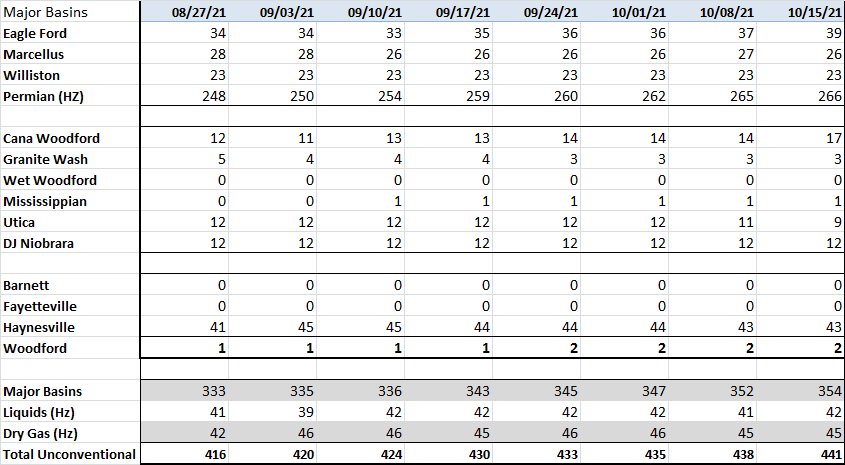

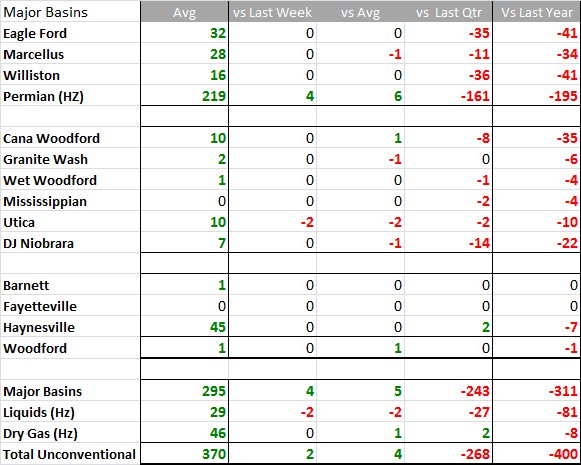

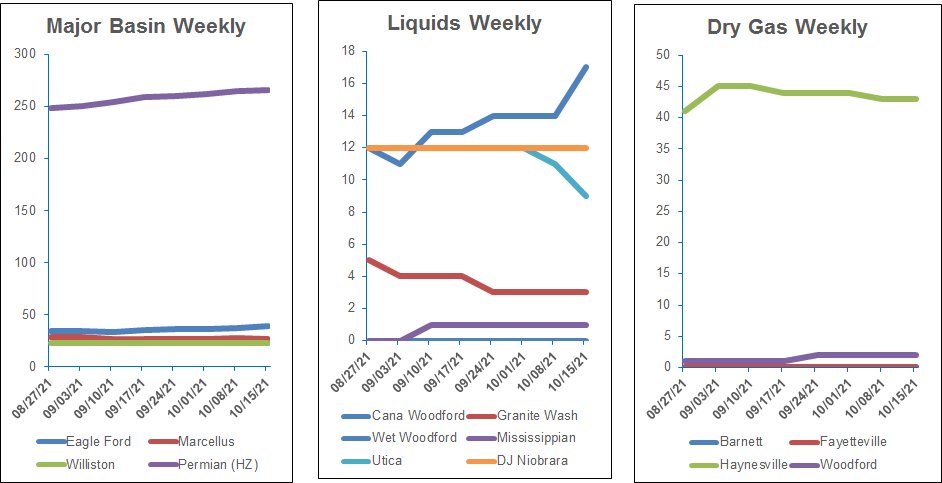

The U.S. rig count increased by 10 in the last week, according to Enverus Rig Analytics. The count is up almost 5% in the last month and up 95% in the last year.

The Permian Basin led the way in the increase, adding seven rigs in the last week to reach 241, while Appalachia gained four rigs for a total of 48 and the Gulf Coast added three rigs for 75. The Williston Basin had the largest drop, losing three rigs week over week to 26.

WTI crude futures in the U.S. rose to their highest since 2014 this week and were currently trading around $82/bbl on Oct. 15, on forecasts of a supply deficit over the next few months as rocketing gas and coal prices stoke a switch to oil products.

An even bigger price increase has occurred for natural gas—futures were up 115% so far this year—but has not yet encouraged drillers to seek more gas.

The oil rig count was up about 67% since the start of the year, while the number of active gas rigs was only up about 19%.

Analysts said there were a lot of reasons drillers were adding more oil rigs than gas, including that U.S. domestic demand for gas has been declining since hitting a record high in 2019 due to coronavirus demand destruction in 2020 and as high prices in 2021 caused power generators to burn more coal.

In addition, the U.S. was already turning all the gas it could into LNG for export, so producing more of the fuel would only reduce prices, not meet an increase in demand.

Trends

Recommended Reading

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

TotalEnergies to Acquire Remaining 50% of SapuraOMV

2024-04-22 - TotalEnergies is acquiring the remaining 50% interest of upstream gas operator SapuraOMV, bringing the French company's tab to more than $1.4 billion.

TotalEnergies Cements Oman Partnership with Marsa LNG Project

2024-04-22 - Marsa LNG is expected to start production by first quarter 2028 with TotalEnergies holding 80% interest in the project and Oman National Oil Co. holding 20%.