U.S. rig count rises–largest gains in Gulf Coast, Permian Basin

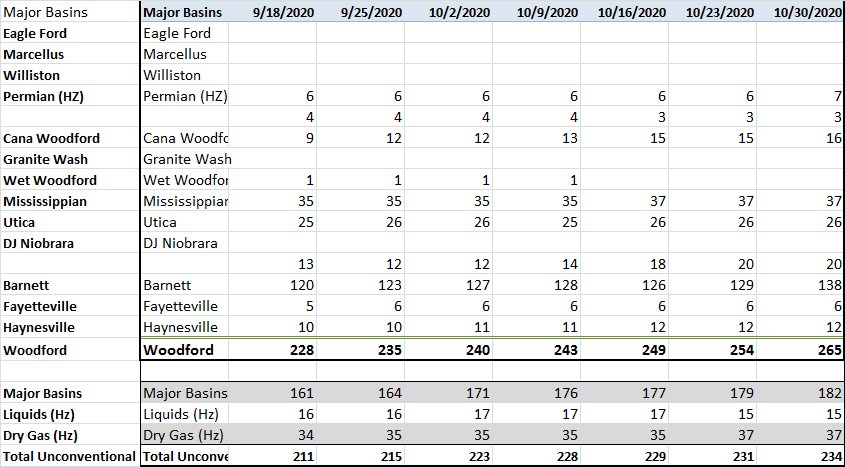

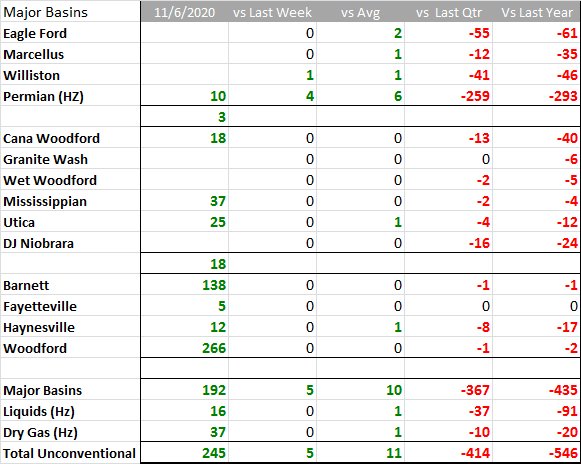

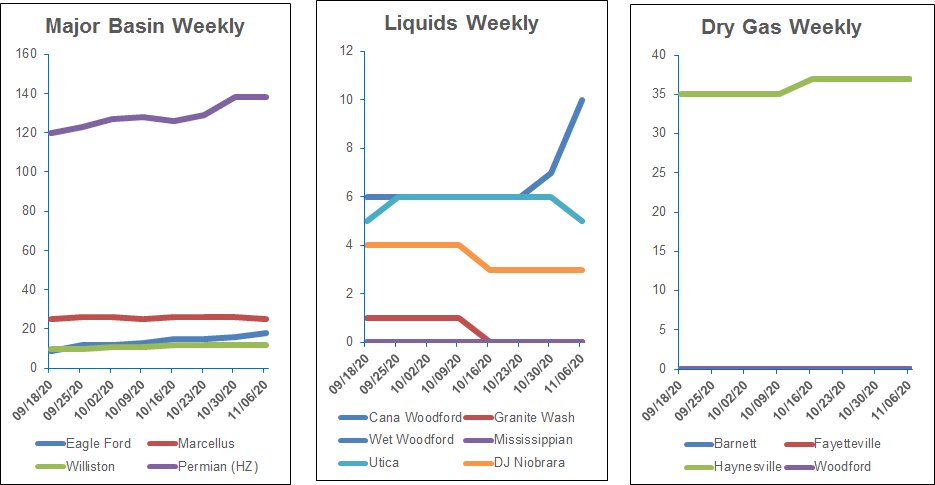

The U.S rig count is up 14% over the last month but down 57% year-over-year, according to Enverus. The firm reported that the largest week-over-week gains by major basin were in the Gulf Coast (five new) and Permian (10 new).

According to the Enverus’ upcoming day-rate report, some contractors that participated in the October survey said they expect drilling to improve slightly in 2021, as bid requests for next year’s drilling programs have increased. However, average day rates have yet to find a bottom since the oil price crash in March, with the average falling another 1% in October to $15,269.

Since late August, when WTI was above $43/bbl for the first time since March, the U.S. rig count has steadily increased from a little over 270 rigs to the current level with only minor hiccups along the way. Yet in that same timeframe, WTI pricing has suffered three major setbacks to around $36/bbl, with the latest occurring last week.

These pullbacks were at least partially caused by threats to demand, such as new lockdowns prompted by an increase in COVID-19 cases, or by threats of increased crude supply, such as Libya’s resurgent production. However, even though roughly 75% of fieldwork performed by drillers is spot work—according to the Enverus day-rate report—the U.S. rig count has largely been unaffected by persistent market volatility.

Reuters reported that oil prices rose more than 2% on Nov. 4 after Donald Trump falsely claimed victory in a tight U.S. election with millions of votes still to be counted and after data showed a large decline in U.S. crude inventories.

Oil prices were also supported by the possibility that OPEC producers, Russia and other allies could consider deferring a planned increase in OPEC+ oil output from January as a second coronavirus wave stifles a recovery in fuel demand.

OPEC+ earlier agreed to ease cuts by 2 million bbl/d from the current 7.7 million bbl/d January.

Trends

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.