Rig count, crude futures fall slightly, shale basin gas production rises

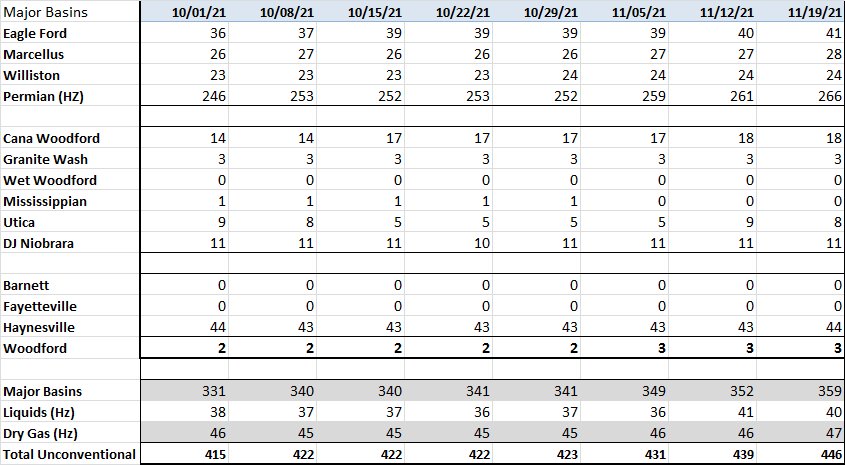

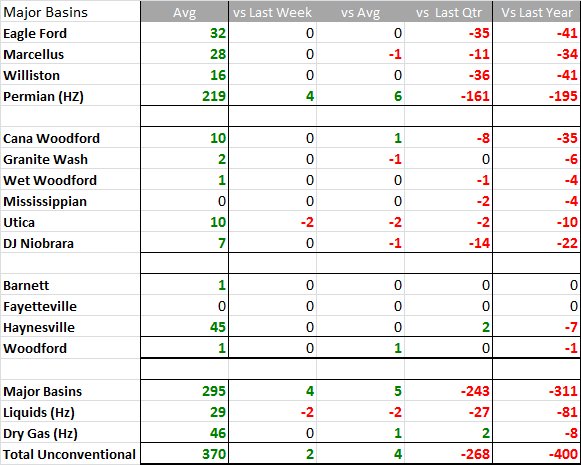

The number of rigs running in the U.S. fell by nine in the last week, according to Enverus Rig Analytics. The count is up 0.6% on the month and up 73% on the year. The most notable week-over-week changes occurred in the Permian, where the addition of 10 rigs brought the total to 263, and the Gulf Coast, where the nine-rig decline brought the tally to 75.

The week-over-week change in the Gulf Coast was driven by single-rig declines by individual operators. Four of those operators were running only one rig to begin with, resulting in the active operator count in the Gulf Coast dropping from 61 to 57. EOG Resources is the most active operator (six rigs), and ConocoPhillips (four rigs).

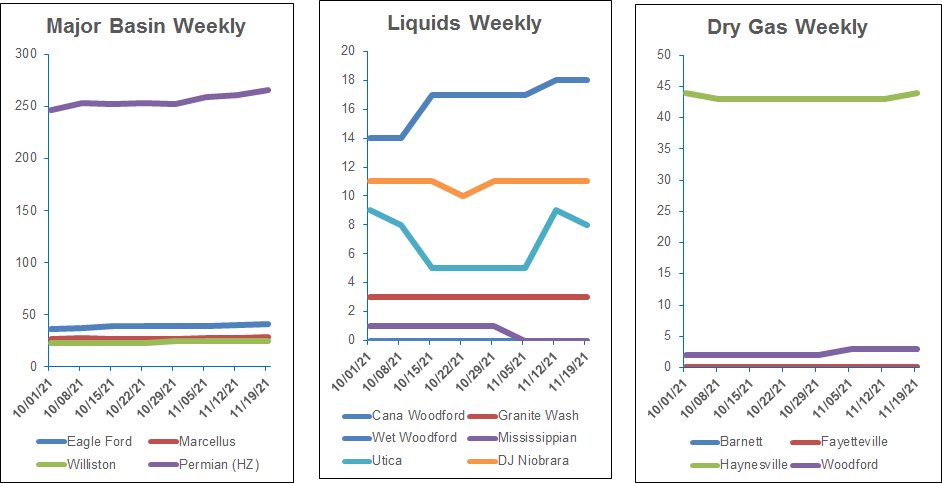

After closing at their highest levels since October 2014 early last week, U.S. crude futures dropped to about $76 per barrel Nov. 19 as surging COVID-19 cases in Europe threatened to slow the economic recovery. Oil prices are still up about 57% this year and natural gas futures were up 96% so far this year but it has not yet encouraged drillers to drill for more gas.

Even though producers were not drilling many new gas wells, the U.S. Energy Information Administration (EIA) projected gas output from the biggest shale basins would rise to a record high for a seventh month in a row in December — this is in part because companies were completing oil and gas wells drilled long ago and it has prompted some analysts to project that drilling will have to increase soon or production will decline as the number of drilled but uncompleted (DUCs) wells falls.

According to the EIA, producers drilled 649 oil and gas wells and completed 871 in the biggest shale basins in October, leaving just 5,104 DUCs, the lowest since December 2014.

That was the 16th month in a row that the number of DUCs declined, the longest streak on record, according to EIA data going back to 2014.

Trends

Recommended Reading

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.