The Noble Bob Douglas is among the drillships that have been used offshore Guyana, where Exxon Mobil Corp. and partners estimate recoverable resources at about 10 Bboe. (Source: Janis DroneFlyer/Shutterstock.com)

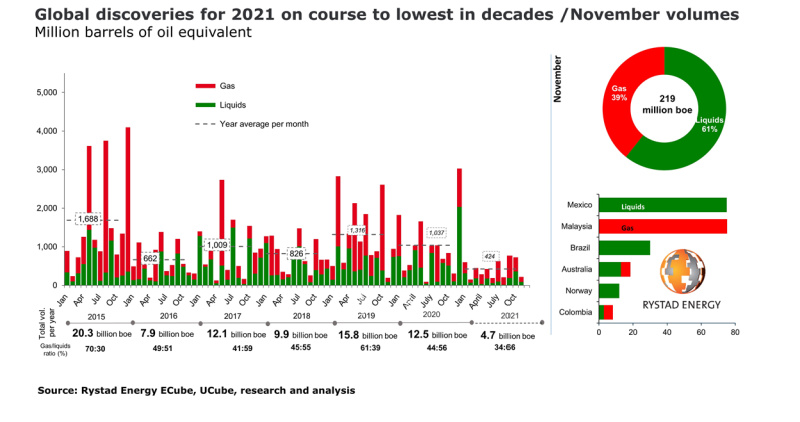

With only 4.7 billion barrels of oil equivalent (Bboe) discovered through the end of November, 2021 is on track to be the worst for global oil and gas discoveries since 1946, energy experts say.

The discovered volume so far this year is down from the 12.5 Bboe oil and gas explorers found in 2020, according to data from Rystad Energy.

“Although some of the highly ranked prospects are scheduled to be drilled before the end of the year, even a substantial discovery may not be able to contribute towards 2021 discovered volumes as these wells may not be completed in this calendar year,” Palzor Shenga, vice president of upstream research at Rystad Energy, said in a news release. “Therefore, the cumulative discovered volume for 2021 is on course to be its lowest in decades.”

The analysis was delivered as oil and gas companies focus on the energy transition, reducing emissions and producing lower-carbon barrels of hydrocarbons as some bet big on natural gas. Many majors have spent less on oil and gas exploration in recent years with decarbonization now an integral part of their company strategies.

The moves come despite forecasts showing growing energy demand and the need for affordable energy in developing countries. NOCs appear to be stepping up.

No major discoveries have been announced so far in December and only seven were announced in November, accounting for about 219 MMboe of new volumes, Rystad said.

The largest of the November discoveries was Lukoil’s Yoti West offshore Mexico, where about 75 MMboe recoverable was found. Drilled 60 km offshore at Block 12, the Russian oil firm said the well “penetrated a sand reservoir in Upper Miocene sediments with high permeability and effective oil-saturated thickness of about 25 meters.”

PTTEP HK Offshore Ltd. and partner Petronas Carigali Sdn Bhd were also among with companies having success with the drill bit in November. Their Nangka-1 well hit sweet gas in the Middle to Late Miocene Cycle VI clastic reservoirs. The discovery marked the second for Petronas for 2021, following news in February of the gas discovery of the Dokong-1 wildcat exploration well in the same block—SK417—offshore Malaysia.

PTTEP’s exploration triumphs for the year, so far, include several other oil and gas finds offshore Malaysia: Kulintang-1 in Block SK438 in May, Sirung-1 in Block SK405B in March and Dokong-1 in Block SK417 in February.

Notable Finds

Other notable finds this year have included Turkey’s TPAO hitting natural gas at the Amasra-1 well in the Black Sea’s Sakarya North field. In-place volumes were estimated at 135 Bcm.

Brazil’s Petrobras also built on its discovered resources in the presalt Santos Basin, where its latest discovery included oil at the Curaçao well in the Aram Block.

Petrobras plans to invest more than $2.5 billion in seismic—essential to understanding reservoirs—over the next five years, Tiago Homem, the company’s executive director of reservoirs, said during the recently held World Petroleum Congress (WPC) in Houston.

“Seismic I think is the key element for enhancing value and for increasing recovery factors,” Homem said.

Mexico’s Pemex earlier this year announced the discovery of between an estimated 500 and 600 MMbbl of crude oil equivalent at the Dzimpona-1 onshore well in Tabasco. The company has said other prospects are also being explored in the area.

Mature Basins

Explorers have also found new resources in mature basins such as offshore Norway. Discoveries here this year included news in May of Wintersall DEA’s Dvalin North, which was estimated to hold between 33 and 70 MMboe; and Equinor and partners PGNiG Upstream Norway and Longboat Energy Norway’s oil discovery at Egyptian Vulture announced in November.

Equinor also had success in the Fram Field area of the North Sea, where an oil discovery announced in March at the Blasto prospect was said to have between an estimated 75 and 120 MMboe or recoverable oil based on preliminary estimates. Equinor said the discovery—which at the time marked four of four successful prospects within 18 months—revitalized one of the Norwegian Continental Shelf’s most mature areas.

The Gulf of Mexico (GoM) also keeps on giving.

Shell in May said it hit oil pay at the deepwater Leopard prospect in the U.S. GoM’s Alaminos Canyon Block 691. The discovery was made in the oil-rich Perdido Corridor in about 6,800 ft of water. Shell and partner Chevron each hold a 50% stake in Leopard, with Shell serving as operator.

The GoM also proved fruitful for BP and partners Talos Energy and Chevron. The trio hit oil pay at the Puma West prospect in Green Canyon Block 821, only 15 miles west of the BP-operated Mad Dog Field, according to news released in April.

Liz Schwarze, vice president of global exploration for Chevron, spoke during the WPC about the GoM’s “terrific geology,” “tremendous installed infrastructure” and it having some of the “lowest carbon barrels” for Chevron.

New Play Concepts, Emerging Areas

After more than 20 years of the industry exploration efforts failed to make a commercial discovery in the Ivory Coast’s deep waters, Italy’s Eni make a major oil discovery there this year. Eni said in September it successfully tested a new play concept offshore Ivory Coast with the Baleine-1x well in Block CI-101.

The Baleine discovery was preliminarily estimated to have between an estimated 1.5 and 2 Bbbl of oil in place and between 1.8 and 2.4 Tcf of associated gas. Production from the block, of which state-owned Petroci Holding has a 10% stake, is expected to begin in second-quarter 2023, Reuters reported Dec. 15.

Meanwhile, offshore Guyana, Exxon Mobil Corp. and partners Hess Corp. and CNOOC Ltd. added to their exploration success story in the Stabroek Block, where the recoverable resource estimate moved up this year to about 10 Bboe.

The latest discovery, announced in October, was made at the Cataback-1 well located about 4 miles east of Turbot 1. The company’s 2021 discoveries offshore Guyana also include Pinktail, Turbot-2, Whiptail, Longtail-3 and Uaru-2.

Exxon Mobil said Turbot-2 discovered net pay in a newly identified, high quality hydrocarbon-bearing sandstone reservoir separate from the original Turbot-1 well.

“We’ve discovered, as you seen over 10 billion oil equivalent barrels in [about] six short years, which is phenomenal and a little bit unprecedented in the industry for a good number of years,” Mike Cousins, senior vice president of exploration and new ventures for Exxon Mobil, said during WPC. “We would suggest that in the Guyana basin, which of course goes right from Guyana-Suriname, the industry will easily see double that over the next four years.”

Recommended Reading

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.