Rig Count Shows Slight Overall Increase

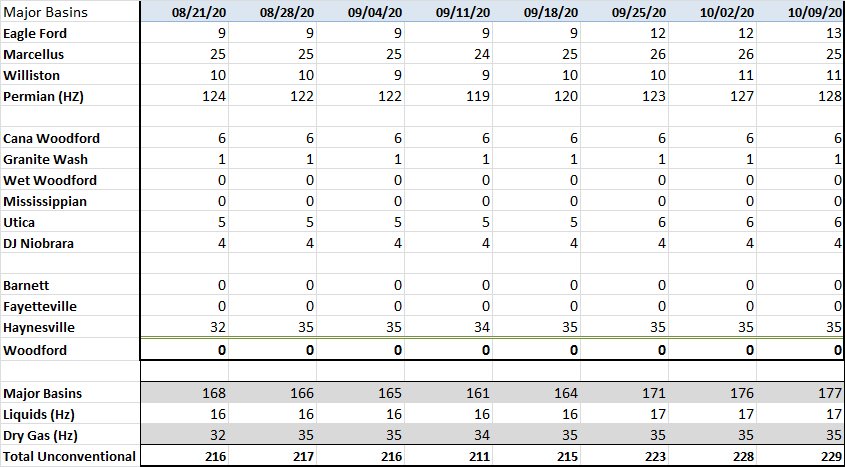

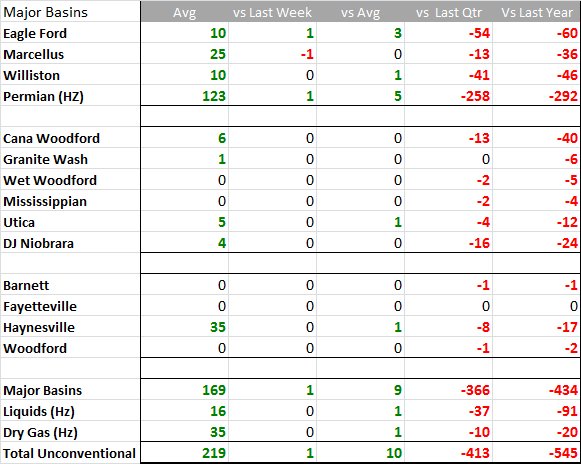

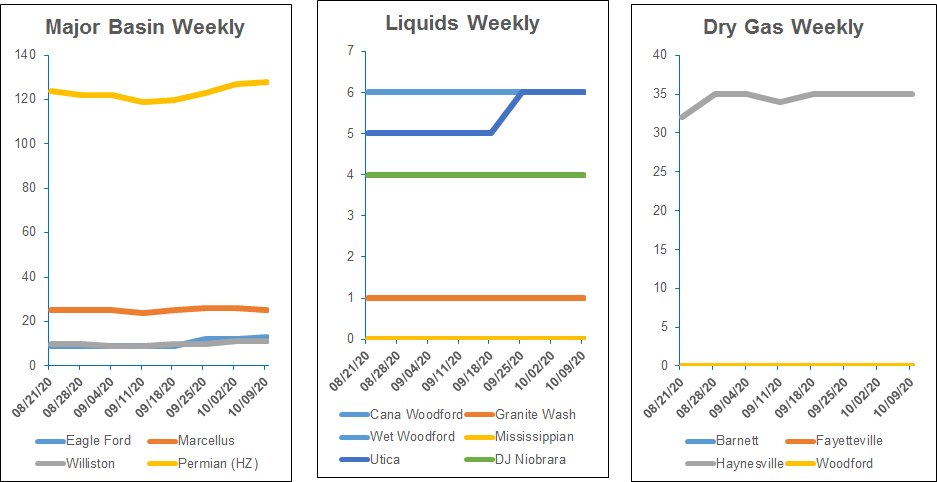

Since the week-over-week rig count from Sept. 30, the total rig count has increased by 17. According to Enverus, the count is up 12% in the last month, but down 64% in the last year.

Two areas lost rigs in the past week—the Permian Basin and the Appalachian Basin. The Gulf Coast region has added four rigs by companies including Penn Virginia, SilverBow Resources and Ineos. Marathon Oil added a third rig.

Even though U.S. oil prices are still down about 33% since the start of the year due to lack of demand from coronavirus, WTI crude futures have gained 117% over the past five months to around $41/bbl on Oct. 9 mostly on hopes global economies and energy demand will snap back as governments lift lockdowns.

Analysts from Tudor, Pickering, Holt & Co. said: “We’re now quite convinced that the horizontal rig count trough is officially in the rear-view mirror, and we continue to expect to see some additional [albeit modest] improvement into year-end 2020.”

Additionally, Simmons Energy, energy specialists at U.S. investment bank Piper Sandler, forecast the U.S. rig count would fall from an annual average of 943 in 2019 to 431 in 2020 and 326 in 2021 before rising to 583 in 2022.

Trends

Recommended Reading

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.