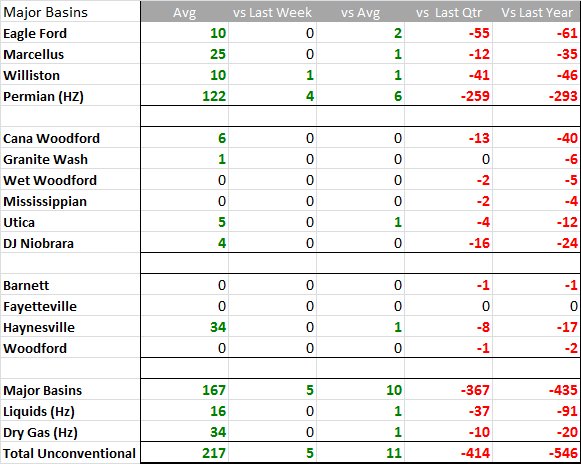

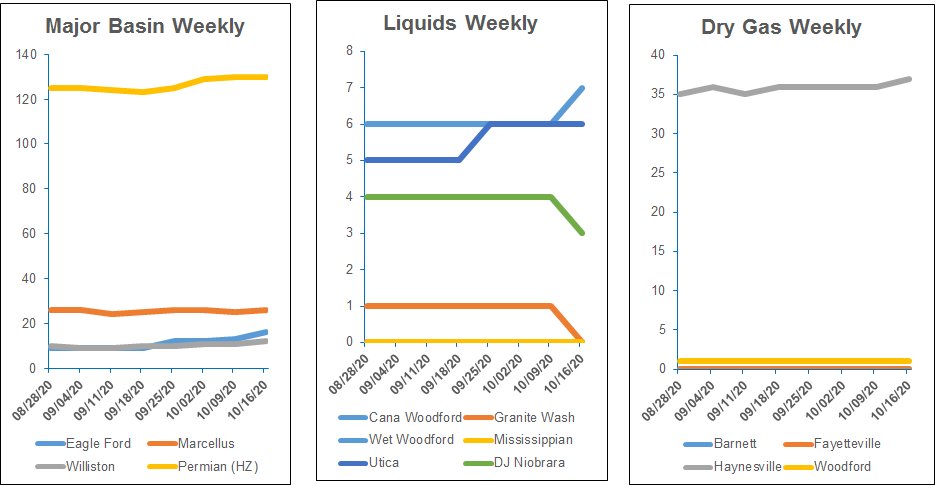

The U.S. rig count rose in the last week. Enverus reported that the count is up 13% in the last month but down 63% year-over-year. The most significant weekly rig increases by major basin were in the Permian (up four to 129), Gulf Coast (up four to 31) and Appalachia (up three to 35).

Pioneer Natural Resources Co. added an eighth rig in the Permian during the second week of October. Mewbourne Oil Co. and Endeavor Energy Resources both averaged two rigs during the third quarter and now have added and additional two rigs each during the current quarter. Private operators Burnett Oil Co. Inc. and Spur Energy Partners LLC had zero operating rigs in the second and third quarters, but both companies have since added one rig each.

Even though U.S. oil prices are still down about 34% since the start of 2020 due to coronavirus demand impact, WTI crude futures have gained 116% over the past six months to about $41/bbl on Oct. 16 mostly on hopes global economies and energy demand will return as governments lift more lockdowns.

Meanwhile two contrasting approaches from Russia and Saudi Arabia have two contrasting approaches to address market imbalances—potential feud among a proactive or reactive response to the winter uptick could disturb oil markets in a few weeks, Stratas Advisors says in its latest oil price forecast.

The oil market is entering some of the most important weeks of the year. With the upcoming U.S. presidential election, a definitive decision—or lack thereof—of an additional economic package to support U.S. businesses and individuals, as well as OPEC’s definitive decision about crude cuts that could potentially impact oil markets and prices until 2022.

Trends

Recommended Reading

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.