(Source: Hart Energy/Shutterstock.com)

[Editor's note: A version of this story appears in the October 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

This should be a time of triumph in the oil patch. Even as economists and global majors were fretting over “peak oil” several years ago, independents were perfecting technology and techniques for unconventional development. That has come to full flower, proving that, as James Baldwin famously quipped, “Those who say it can’t be done are usually interrupted by others doing it.”

But with fears of peak oil supply vanquished, concerns about peak oil demand have emerged. Creeping over the assurance of Baldwin’s expression is the shadow of a grimmer outlook voiced by Wolfgang von Goethe: “Everything in the world may be endured except continued prosperity.”

At the same time, a different supply problem has come to vex producers, especially independents—the supply of capital. In an unexpected development, the supply of crude appears less connected to the supply of capital. Independents have overcome one round of bankruptcies already and may be in the early stages of another. The midstream sector has struggled to keep up. And yet the oil just keeps coming.

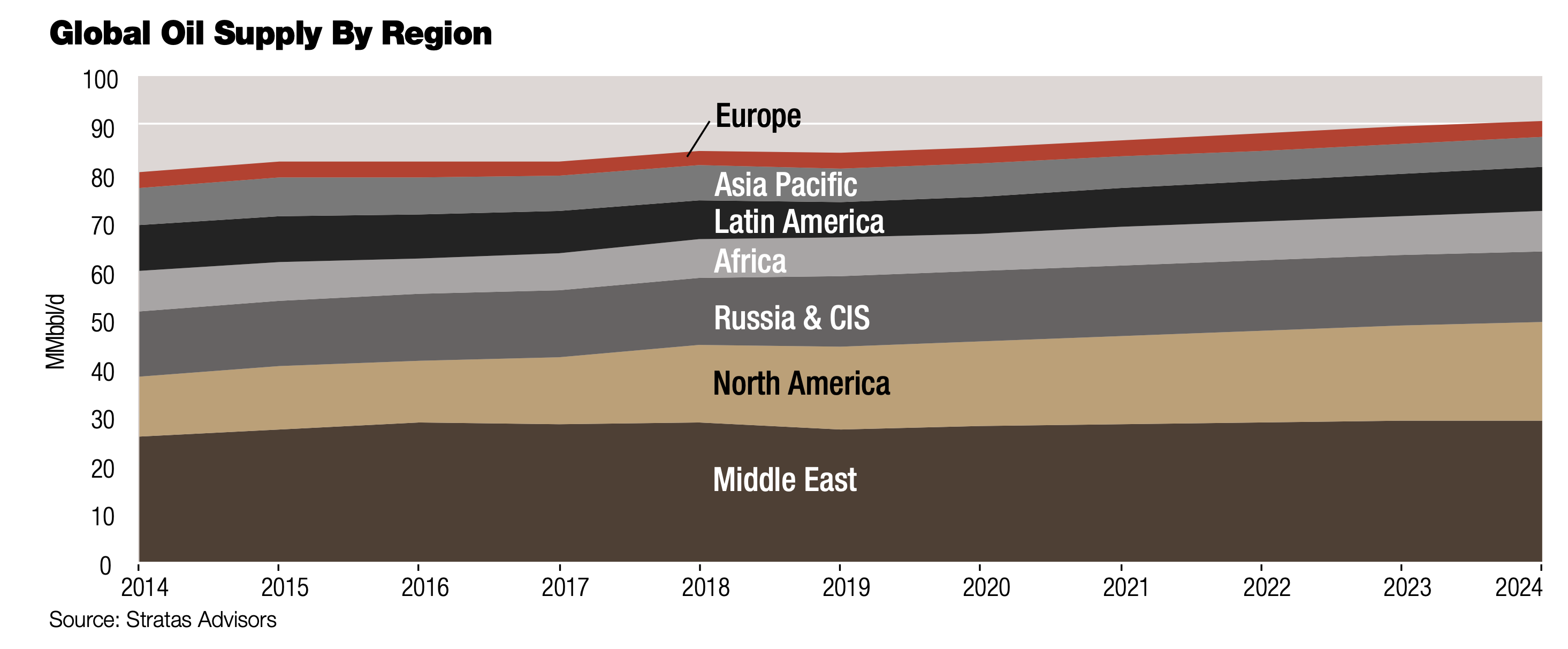

The consensus among analysts is that U.S. unconventional supplies will set the pace for the global market, if not strictly the incremental cost of production, for at least another decade. Other regions have had to or will have to adapt. The risk of supply exceeding demand is not great in the near term, but there is virtually no risk of the reverse.

OPEC concurs. In its outlook to 2040, published late last year, the cartel noted, “the concerns around global warming have accelerated the development of energy paths toward lower emissions. The ongoing, and at least already partially successful, introduction of electric vehicles as a complement to the internal combustion engine (ICE) is an important development for the energy market, although in many aspects ICEs still have substantial potential for further developments.

"Tight oil plays are also an area of intense technology developments. Impressive advances have also been achieved in wind and solar for power generation. The ongoing revolution in information technologies will impact both supply and demand, toward higher efficiency, lower emissions and lower costs.”

producers up

their game

with effective

improvements

in spacing,

fracturing or

other recovery

techniques, the

buffer provided

by shale against

global supply

interruptions

could expand

through the

end of the next

decade,” said Greg

Haas, director

of integrated oil

and gas at Stratas

Advisors.

With those givens, OPEC’s reference case sees energy demand increasing from 274 million barrels of oil equivalent a day (MMboe/d) in 2015 to around 365 MMboe/d in 2040, with an average annual growth of 1.2%. Almost 95% of the increase is accounted for by developing countries, including China and India, with an average annual growth of 1.9%.

OPEC’s outlook suggests that oil will “remain the largest contributor to the energy mix throughout the forecast period, with a share of nearly 28% in 2040, higher than gas and coal. Despite relatively low demand growth rates, especially for coal and oil, fossil fuels are projected to remain the dominant component in the global energy mix, with a share of 75% in 2040, albeit a drop of 6 percentage points from 2015.”

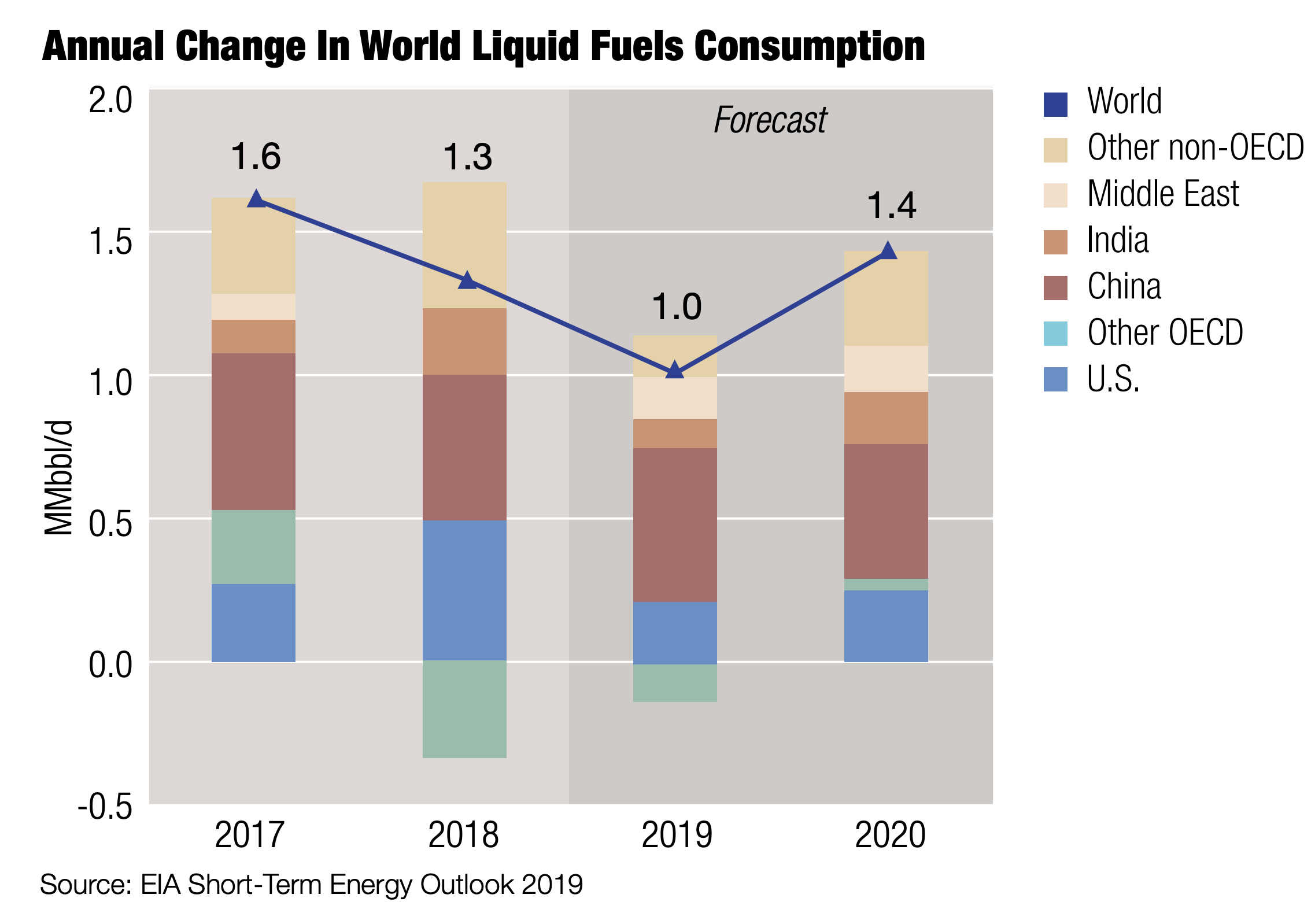

In the nearer term, the July Oil Market Report from the International Energy Agency (IEA) projected that global demand growth is set to accelerate from an exceptionally weak 310,000 barrels per day (bbl/d) in first-quarter 2019 and 800,000 bbl/d in second-quarter 2019 to reach 1.8 MMbbl/d in the second half of the year as economic activity improves and petrochemical plants ramp up. For 2020, the pace of growth will average 1.4 MMbbl/d compared to 1.2 MMbbl/d this year.

For 2020, the IEA stated, “Our balances show the potential for oversupply next year, with a 2.1 MMbbl/d expansion of non-OPEC supply, led by the U.S., vs. 2 MMbbl/d in 2019. That will lower the requirement for OPEC crude, with the call on OPEC plunging to 28 MMbbl/d in first-quarter 2020. OPEC has not produced at such a low level since third-quarter 2003.”

Other people’s money

These forecasts put U.S. unconventional producers in the driver’s seat, but they hardly give them the whip hand. “After proving they can produce hydrocarbons in spades if given other people’s money via the capital markets, today independent shale producers are on a mission to grow production, and at the same time, achieve positive cash flow that can sustain operations and dividends. It’s a tall order,” said Greg Haas, director of integrated oil and gas at Stratas Advisors, a Hart Energy company.

After years of growth fed by cheap capital leading to a high production base, managing an exploration and production company for cash flow is proving to be very different than managing an E&P to flip or to maximize reserve-based valuations. “U.S. shale producers are trying to rotate toward a sustainable cash-flow model and that takes time,” said Haas. “They’ve been at it for a couple years now after investors began re-evaluating E&P firms, and as capital markets soured on energy production growth for growth sake.”

For all that time and effort, Haas indicated that progress has been slow. “It would be nice if the U.S. independent E&P industry was further along at this point,” he noted ruefully. “But achieving sustainable free cash flows takes even more time when commodity prices erode as we have seen for oil, gas and gas liquids across North America. And we see a multiquarter lag time associated with dialing back production.”

That response timing is at odds with volatile and skittish commodity markets that can swing prices significantly. “It seems that buyouts or even bankruptcies may be the disciplining blast of cold water in the face of management teams who may have not yet progressed fast enough toward a more sustainable model not dependent on debt or equity capital markets,” Haas added.”

On the revenue side, U.S. shale has clearly hit foreign suppliers. That is true for both volumes sold as well as the price per barrel or cubic foot of hydrocarbon sent into commerce. “We see a consolidation in the U.S. as shale becomes the focus area of ever larger firms and even multinational super majors like ExxonMobil [Corp.], Chevron [Corp.] and others,” said Haas.

That trend is likely to put North American shale production into competition with production in other regions at the boardroom level, rather than at the trading desk. The global majors “will be ranking U.S. investments, returns and risks against global projects in their portfolio,” said Haas. “The Permian can win much of those contests especially for large firms with legacy Permian acreage acquired, operated and piped up prior to the shale revolution.”

Head to head with other regions, U.S. shale plays are considered to be strong competitors. “We see the Permian and other glittering regions in the U.S. shale-oil crown like the Bakken as having enough resources to continue to grow production for several years with current technology,” said Haas. “If shale producers up their game with effective improvements in spacing, fracturing or other recovery techniques, the buffer provided by shale against global supply interruptions could expand through the end of next decade.”

That buffer could also expand with higher oil prices because they could cover a multitude of independent producer ills and would enable more acreage and drilling areas to be economic.

Capital constraints on crude

“Shale is going to flow once a basin is established,” said Devin Geoghegan, global director of petroleum intelligence, Genscape. “Of course there is a decline curve, and production does deteriorate. But as long as a producer has enough Tier 1 and Tier 2 targets in inventory, they can keep declines at bay and sustain the ‘hamster wheel’ for production.”

Production is challenging enough in terms of modulating supply in response to real demand. Still, there could be ways for supply to be more responsive if operating companies felt more present need to do so. “The real problem is that most publicly traded producers don’t pay a dividend,” said Geoghegan. “Even the ones that do don’t pay very much. They need the financial discipline of having to return cash to shareholders vs. issue new equity, which is what many of them have done.”

Even the specter of bankruptcy is not a deterrent. If anything, it may help them re-establish themselves so they have a second chance at growth.

“If you look at the bankruptcies in 2013 to 2015, these didn’t actually curtail any substantial growth in production. Bankruptcies extinguish debt, which can allow the company to focus on operations rather than financial worries. If the company is able to get financing post-bankruptcy, either from investors or from the purchaser, then production can grow,” explained Geoghegan.

“The companies that sought to reorganize shed debt, allowing them to refocus on operations and resume production. In some ways, the process perpetuated growth. Bankruptcy is unlikely to reduce shale production in any substantial way. The only real brake on production is growth of supply.”

and other issues

in Venezuela,

sanctions on Iran

and production

declines in

Mexico, a

significant

amount of the

world’s heavy and

heavy-medium

crude supply is

constrained,” said

Devin Geoghegan,

global director

of petroleum

intelligence at

Genscape.

To be sure, management does have discretion to throttle back, “and the disciplined ones do just that,” said Geoghegan. “It seems that, at least until the last few years, investors in public companies demanded growth. Recently though, we are starting to hear more investors wanting returns. They are also asking why SG&A [selling, general and administrative] costs are so high if shale production has become a manufacturing process.”

He stressed that some producers have reined in costs. “Those who have, performed relatively better and are likely to continue to do so,” said Geoghegan.

Indeed, a structural change has been underway among investors in energy. Of the 10 major segments in the S&P 500 Index, energy has performed the worst during the past 10 years. In seven of the past eight years, energy has underperformed the broader index. As a result, energy’s share of the broader index has been slashed by almost two-thirds, from 13.1% to 4.99%. Clearly, investors are not just migrating away from energy in a cyclical way that implies return, but shifting away over time in a structural way.

At first glance, global demand for liquids looks steady, if not robust, growing at a little more than 1 MMbbl/d a year. But, “some of that is NGL for petrochemicals,” said Geoghegan, “and once this is stripped out we are often looking at less than a million barrels a day of annual growth in supply for black oil, crude and condensate for refineries. That is within reach of U.S. production growth at a slightly higher forward price curve, so the U.S. could supply all the global growth in demand all by itself in many years.”

That is lovely for U.S. producers, but a chilly outlook for the rest of the world, especially OPEC, or countries like Norway or Canada which also rely heavily on oil exports. Indeed those exporters are not backing away. Canada is pressing ahead to resolve its persistent pipeline problems, and a large new field is expected to come into service next year off Norway. “OPEC growth is necessarily limited at current price decks because the U.S. and a handful of other countries can provide necessary supply growth,” Geoghegan added.

Demand growth ‘crawling’

“The world’s crude market is not short of supply,” said Haas at Stratas. “U.S. unconventional hydrocarbon production growth is still occurring, and we expect it should likely continue into the mid-2020s.” That is happening at a time when production elsewhere is held back by various edicts, agreements or circumstances in Canada, OPEC member nations, Venezuela and elsewhere.

“So with the prospect for millions of daily barrels of crude, as well as associated gas and gas liquids, returning if the spigots opened one way or another, it makes sense that the market is laser-focused on oil demand,” Haas said.

“Of great relevance to global oil markets, we see global demand for refined products not peaking until the 2030s,” Haas forecasted. “That said, we see petroleum-product demand growth crawling in the latter half of the 2020s and early 2030s until its plateau.”

The main driver affecting petroleum product demand will be the rate of adoption of electric motors across all transportation classes from trucks to passenger cars, off-road uses and others, Haas explained. “Trillion-dollar questions will be raised and answered during the next few decades around the extent to which electric motors, batteries and charging stations develop to meet the needs in growth markets or to supplant incumbent technologies in existing markets using internal combustion engines, fuel tanks and refueling infrastructure across the planet.”

The next question after total volume, explained Geoghegan at Genscape, is weight. “With sanctions and other issues in Venezuela, sanctions on Iran and production declines in Mexico, a significant amount of the world’s heavy and heavy-medium crude supply is constrained. Because shale oil tends to be lighter, the U.S. cannot fulfill the world’s demand for heavy crudes.” That does not necessarily signal a problem, Geoghegan hastened to add. “We think that the world is relatively well supplied with heavy crude at today’s prices. Russia can supply more, and if demand increases, then Saudi Arabia and Kuwait could produce more from fields in the Neutral Zone that have been shut in for years.”

In a small irony, one major demand center for heavy sour crude is the string of massive refineries on the U.S. Gulf Coast. Refiners spent heavily over many years to equip those complexes for deep conversion, but now find themselves with little need for the domestic bonanza of light, sweet shale oil.

Small ironies

In another small irony, that surfeit of light sweet crude actually increases demand for medium crudes, notably from offshore U.S. It might seem that if unconventional development can’t help but grow inherent production, the first barrels displaced would be from the Gulf of Mexico. Why would majors spend billions on high-capital development when independents are drilling multiple laterals from single-well pads for a fraction of the cost?

“There are still economical projects in the Gulf of Mexico,” Geoghegan explained. “There are some very tasty medium crudes there that are definitely needed for domestic refineries just on a dietary basis. Of course offshore development is slower in a lower-cost environment, but the big guys have been doing this for decades and are doing it properly.”

A smaller variable in the demand for heavy crude are the new ultralow sulfur rules that the International Maritime Organization will begin enforcing on Jan. 1, 2020. It is widely expected that ship operators will meet the mandates with a wide range of approaches, from buying compliant fuels, to modifying engines to burn other fuels, to retiring old ships to cheating.

“It is unclear how much heavy crude will be needed in the next few years,” said Geoghegan. “I don’t see many refiners adjusting their processes just yet. Most likely a few would make incremental changes.”

Current price ranges and production levels are essentially dependent on OEPC maintaining its self-imposed production cuts. “We have been saying since September 2018 that OPEC needs to extend their cuts through 2020, and then hold any moderate increases steady through 2021 and 2022.”

That brings the conversation back to the point of true demand for black oil, ex-liquids for petrochemical manufacturing. “A continuation of the trade war could knock a year off demand growth,” said Geoghegan. “Other than that, and barring a recession, we see growth in demand continuing, but it will be fairly lumpy.”

The big known variable is the divergent demand growth rates in developed as compared to developing countries. The known unknown within that is the possibility that alternative-fuel vehicles will also gain traction in those developing countries.

“China and India are targeting cars for pollution reduction,” said Geoghegan. “And everyone is trying to mitigate use of fossil fuels, especially for fleet vehicles. So long-term growth in demand for oil slows down. But I am dubious about the general idea of ‘peak demand.’ At least just yet. Fleet turnover among passenger vehicles and trucks has been about seven or eight years in the U.S., maybe a little longer now and elsewhere. So peak demand may be a factor in another 10 years given a lot of electric cars around the world would certainly punch a hole in oil demand.”

Recommended Reading

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.