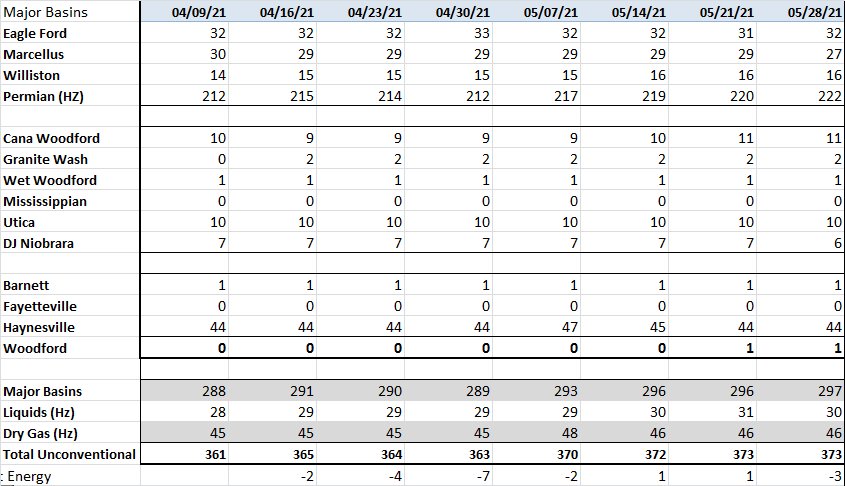

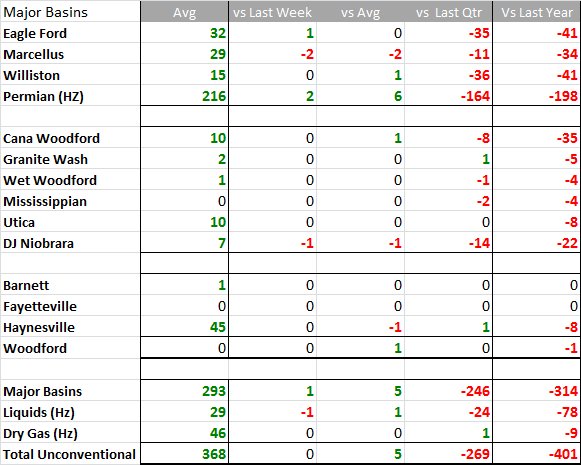

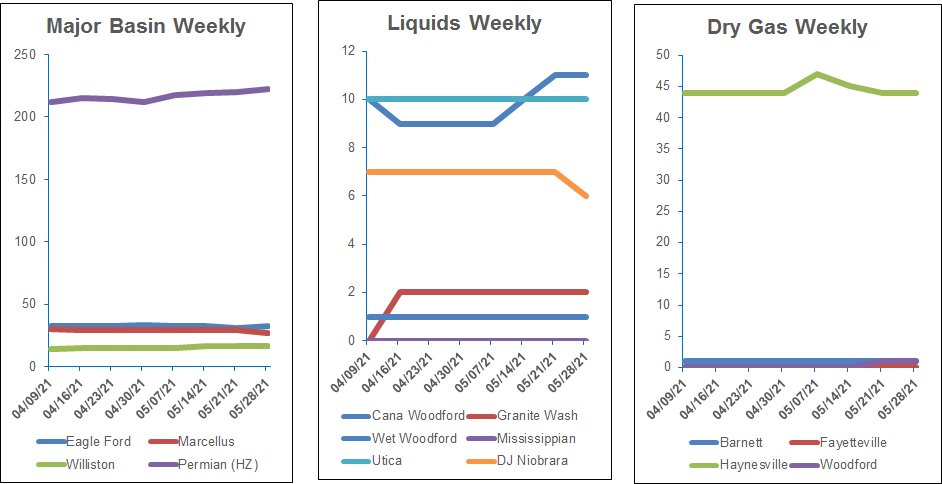

Rig count down slightly for second week in a row

According to Enverus, the U.S. rig count fell slightly for the second week in a row, leading to the conclusion that last week’s sudden drop was more than a blip caused by rig downtime — some rigs moving between wells. The count is down 4% in the last month, but up 63% year-over-year.

The largest month-over-month decline by region occurred in Appalachia, falling by four to 45. Four operators reduced their rig counts by a rig apiece: EQT Corp., Gulfport Energy, HG Energy and Range Resources. Gulfport is now running a single rig; the other three companies have two rigs each.

U.S. crude futures were trading below $64 per barrel on May 21, putting the contract up about 31% so far this year after they dropped about 21% last year.

U.S. oil output from seven major shale formations, including the Bakken, is expected to climb by 26,000 barrels per day in June to 7.73 million barrels per day, the first rise in three months, the U.S. Energy Information Administration said in a monthly forecast on May 17.

Trends

Recommended Reading

Matador Stock Offering to Pay for New Permian A&D—Analyst

2024-03-26 - Matador Resources is offering more than 5 million shares of stock for proceeds of $347 million to pay for newly disclosed transactions in Texas and New Mexico.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.