Some New Rigs Added Last Month; Crude Futures Have Increased Over Past Three Months

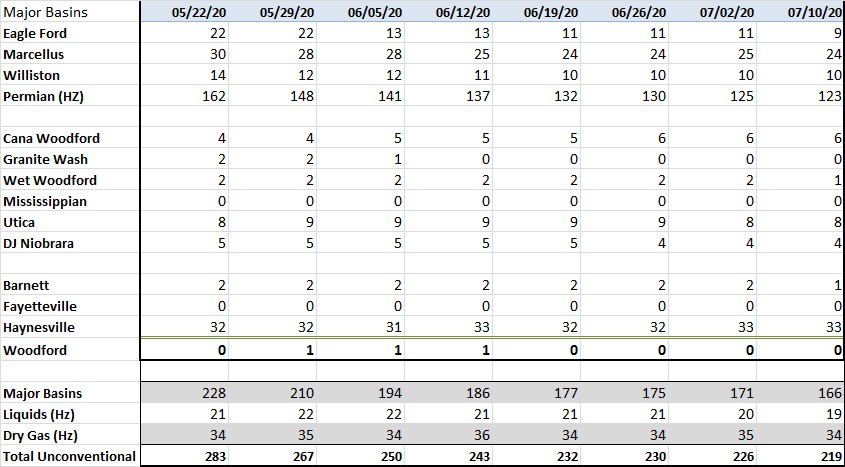

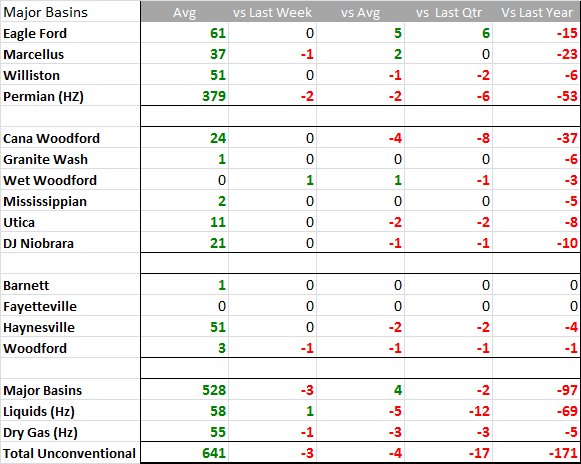

As of July 8, the total U.S. rig count only fell seven rigs from last week, according to Enverus.

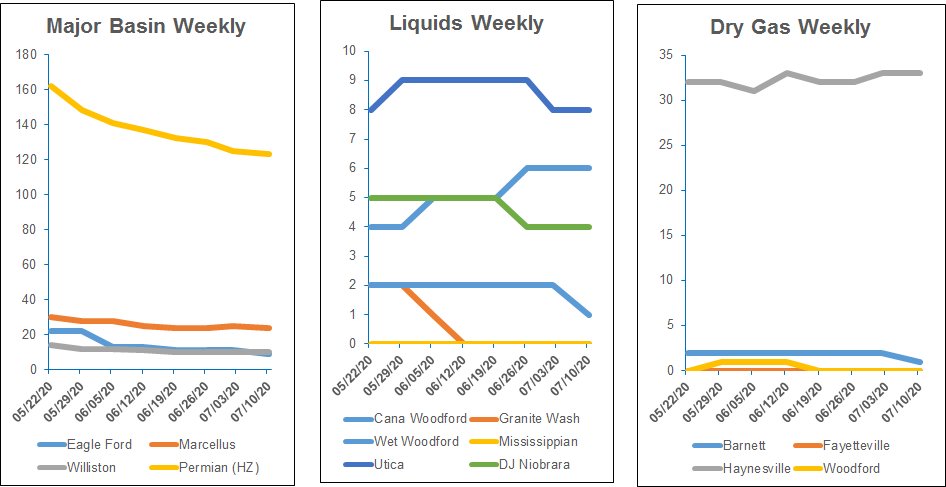

Faring the best were natural gas plays, with the onshore Gulf Coast region well starts (dominated by the Haynesville Shale) down 18% in the second quarter and Northeast spuds (primarily the Marcellus and Utica shale plays) down 22%. The largest monthly declines were in the Denver-Julesburg Basin (-57%), Williston Basin (-17%) and Permian Basin (-16%). Gas plays along the Gulf Coast, primarily the Haynesville Shale, have had smaller decreases.

The U.S. Energy Information Administration projected a fall in domestic crude output from 12.2 million bbl/d in 2019 to 11.6 million bbl/d in 2020. Global petroleum and other liquid fuels consumption fell from a record 101 million bbl/d in 2019 to 92.9 million bbl/d in 2020.

Even though U.S. oil prices are still down about 34% since the start of the year due to the effect of coronavirus on fuel demand, U.S. crude futures have jumped 113% over the past three months to about $40/bbl on July 10 on hopes global economies will snap back as governments lift lockdowns.

Analysts said higher oil prices will encourage energy firms to slow rig count reductions and possibly start adding some units later this year.

Weekly

Trends

Recommended Reading

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Paisie: Economics Edge Out Geopolitics

2024-02-01 - Weakening economic outlooks overpower geopolitical risks in oil pricing.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

US Oil Stockpiles Surge as Prices Dip, Production Remains Elevated

2024-02-14 - EIA reported crude oil stocks increased by 12.8 MMbbl as February began, far outstripping expectations.