Rig count increases slightly; oil and natural gas prices rise

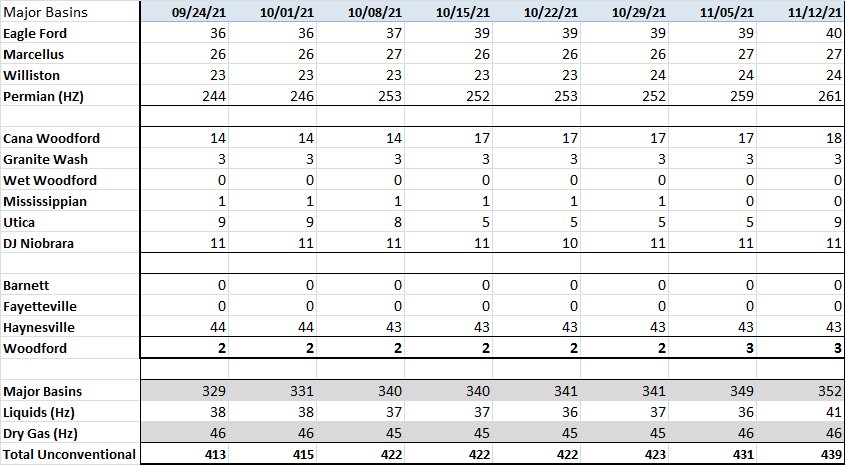

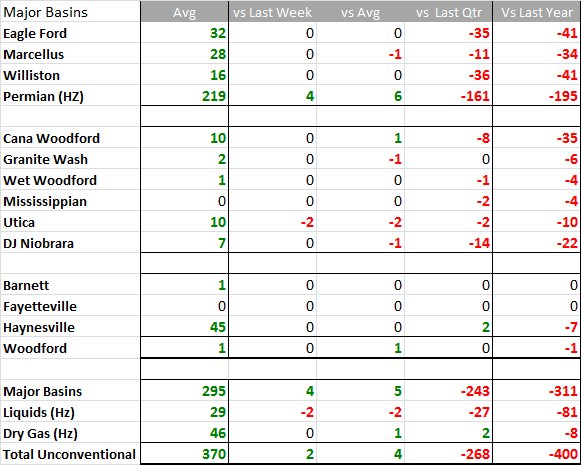

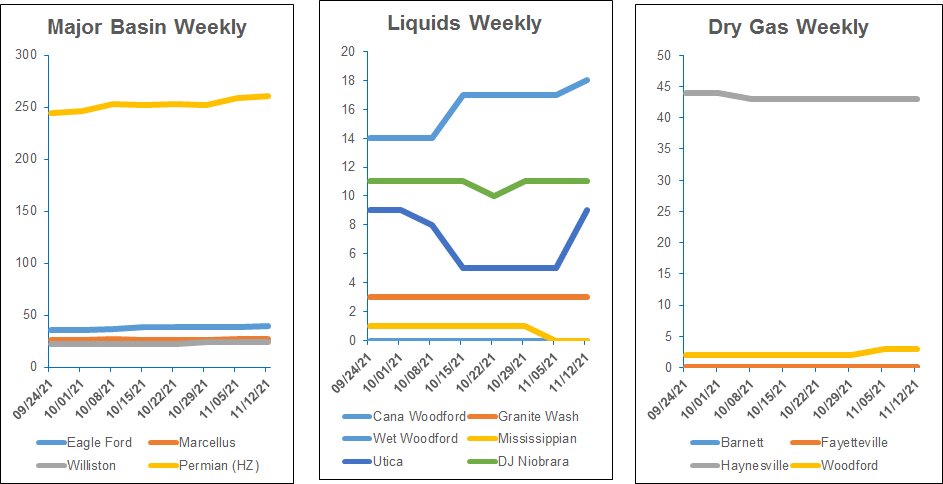

The active U.S. rig count increased by three last week, according to Enverus Rig Analytics. The count is up by over 3% in the last month and 76% in the last year.

The Permian Basin had the largest week-over-week gain, adding five rigs. The Anadarko Basin had the largest loss, dropping five rigs.

The most active operators in the U.S. are currently:

- Pioneer Natural Resources Co. with 25 rigs;

- EOG Resources Inc. with 22;

- Mewbourne Oil Co. with 18;

- Continental Resources Inc., ConocoPhillips Co. and Devon Energy Corp. with 17 each; and

- Occidental Petroleum Corp. with 16.

In the Permian Basin, Mewbourne was the only operator to add more than one rig over the last week, increasing its Permian total to 16. Quantum Energy Partners-backed Rio Oil & Gas II dropped both of its rigs in the Permian and was the only company to drop more than one.

No operators in the Anadarko Basin gained or lost more than one rig. Of the 11 companies that dropped a rig week over week, nine were only running one rig to begin with. Conversely, all six operators that added a rig were inactive in the play the previous week.

WTI crude futures in the U.S. rose close to their highest prices since 2014 earlier this week and were trading around $81/bbl on Nov. 12.

With oil prices up about 67% so far this year, some energy firms said they plan to boost spending in 2021 and 2022 but that spending increase, however, remains small as most firms continue to focus on boosting cash flow, reducing debt and increasing shareholder returns rather than adding output.

Natural gas had a larger price increase than oil—futures were up 91% so far this year but has not yet encouraged drillers to seek much more gas.

Trends

Recommended Reading

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

2024-04-18 - Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.

‘Monster’ Gas: Aethon’s 16,000-foot Dive in Haynesville West

2024-04-09 - Aethon Energy’s COO described challenges in the far western Haynesville stepout, while other operators opened their books on the latest in the legacy Haynesville at Hart Energy’s DUG GAS+ Conference and Expo in Shreveport, Louisiana.

Mighty Midland Still Beckons Dealmakers

2024-04-05 - The Midland Basin is the center of U.S. oil drilling activity. But only those with the biggest balance sheets can afford to buy in the basin's core, following a historic consolidation trend.

Mesa III Reloads in Haynesville with Mineral, Royalty Acquisition

2024-04-03 - After Mesa II sold its Haynesville Shale portfolio to Franco-Nevada for $125 million late last year, Mesa Royalties III is jumping back into Louisiana and East Texas, as well as the Permian Basin.