Rig count, oil prices increase

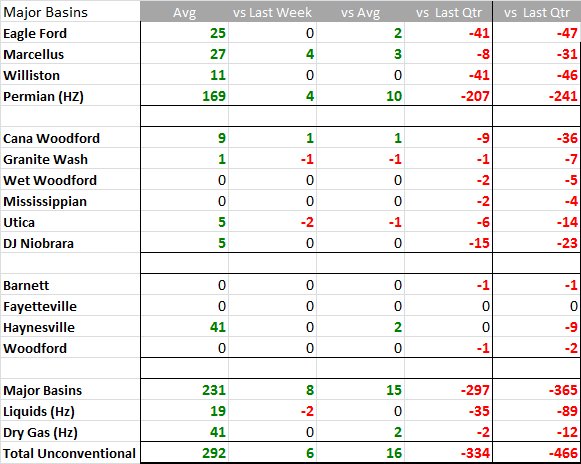

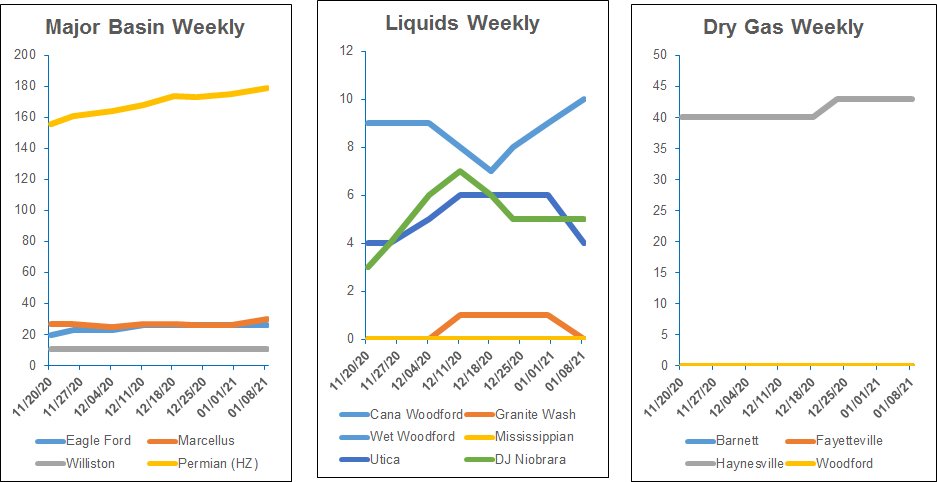

The U.S. rig count rose by about 13 rigs in the last week to 393 as of Jan. 6, according to Enverus Rig Analytics.

The count is down 3% in the last month and down 52% year-over-year. The Appalachian and Permian basins both added three rigs. The month-over-month, declines occurred in the Gulf Coast (down five) and Permian (down five).

The most notable changes in the last month were in the Louisiana’s Haynesville, Oklahoma’s STACK and the Midland Basin. Three rigs were added in the Haynesville, and the STACK play doubled its activity level (month-over-month).

WTI crude futures in the U.S. soared to almost $52 this week, the highest level since February 2020. The higher prices have already encouraged energy firms to drill more since the total rig count fell to a record low of 244 in August, according to Baker Hughes data going back to 1940.

While the rig count fell by 454 in 2020, its second annual decline in a row, it rose in the fourth quarter in its biggest increase since second-quarter 2017.

However, WTI was trading lower at around $51/bbl for the balance of 2021 and $48 for calendar 2022, which could prompt producers to reduce activity.

Trends

Recommended Reading

Which Haynesville E&Ps Might Bid for Tellurian’s Upstream Assets?

2024-02-12 - As Haynesville E&Ps look to add scale and get ahead of growing LNG export capacity, Tellurian’s Louisiana assets are expected to fetch strong competition, according to Energy Advisors Group.

EQT, Equitrans to Merge in $5.45B Deal, Continuing Industry Consolidation

2024-03-11 - The deal reunites Equitrans Midstream Corp. with EQT in an all-stock deal that pays a roughly 12% premium for the infrastructure company.

From Tokyo Gas to Chesapeake: The Slow-burning Fuse that Lit Haynesville M&A

2024-03-01 - TG Natural Resources rides the LNG wave with Rockcliff deal amid shale consolidation boom.

EQT, Equitrans Midstream to Combine in $5.5B Deal: Reports

2024-03-11 - EQT Corp.'s deal would reunite the natural gas E&P with Equitrans Midstream after the two companies separated in 2018.

Chesapeake-Southwestern Deal Delayed Amid Feds Scrutiny of E&P M&A

2024-04-05 - The Federal Trade Commission asked Chesapeake and Southwestern for more information about their $7.4 billion merger — triggering an automatic 30-day waiting period as the agency intensifies scrutiny of E&P deals.