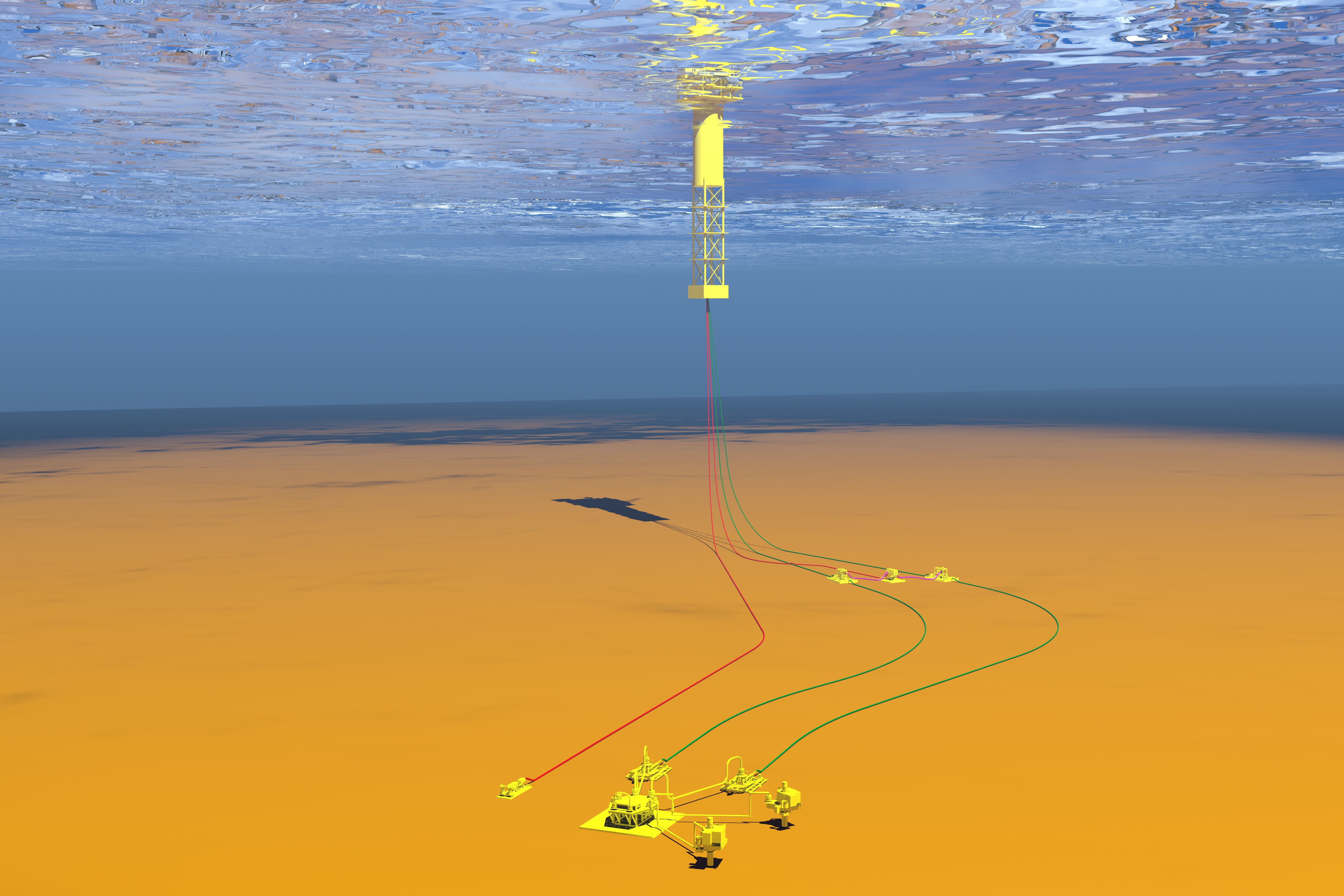

LLOG Exploration Co.’s Who Dat facility in the Gulf of Mexico came on stream in December 2011. (Photo Courtesy of LLOG Exploration Co.)

[Editor's note: A version of this story appears in the May 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

The double whammy of excess oil supply and the coronavirus has done a number on crude oil prices, which in turn has prompted E&P companies to slash capital spending plans for 2020. Larger independents like Devon Energy Corp., Noble Energy Inc. and Pioneer Natural Resources Co. have chopped spending plans by a third to almost half so far, mainly around their unconventional resource plays and deferring exploration programs. This trio has something else in common. Over the past decade and a half, each exited a dark horse, long-lived asset play that has shown increasing signs of its resilience in these most recent trying times—the U.S. Gulf of Mexico.

As an oil province, the U.S. Gulf has been referred to as the ‘Dead Sea’ by many—and many times over. The region has been through many peaks and troughs since the first well was drilled there more than 80 years ago. Investment in the region has ebbed and flowed with the shifting tides—be it the splash of deepwater royalty relief which spurred a robust exploration phase in the region during the 1990s, or the Deepwater Horizon incident in 2010 that ground activity to a halt. The place producers find themselves today are truly uncharted waters—a perfect storm of oil price destruction due to oversupply and oil demand destruction related to most of the world operating remotely due to the threat of COVID-19.

The situation is dire, but like all crises, it can be viewed as equal parts danger and opportunity. Cautious opportunity.

“Operators will have to be more selective with reduced budgets,” said Justin Rostant, principal analyst with Wood Mackenzie. “I expect companies will cut 2020 budgets and even some 2021—wherever they can as they become more disciplined with their reduced investment capital.

“Breakeven prices for projects we expected to FID [final investment decision] in 2020 range from Brent $38 to $45/bbl, so they are still attractive in the long run, but I now expect some to be delayed as operators try to slow down their near-term spend. Where you will likely see a bigger impact is in exploration wells drilled. Companies with rig contracts in place will reduce exploration activity and focus on development wells or lower risk exploration wells near infrastructure that can be tied back and brought online quickly to generate revenue.”

Today’s crisis is yet another marker in the timeline, but one that could hold a silver lining for cash-rich, less risk averse operators at a time when service costs are depressed, even for the most elite equipment.

“Rig rates used to be in the $600,000 per day range at its peak for a deepwater rig,” said Rostant. “In 2018, we saw day rates as low of $150,000, but current rates are closer to $220,000. These lower rates are a huge contributor to the overall costs coming down in the deepwater Gulf of Mexico.

“The other thing that you’re seeing as well is the technology on the rigs; the high-spec rigs have always improved the efficiency and how fast they can drill wells. Back in 2014, we had an average five days per thousand feet from a drilling rate standpoint. By 2019, it was touching two and a half days per thousand feet. So again, part of that’s due to the high-spec rigs coming into the Gulf of Mexico.”

The current outlook may take rates even lower. Pundits see that the combination of E&P capex cuts and the impact of COVID-19 on the ability to get personnel and equipment and services to and from offshore rigs will soon put downward pressure on utilization. If the U.S. Gulf goes into lockdown due to increasing logistics complications, the fleet will go idle and warm stack the units in the region. According to a recent report from Westwood Global, the result will be likely an increase in force majeure declarations, which can lead to contract renegotiations or, in some cases, terminations.

The Trump administration is looking into a possible aid package for oil and gas producers, including those offshore. A group of lawmakers sent a letter to the White House asking the president to reduce or waive collections of production royalties from the federal waters of the U.S. Gulf. The move followed Trump’s decision to purchase 30 million barrels of oil from producers for the U.S. Strategic Petroleum Reserve.

A mid-March U.S. Gulf lease sale attracted only half the bids of the previous fall auction. The sale took in $93 million in high bids, the lowest tally in four years. While the offerings did not attract much new investment, the legacy independents in the region, such as W&T Offshore Inc., Houston Energy LP and LLOG Exploration Co., participated scoring multiple lease blocks at bargain prices.

Denizen of the deep

LLOG took its first steps in the deepwater U.S. Gulf in 2002 with a series of wells in the region’s flex trend area just beyond the shelf’s edge. Since that time, almost 100% of the company’s investment dollars have been pumped in the Gulf’s deep waters. LLOG has drilled 296 wells in the U.S. Gulf since 2002 with 104 of those being in deep water. From 2010 forward, the operator has concentrated solely on the region’s deepwater theater. Several of the private company’s peers were leaving the region around the same time as it went all-in, taking their capital and putting it into the burgeoning shale plays around the U.S. Lower 48. So, why didn’t LLOG join the exodus and come onshore with its peers?

“It can be difficult to acquire acreage in the unconventional play as a fast follower,” explained Rick Fowler, COO of LLOG. “Also, to execute effectively in the unconventional play requires a different staff and culture. LLOG’s breakeven costs in the deepwater Gulf of Mexico compare favorably to the unconventional plays.”

The operator has a number of deep Gulf discoveries that are in various stages of development including its Buckskin project, which achieved phase one production in June 2019 and where additional drilling is planned. LLOG also has redevelopment plans ongoing at its Who Dat Field originally brought online in 2011. The project includes drilling new wells in and near the field.

The company has sanctioned its Praline subsea development, which will tie into the Pompano fixed platform in Mississippi Canyon Block 29. Praline is a Pliocene-aged subsalt oil discovery located in Mississippi Canyon Block 74. Additional discoveries moving toward development include Leon (Keathley Canyon Block 642), Moccasin (Keathley Canyon Block 736), Shenandoah (Walker Ridge blocks 51 and 52), Spruance (Ewing Bank Block 877), Taggart (Mississippi Canyon Block 816) and Yucatan (Walker Ridge lock 95).

“LLOG has been somewhat contrarian throughout our history, and historically we’ve added the most value to our company during periods of low commodity prices,” Fowler said. “We tend to keep our budgets flat, which allows us to drill more wells when commodity prices are low, which can drive down costs of services. At the moment, LLOG has one deepwater rig under contract, the Seadrill West Neptune, which we expect to continue working throughout 2020.”

At press time, LLOG had the rig conducting completion operations following a sidetrack at its J Bellis Field in Green Canyon Block 157. J Bellis is a three-well subsea tieback to the EnVen Energy Corp.-operated Brutus tension-leg platform one block to the east.

LLOG has been offered opportunities in other offshore provinces, but according to Fowler, the company prefers to explore in the area where it is most familiar with the rocks and fluids. Additionally, U.S. Gulf infrastructure, access to services and regulatory environment offer key advantages. “LLOG continues to see plenty of opportunities in the deepwater Gulf of Mexico so we’ve not been tempted to look elsewhere,” he added.

Competitive with the shales

Kosmos Energy Ltd. is an international player but sees much of its 2020 production growth coming from the strategic exploitation of its deepwater U.S. Gulf assets that reside in the play’s more active regions. The company refers to the assets as its “advantaged portfolio” for several reasons—No. 1 being how it stacks up against other basins around the U.S. and globally for both quality and lower carbon emissions. The operator estimates its deepwater U.S. Gulf operations casts off about 7 kilograms of CO2 per barrel of oil equivalent. Kosmos rates the Permian Basin at around 16 kilograms of CO2 per equivalent barrel.

“I want to point out the competitiveness of the deepwater Gulf of Mexico versus the Permian,” Andrew Inglis, chairman and CEO of Kosmos, told investors in late February. “Based on an expert third-party analysis of public data, carbon intensity is twice as high in the Permian compared to Gulf of Mexico. The advantage stems from the natural aquifer drive, which requires no gas or water injection, an abundance of existing and available infrastructure, no routine flaring and no fracking,” he said.

Kosmos’ infrastructure-led exploration (ILX) portfolio is designed to give it quick access to new reserves utilizing existing hardware and subsea technology. The company participated in an ILX venture at Gladden Deep in early 2019, which resulted in a discovery with recoverable resources expected to be around 7 million barrels of oil equivalent gross. That might not seem like a lot of oil, but when you can install a single subsea well and hook it into an existing pipeline that flows back to a nearby floating production platform, the economics are attractive.

A third-quarter 2019 ILX well at the Nearly Headless Nick prospect in Mississippi Canyon Block 387 was successfully drilled, encountering 85 feet of net pay in the Middle Miocene objective. That well was brought on stream via subsea tie-back to the LLOG-operated Delta House floating production unit.

“We see growth coming from the ILX opportunities,” said Inglis. “We’ve seen growth actually in the Gulf of Mexico. When we took the asset on, it was doing slightly less than 25,000 barrels a day. We’re forecasting a range up to 28,000 barrels a day for this year. That’s come from the tieback of the initial successes that we have in Gladden and Nearly Headless Nick. So these things are relatively fast time to production. So in terms of the medium term, the growth is going to come from ILX success. We’ve got a three-well program in the second half of 2020 [planned] in the Gulf of Mexico.”

The three-well program comes from five high-graded prospects and is slated to kick off around mid-year. Two of the prospects, Spencer and Tiberius are located in Keathley Canyon and are in tieback range of the Occidental Petroleum Corp.-operated Lucius spar platform in Block 875.

Spencer will test a Pliocene prospect while Tiberius will test a deeper Wilcox prospect. Additional prospects include Zora and Honey Ryder, which are Miocene amplitudes adjacent to the company’s Odd Job Field in Mississippi Canyon Block 214. Highland Rim is located in Mississippi Canyon Block 864 and is another Miocene amplitude in tieback range of the Devil’s Tower spar.

“All of these prospects share similar financial characteristics, tieback to existing infrastructure resulting in high return, fast payback projects,” said Inglis.

Kosmos’ U.S. Gulf portfolio depth boasts 23 prospects across 71 blocks or approximately 375 million barrels oil equivalent of net unrisked resource in total. According to the company, the opportunities amount to over five years of future drilling inventory at three to four wells a year.

The contrarian

Where some folks see liability, others see opportunity. When Werrus Energy was formed in 2017, the private energy fund and investment management company sought to invest in low-cost energy products, mainly across North America.

The company dipped its toe in the Austin Chalk, Canada’s Montney Shale and the saltwater disposal business in Appalachia with small but targeted investments. Then, under its subsidiary, Werrus AquaMarine, it did something few have done over the past decade—it entered the shallow-water U.S. Gulf of Mexico, snatching up 100% working interest in a pair of undeveloped blocks. The move was curious given the mass exodus out of the region over the past several years.

Many majors have shed their shallow- water portfolios in favor of bigger game further offshore or to invest in the shale gale of the past decade in places like the Permian Basin. Larger independents also fled the region. Companies like Devon Energy, Pioneer Natural Resources and Noble Energy, once mainstays in the U.S. Gulf, sold out of the space to tackle the shales and/or perceived greener pastures internationally.

“I want to be as diverse as possible,” said Sergei Pokrovsky, founder and managing director of Werrus Energy. “I don’t want to put all my eggs in the same basket whether it’s purely upstream, shale or whatever. I’m in the business of managing risk first and foremost. The barriers to entry (in the Gulf) have come way down. Services prices are depressed to the point that I don’t think they can get any lower.”

Werrus AquaMarine spent less than $350,000 combined on Main Pass Block 295 and South Timbalier Block 267. Both blocks are situated in less than 250 feet of water, and neither block has any structures associated with them.

“When I entered the Gulf, part of my search criteria was that I only wanted to consider assets I could access with a jack-up,” explained Pokrovsky. “A proved hydrocarbon system in that block was another. That means that there should’ve been some penetration there that showed oil. I wouldn’t go purely into the greenfield. There’s not too many of those left. Also, I needed to be more on the liquid side. Another thing was, I wanted to limit myself to additional exposure that’s kind of out of my control. So I wanted to find the blocks without additional liabilities. I wanted a clean slate.”

Main Pass 295 will likely be the location of the first Werrus AquaMarine well. It has a known hydrocarbon system with deeper bonus potential.

In 2013, Apache Corp. (together with two other partners) drilled its Heron well on the block reaching a total depth of 19,555 feet. Partner Energy XXI reported up to 100 feet net oil pay, of which a substantial proportion is in three relatively shallow sands (between 8,405 feet and 9,110 feet), immediately underlying a salt overhang.

While Werrus is most interested in the much shallower oil pays, it is well aware of the additional bounty that lies below salt.

“There is an interesting subsalt play there, but that’s not something that I’m going after right now,” said Pokrovsky. “I know that it’s there. I know what to do with it, but it’s going to take more capital. I look at Main Pass 295 as a good launching point because there’s plenty of low-hanging fruit that could be economical.”

The company is fully funded to drill the initial well; however, it is in discussions with a potential co-investor to take a 25% stake in the project. Werrus is in negotiations with a rig contractor to move a jack-up onto Block 295. The goal is the get the well down prior to this year’s hurricane season, which kicks off on June 1. However, there is no pressure to get it done prior to then. If a deal cannot be struck in time, the company will likely wait until late fall to drill.

“I don’t have any pressure, either from investors or from the overall market right now, to go and do something, to go and spend money,” said Pokrovsky. “But I do need to spend this money to take us to the next level.”

If the well is successful and a commercial development is green-lit, Werrus would move forward with a newbuild production platform—a rarity in the shallow-water Gulf these days—which could kick-start a slow, deliberate move to increase its foothold in the region.

“I would consider expanding and maybe getting a couple more blocks at that point,” said Pokrovsky. “There have been cycles in the past several years of clear underinvestment in finding new projects. The shelf of the Gulf of Mexico lost its mojo and attractiveness. A lot of people just rushed away from it and left a lot of good things behind.”

There and back again

For over three and half decades, W&T Offshore has been a fleet of foot operator in the U.S. Gulf, adding reserves both by acquisition and the drill bit. However, in 2011, the company took a position in the then burgeoning Permian Basin of West Texas. The 21,900 gross acres entry cost the company $366 million. At the time of the deal, W&T founder and CEO Tracy Krohn called it a “new focus area that offers the potential for substantial long-term growth and attractive full-cycle economic returns.” After four years of drilling, pumping and trying to generate positive cash flow out of the properties, the oil price dropped. The project was stuck in neutral, and W&T sold the assets for $376.1 million.

“We didn’t do any one thing to bring the company down by going out to West Texas, but it wasn’t optimal for us,” recalled Krohn. “Things could have gone differently, but the truth is, we just spent a lot of money. When you think of the money we spent and what we got in return, West Texas just doesn’t cash flow.”

After that, the company returned to the U.S. Gulf exclusively, an area Krohn knew could be cash-flow positive by continuing to work and rework the company’s substantial shallow and deepwater footprint.

“Reserves are generally bigger,” Krohn said of his attraction to the U.S. Gulf. “Cash flow is usually better. It takes a while if you’re doing a greenfield project, it takes a while to get things on production, but the good news is we have a pretty good footprint across the Gulf of Mexico. So there is a lot of infrastructure already in place. Having that is very helpful. Having a large vault of intellectual property is quite valuable as well. A lot of the guys that are with us have been out in this basin for a very long time. We’ve got a lot of data. Those are the ties that bind us to the Gulf of Mexico. I think it is an excellent place for us to be.”

The company has remained active in the acquisition arena. Last December, it struck a deal with ConocoPhillips Co. to purchase the oil-weighted Magnolia Field in the Garden Banks area of the deepwater Gulf for $20 million and assumption of property liabilities. In October 2019, the field was producing 2,300 net barrels of oil equivalent per day (82% oil) to the acquired stake.

Today’s commodity price challenges has prompted the operator to slash its 2020 spending plans by more than 70% from a range of $15 million to $25 million from its prior level of $50 million to $100 million. At the midpoint of the revised budget, the company expects to remain cash flow positive at or above $25/bbl of oil and $1.50 per thousand cubic feet of natural gas.

W&T’s drilling plans in 2020 for the region will be slowed but not halted entirely.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.