Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

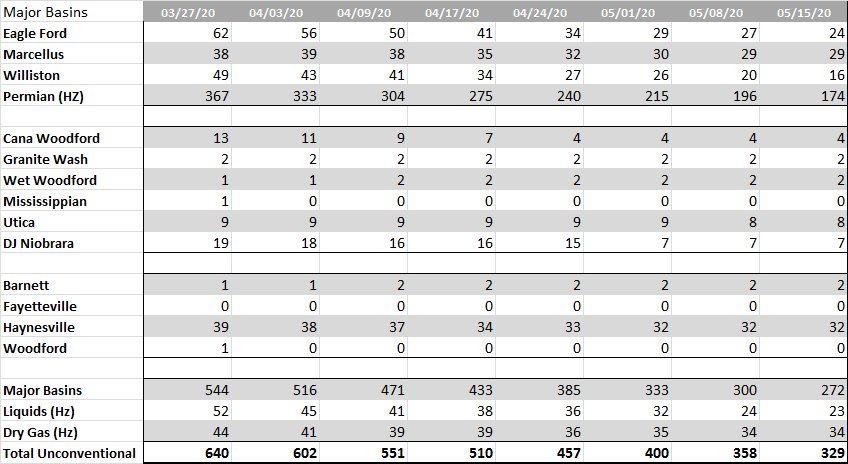

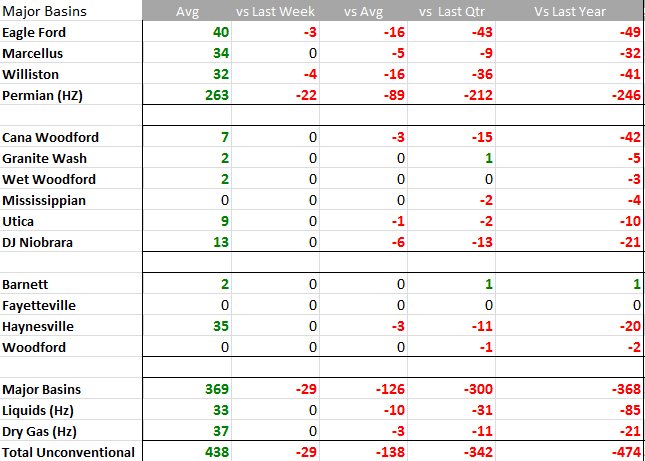

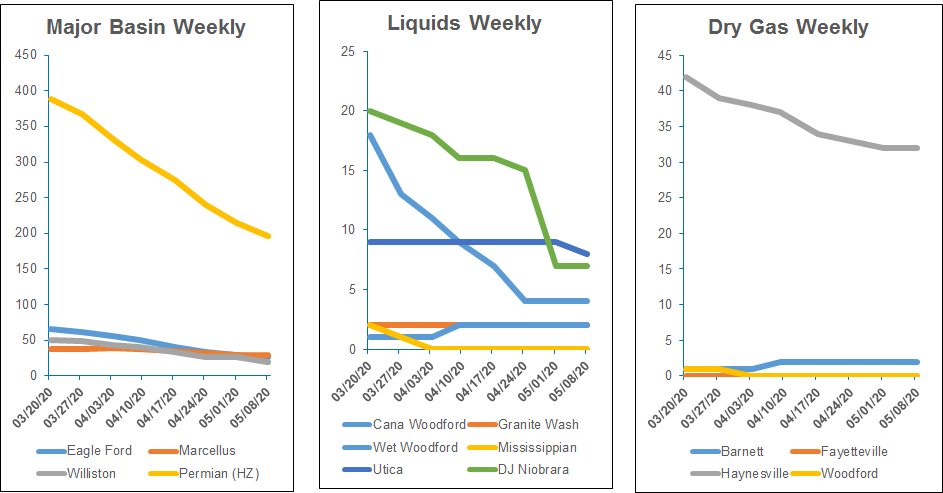

U.S. rig count continues to drop

For a second week in a row, the number of rigs operating in the U.S. fell to another all-time low, with the total U.S. rig count down eight rigs from last week. However, according to Enervus, this is the first single-digit decline in the U.S. rig count over the past 12 weeks when the oversupply in the crude market started.

The U.S. rig count is down by 38% in the last month and 62% in the last year. Since the beginning of the year, U.S. rig count has fallen about 52%.

More than half of the total U.S. oil rigs are in the Permian Basin in West Texas and eastern New Mexico, where active units dropped by 37 this week to 246, the lowest since December 2016—that was the biggest weekly cut since February 2015.

Global fuel demand is expected to drop roughly 10% in 2020 from last year, prompting companies to make drastic cuts to spending, lay off thousands of workers and close production to offset the worldwide supply glut.

Raymond James analysts projected total U.S. oil and gas rigs would collapse from around 800 at the end of 2019 to a record low of around 400 by the middle of the year and around 200 at the end of 2020. The investment bank forecast the rig count would average a mere 225 rigs in 2021.

Weekly

Trends

Recommended Reading

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.

73-year Wildcatter Herbert Hunt, 95, Passes Away

2024-04-12 - Industry leader Herbert Hunt was instrumental in dual-lateral development, opening the North Sea to oil and gas development and discovering Libya’s Sarir Field.

Riley Permian Announces Quarterly Dividend

2024-04-11 - Riley Exploration Permian’s dividend is payable May 9 to stockholders of record by April 25.