Source: Hart Energy

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

In the past six months, Halcón Resources Corp. (NYSE: HK) has been on a tear.

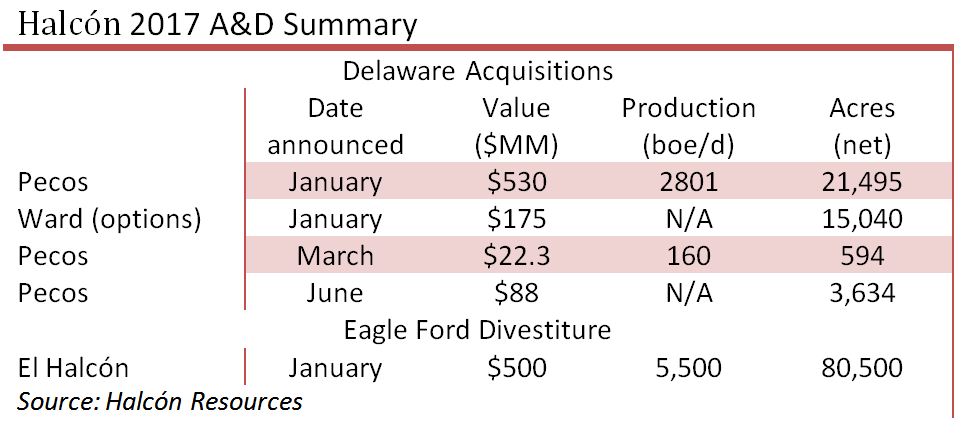

In January, it swooped down in the Delaware Basin and began to amass acreage at an unusually reasonable price—culminating in June with another deal in Pecos County, Texas.

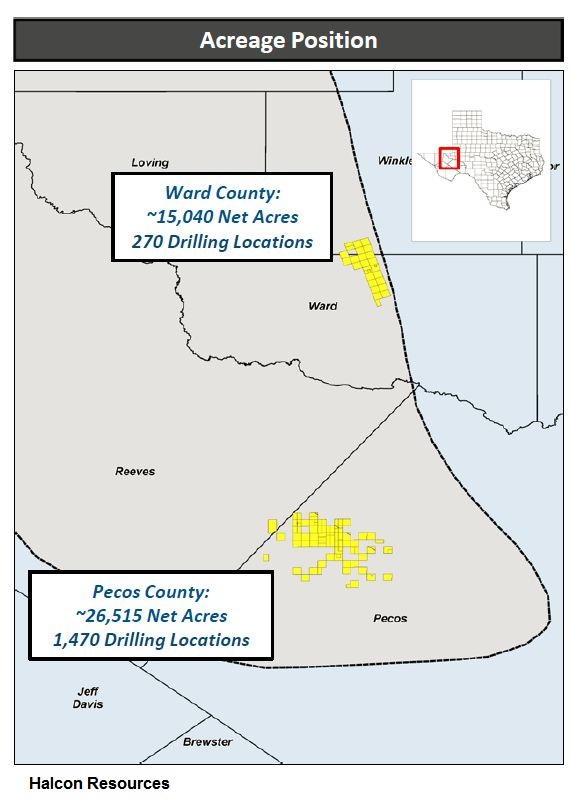

Since September, the company has raced from exiting bankruptcy court to staking out a 41,600 net acre position in the Delaware through acquisitions that have closed or been announced, some for as little as $11,000 per acre.

In the latest, Halcón closed the acquisition of 3,634 net acres in Pecos for $88 million, the company said June 1. The acreage represents a partner’s interest in Halcón operated units.

Stemming from its $705 million deal announced in January, the company also plans to exercise options to purchase acreage in Ward County, Texas.

“HK plans to exercise its option to purchase the acreage at a pre-agreed $11,000/acre price, which we view as a relative steal given recent Delaware A&D comps that have climbed greater than $40,000/acre,” said Mike Kelly, senior analyst at Seaport Global Securities.

Average production with the recent Pecos acquisition is about 790 barrels of oil equivalent per day (boe/d). After adjusting for production at a value of about $40,000 per flowing boe/d, the acquisition equates to an effective purchase price of $15,520 per net acre, Halcón said.

Kelly called the price “reasonable.”

Separately, Halcón continues to add additional acreage near its existing positions. Overall, the company entered the Delaware Basin in a $705 million deal—a price that included the Ward acreage at $175 million.

In Ward, Halcón said it will exercise an option by June 15 to acquire 6,720 net acres in a southern tract of the county for $11,000 per acre or about $73.9 million. The company expects to exercise another option to acquire an additional 8,320 net acres in the northern part of Ward, also for $11,000 an acre, by Dec. 31—or $91.5 million.

The Delaware position, including land acquired or under contract, now stands at 41,555 net acres—at an average adjusted purchase price of $20,342 per acre.

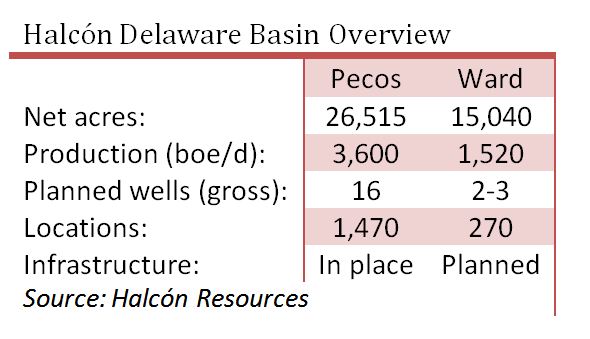

Halcón’s Delaware Basin assets are currently producing about 4,500 net boe/d, “which is well above its forecast for the area,” the company said.

Two rigs will continue to run in the Delaware for the remainder of 2017, with completion activities in Pecos scheduled for mid-June with a dedicated frack fleet.

Halcón continues to hold 119,300 net acres and 570 gross operated locations in the Williston Basin, where it is marketing nonoperated assets.

“We think the sale could potentially garner more than $100 million based on a 5x cash flow multiple and take year-end 2017 net debt/EBITDA 0.2x lower to 3.7x,” Kelly said.

The properties—about 15,600 net acres and 1,000 gross undeveloped locations—produce an average 2,350 boe/d (91% oil) across the Williston. Halcón anticipates completing a sale this summer, subject to an acceptable offer.

Proceeds from the Williston nonoperated asset sale, as well as borrowings on its senior revolving credit facility, will fund the Ward option acreage and other Pecos acreage acquisitions.

In March, Halcón closed the sale of its El Halcón assets in East Texas for $500 million.

Halcón said it has significant liquidity to fund its planned 2017 operations without having to seek additional financing. On May 1, its borrowing base increased to $650 million from $600 million in March.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

What's Affecting Oil Prices This Week? (April 15, 2024)

2024-04-15 - While concerns about the stability of oil supply are increasing, Stratas Advisors does not expect oil supply to be disrupted – unless there is further escalation in the Middle East.

US NatGas Futures Hit Over 2-week Low on Lower Demand View

2024-04-15 - U.S. natural gas futures fell about 2% to a more than two-week low on April 15, weighed down by lower demand forecasts for this week than previously expected.

BKV CEO: Texas Grid Needs More Combined Cycle NatGas Plants

2024-04-12 - BKV CEO Chris Kalnin dives into the "core issue" of Texas' renewable grid and how the company is increasing production as the the largest producer in the Barnett Shale, in this Hart Energy Exclusive interview.

Asia Spot LNG at 3-month Peak on Steady Demand, Supply Disruption

2024-04-12 - Heating demand in Europe and production disruption at the Freeport LNG terminal in the U.S. pushed up prices, said Samuel Good, head of LNG pricing at commodity pricing agency Argus.

US NatGas Flows to Freeport LNG Export Plant Drop Near Zero

2024-04-11 - The startup and shutdown of Freeport has in the past had a major impact on U.S. and European gas prices.