(Source: Shutterstock/Hart Energy)

Though the Guyana-Suriname Basin has risen to the top of the oil exploration watch list, with the Exxon Mobil Corp.-led consortium and the Total SA-Apache Corp. duo set to drill two of the most-watched wells this year, the prolific basin is not without risks, analysts say.

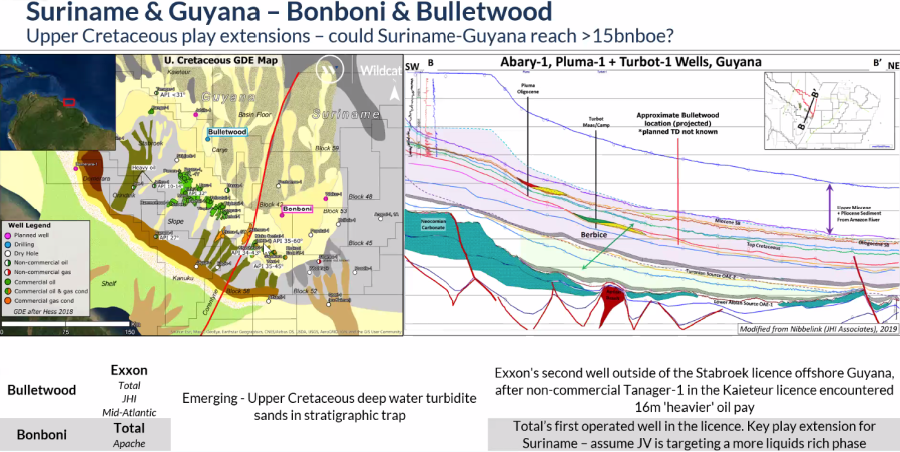

Participants surveyed during a Westwood Global Energy Group webinar Jan. 20 placed Exxon’s Bulletwood prospect offshore Guyana above others as the well most likely to lead to a commercial discovery this year. It was followed closely by the Total-operated Bonboni prospect offshore Suriname.

Both bring something new to the companies’ exploration campaigns, adding to risk. A 50-km step-out from proven areas, drilling at Bulletwood—Exxon’s first well on the Canje Block adjacent to Stabroek—is already underway to test the Upper Cretaceous play. The Bonboni prospect veers from the west-east direction Apache had been moving with exploration wells on Block 58 and into the block’s north-central area as partner Total takes over as operator. Bonboni has Campanian and Santonian targets.

Despite Exxon’s 18 discoveries, totaling about 9 Bboe in recoverable resources on the Stabroek Block offshore Guyana and Apache’s four discoveries offshore Suriname, exploration risks remain, given what some explorers have faced in the emerging basin.

The Petronas-operated Sloanea-1 well offshore Suriname’s Block 52, of which Exxon is a partner, aimed to extend the play further south. “This has only been announced as a hydrocarbon discovery, which we’re assuming to refer to gas,” Jamie Collard, a senior analyst for Westwood Global Energy Group, said during the webinar. “At the moment, we’re holding this as probably noncommercial.”

Exxon said in December the Sloanea-1 discovery was being evaluated to determine its potential.

“We had Tullow encountering heavy oil at Joe and Jethro, testing tertiary plays [Orinduik Block offshore Guyana]. We had Repsol trying to extend the Upper Cretaceous play into the shallow waters, so back towards the shelf, at Carapa [Kanuku Block offshore Guyana], and made a noncommercial discovery with four meters of net pay,” Collard said. “We then had Exxon trying to extend the play further outboard at Tanager [Kaieteur Block offshore Guyana], encountering heavier oil and 16 meters of pay and that is another noncommercial discovery.”

Helen Doran, also a senior analyst for Westwood, said results at Tanager—which lies northwest of Bulletwood—increases risk regarding fluid quality in the basin floor and raise questions for quality encountered at Ranger, which shares the same source kitchen as Tanager.

“Additional risks to Bulletwood include the volume and quality of reservoir. We’re still trying to piece together how much reservoir is getting under, beyond the Liza and cluster area. And of course, the nature and effectiveness of the trap,” Doran said.

Turning to Bonboni offshore Suriname, she said Westwood believes “this might be a strategic move out into a more oil-prone portion of the Canje kitchen to enhance the liquid content versus the gas in this part of the basin.”

However, there are some risks related to trapping style and charge access, she said.

The Guyana-Suriname Basin is not the only area in South America being eyed for potential oil and gas finds. Others are in the presalt offshore Brazil, where Collard noted Total is attempting to “find Nemo.” Brazil’s oil regulator ANP has said the Nemo prospect, located on C-M 541 block, has a nearly 6.9 Bboe potential. Exxon’s exploration work in the Sergipe-Alagoas Basin is also on the radar.

Recommended Reading

Qnergy Tackles Methane Venting Emissions

2024-03-13 - Pneumatic controllers, powered by natural gas, account for a large part of the oil and gas industry’s methane emissions. Compressed air can change that, experts say.

A Different Way to Approach Energy Industry Hiring

2024-02-07 - Modern energy companies have embraced competitive efficiency, cutting-edge innovation and ESG transparency. It is time for modern energy hiring to do the same.

Women in Energy: Here’s to Ms. Flat-Bottomed Paper Bag Inventor

2024-03-10 - A salute to the women of genius, including ‘Ms. Plain English Computer Language Inventor’ and ‘Ms. Parity is Not Conserved in Weak Interaction Discoverer.’

MethaneSAT: EDF’s Eye in the Sky Targets E&P Emissions

2024-03-07 - The Environmental Defense Fund and Harvard University recently launched MethaneSAT, a satellite tracking methane emissions. The project’s primary target: oil and gas operators.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.