Rig count down from the previous week and crude futures have jumped 200% over the past 10 weeks.

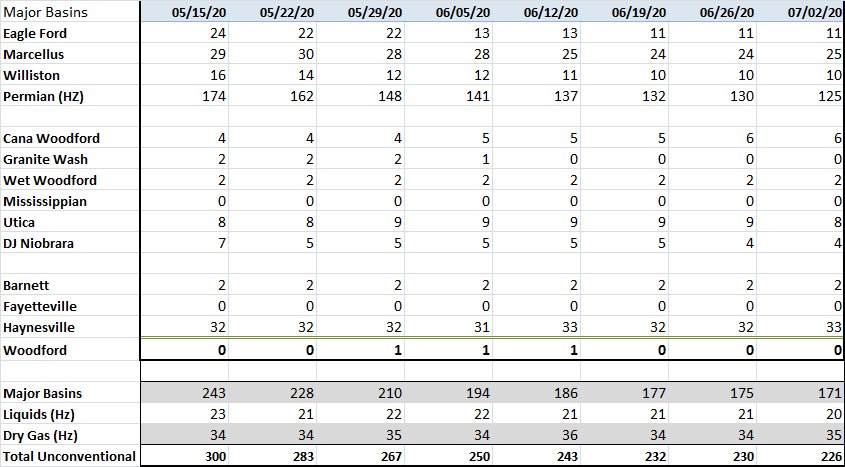

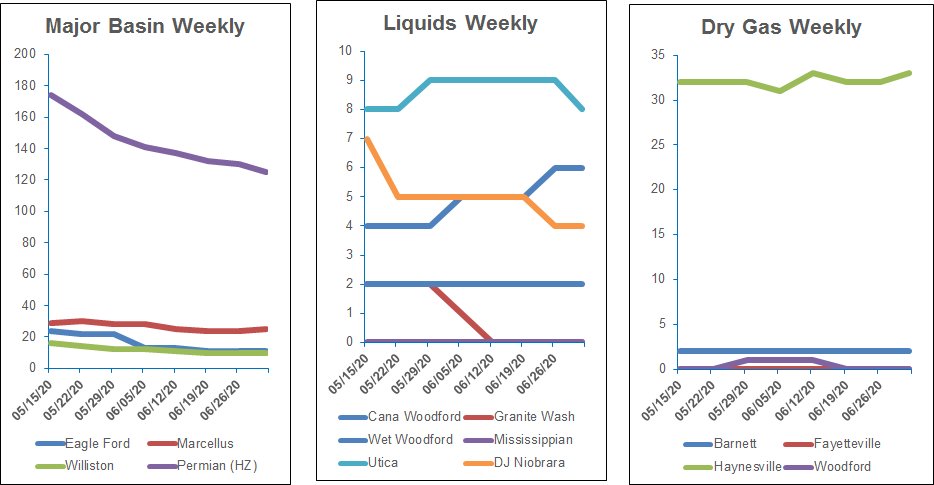

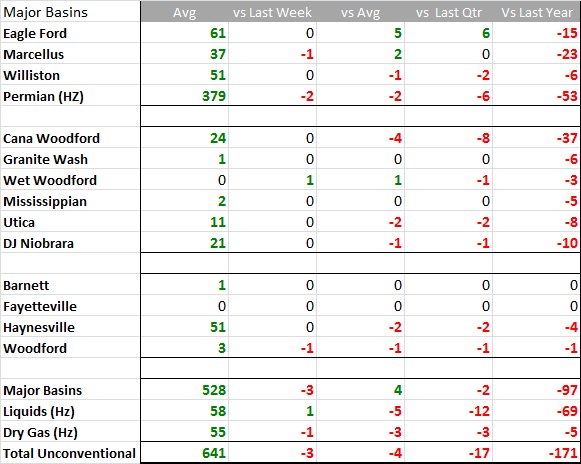

As of July 1, the total U.S. rig count is down 14 from the previous week. According to Enverus, the U.S. rig count over the past month has been relatively flat with around 300 rigs. Since the beginning of the year, the number of rigs operating has fallen by 64%. The Permian Basin currently accounts for 45% of the active rigs (approximately 120 rigs in New Mexico and West Texas) and has lost approximately 15% of its rigs in the last month and is down by 66% (year-over-year).

Prices are still down about 34% since January due to the demand impact of the coronavirus. Baker Hughes said that U.S. crude futures have jumped 200% over the past 10 weeks to about $40/bbl as of July 2 on hopes global economies will snap back as governments lift lockdowns.

Analysts said higher oil prices will encourage energy firms to slow rig count reductions and possibly start adding some units later this year.

Weekly

Trends

Recommended Reading

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Defeating the ‘Four Horseman’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production — and keep the cash flowing.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Ozark Gas Transmission’s Pipeline Supply Access Project in Service

2024-04-18 - Black Bear Transmission’s subsidiary Ozark Gas Transmission placed its supply access project in service on April 8, providing increased gas supply reliability for Ozark shippers.

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.