Rig count up 4% in the last month; oil and gas prices still increasing

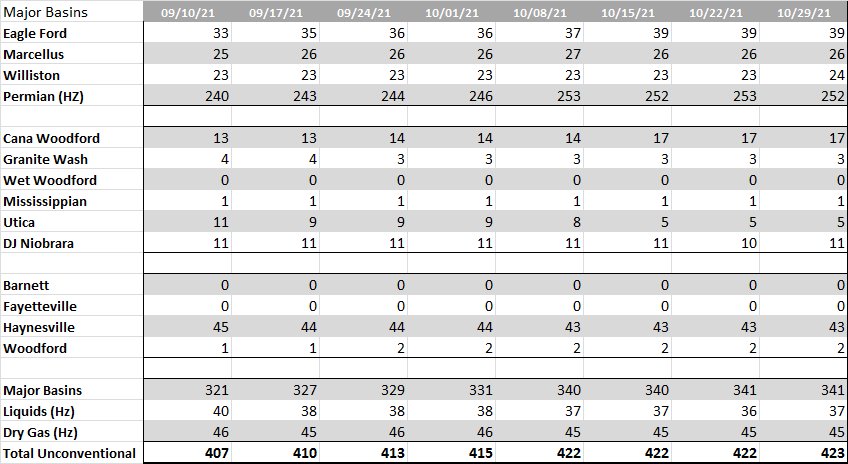

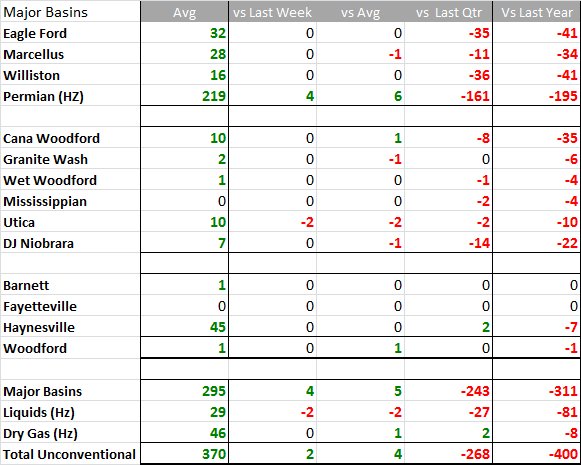

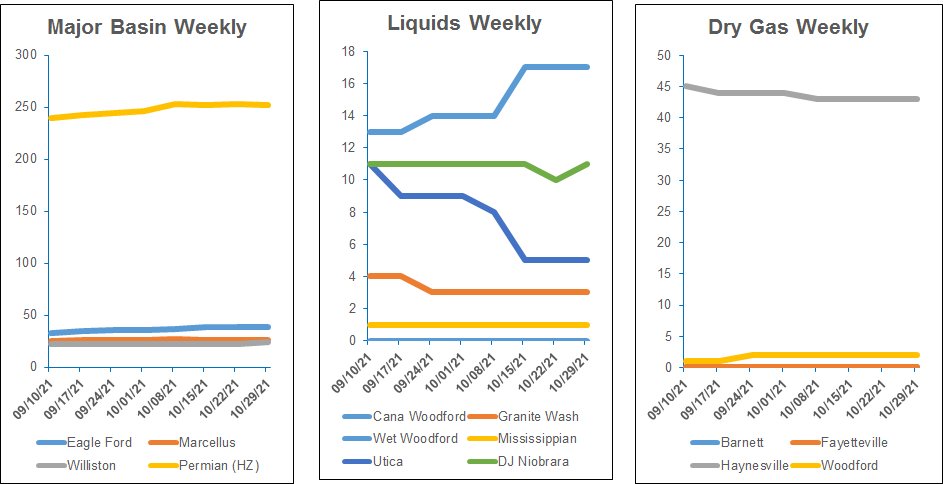

The U.S. rig count rose by two in the last week. According to Enverus Rig Analytics, the count is up 4% in the last month and up 91% in the last year. Activity levels are still down nearly 200 rigs compared to this time in 2019. That was the seventh time the rig count increased in the past eight weeks.

Several of the major plays are at or near 2019 levels for this time of year, with the Anadarko Basin running only four fewer rigs than in October 2019 at 53. Appalachia is essentially flat while the Gulf Coast is off only 10% at 81. The Permian Basin is about 38% below October 2019, and the Denver-Julesburg Basin is still down more than 40%. The total count is up for a 14th month in a row for the first time since July 2017.

WTI crude futures in the U.S. rose to their highest since 2014 earlier this week and were currently trading around $83/bbl Oct. 29.

An even bigger price increase has occurred in natural gas—futures were up 115% so far this year but it has not yet encouraged drillers to drill for more gas. The oil rig count was up about 66% since the start of the year, while the number of active gas rigs was only up about 20%.

Even though producers were not drilling many new gas wells, the U.S. Energy Information Administration (EIA) projected gas output from the biggest shale basins would rise to a record high for a sixth month in a row in November—this is in part because companies were completing oil and gas wells drilled long ago, prompting some analysts to project that drilling will have to increase soon or production will decline as the number of DUCs falls.

The EIA said producers completed 876 oil and gas wells in the biggest shale basins in September, the most since March 2020, leaving just 5,385 DUCs, the lowest since February 2017.

It was the 15th month in a row that the number of DUCs declined, the longest streak on record, according to EIA data going back to 2014.

Trends

Recommended Reading

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Northern Oil and Gas Ups Dividend 18%, Updates Hedging

2024-02-09 - Northern Oil and Gas, which recently closed acquisitions in the Utica Shale and Delaware Basin, announced a $0.40 per share dividend.

ConocoPhillips EVP of Strategy, Sustainability, Technology Macklon to Retire

2024-02-16 - Dominic Macklon, who began his career with Conoco in 1991, is set to retire ConocoPhillips May 1.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

GE Vernova Completes Spin-Off from GE

2024-04-04 - GE Vernova, an energy transition company, began trading as an independent company on the New York Stock Exchange this week.