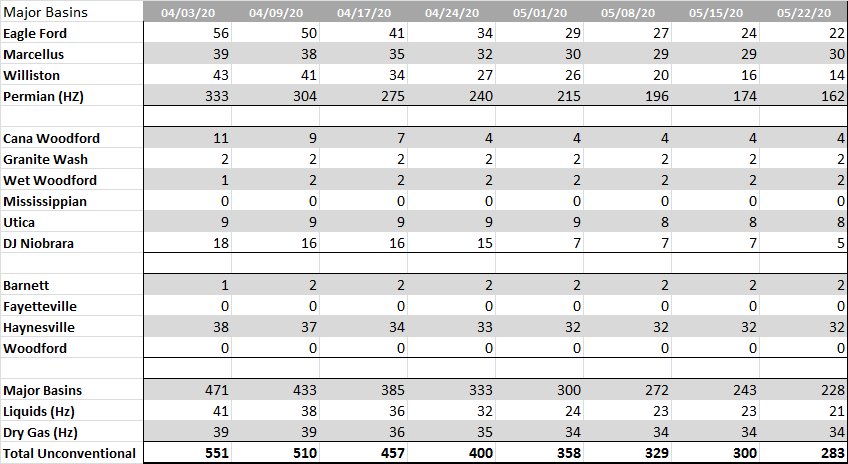

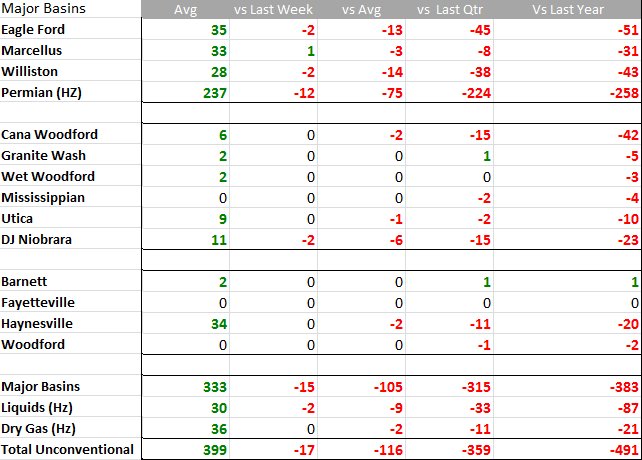

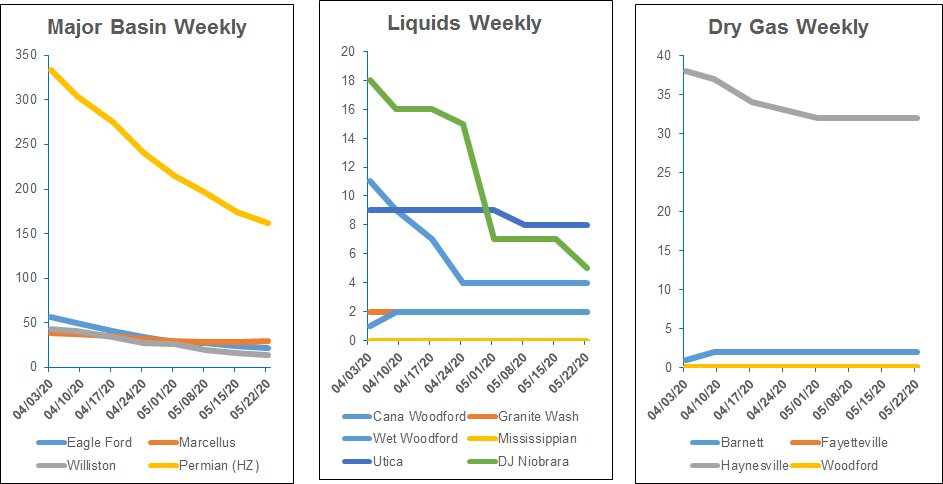

U.S. rig count is down 28 from last week

with the Permian Basin

leading the declines with 17.

North American rig count has fallen to all-time lows as energy firms cut spending after the global coronavirus lockdowns caused energy prices and demand to collapse.

The U.S. rig count, an early indicator of future output, fell by 21 to a record low 318 in the week to May 22, according to data from energy services firm Baker Hughes Co. that dates back to 1940. That was a third consecutive week of record lows for the U.S. rig count.

According to Enervus, year-on-year, drillers have cut rigs by 68% in the U.S. and 73% in Canada. Analysts expect energy firms to keep chopping rigs for the rest of the year and keep the count low in 2021 and 2022.

The bleak forecast is the result of a growing oversupply of oil amid unprecedented demand destruction created by the coronavirus pandemic. E&P companies have responded to the market dynamics by announcing major curtailments despite earlier oil proration efforts made by some U.S. producers.

Announced curtailments:

- ConocoPhillips Co. now plans to curtail a gross 265,000 bbl/d of oil (230,000 bbl/d net) from its Lower 48 operations and Surmont project in Canada during May. The curtailment is up from a prior target of 225,000 bbl/d of oil. In June, the company will curtail 460,000 bbl/d of oil from the Lower 48 (260,000 bbl/d), Surmont (100,000 bbl/d) and Alaska (100,000 bbl/d). On a net basis, June curtailments total 420,000 bbl/d, or about 30% of ConocoPhillips’s output.

- Chevron Corp. is cutting output by 200,000-300,000 boe/d in May, with these reductions split 50:50 between the U.S. and international assets.

- Through economic shut-ins and market-related curtailments, Exxon Mobil Corp. expects its second-quarter output will be 400,000 boe/d lower.

- EOG Resources Inc. plans to curtail 125,000 bbl/d of oil in May and 100,000 bbl/d of oil in June, with full-year cuts expected to average 40,000 bbl/d.

- Continental Resources Inc. is voluntarily deferring 70% of its oil production in May. While the company did not give a specific number, 70% of first-quarter net volumes comes to 140,500 bbl/d of oil.

- Chaparral Energy Inc. is shutting in production gradually as its tank batteries are filled and, if prices don’t recover, it could have 70%-75% of its production shut in by late June or July.

- As of May 8, Ovintiv Inc. had 65,000 boe/d shut in or deferred, including 35,000 bbl/d of oil and condensate. The company expects curtailed volumes to rise in June.

- Noble Energy Inc. is curbing May net production by 5,000-10,000 bo/d and expects to curtail 30,000-40,000 bbl/d of oil in June.

- PDC Energy Inc.’s May and June production volumes will be reduced by 20-30%; first-quarter volumes were 185,000 boe/d.

- Cimarex Energy Co. is reducing volumes by 20% in May; first-quarter output was 89,800 boe/d.

Weekly

Trends

Recommended Reading

Tangled Up in Blue: Few Developers Take FID on Hydrogen Projects

2024-04-03 - SLB, Linde and Energy Impact Partners discuss hydrogen’s future and the role natural gas will play in producing it.

Identified Need: Hydrogen Safety Standards in an Emerging Sector

2024-03-22 - Establishing fire protection measures remains critical for industry growth.

Energy Transition in Motion (Week of April 19, 2024)

2024-04-19 - Here is a look at some of this week’s renewable energy news, including the latest on global solar sector funding and M&A.

Energy Transition in Motion (Week of March 28, 2024)

2024-03-31 - Here is a look at some of this week’s renewable energy news, including proposals submitted to develop about 6.8 gigawatts of wind projects offshore Connecticut, Massachusetts and Rhode Island.

Bill Gates: ‘A Heroic Effort’ is Beginning, but Climate Goals Still Won’t be Hit

2024-03-26 - Bill Gates said during CERAWeek by S&P Global that the energy transition was picking up speed but still wouldn’t be able to achieve the climate goals established under the Paris Agreement of 2015.