(Source: Shutterstock.com)

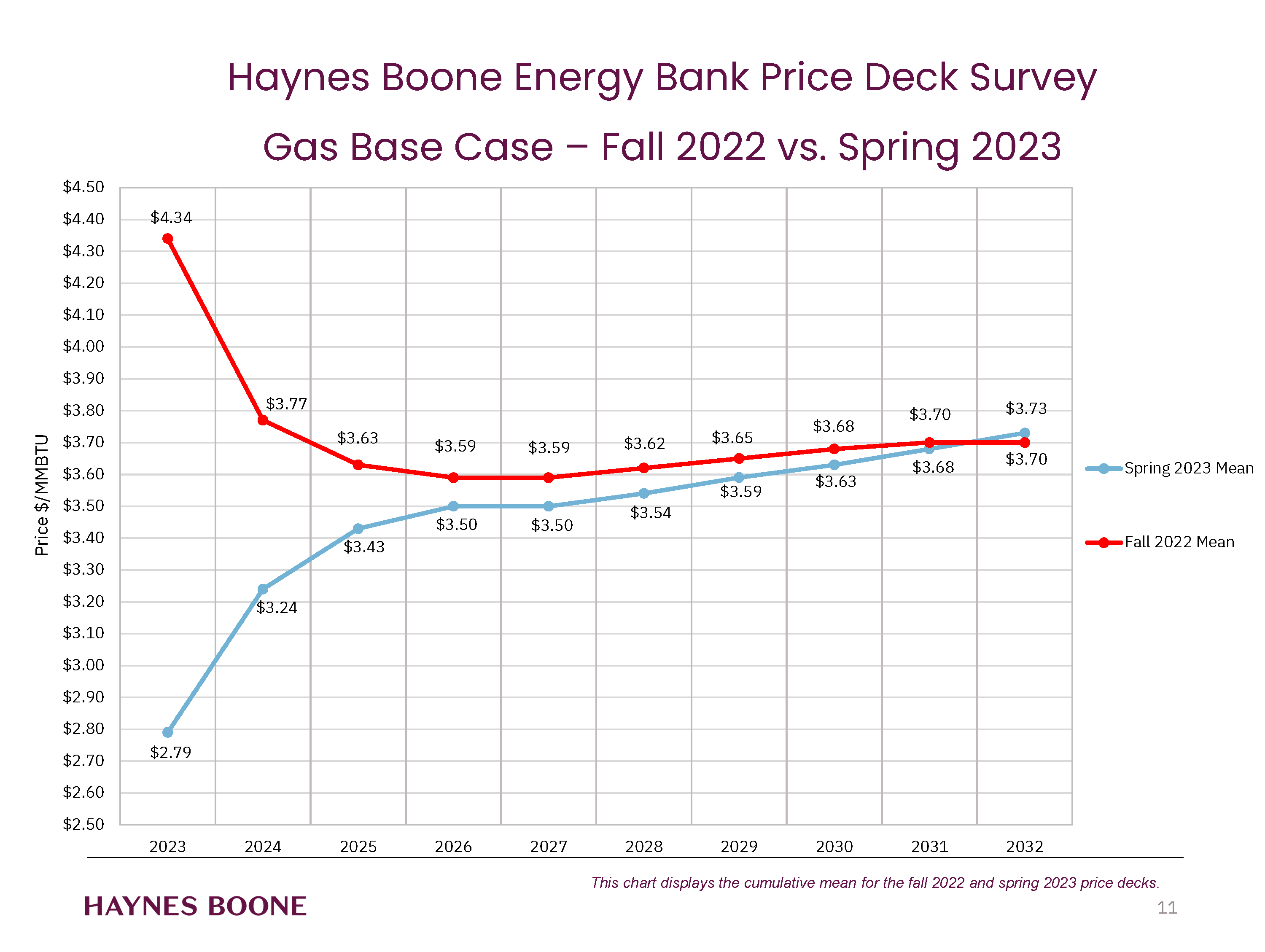

Banks are projecting this year’s gas prices at more than a third lower than they predicted in the fall of 2022, according to a survey of banks active in the energy sector.

The biannual calculations affect oil and gas producers’ access to bank loans.

“Gas producers are not as happy as oil producers today,” said Buddy Clark, energy practice co-chair at Haynes Boone, the law firm responsible for the banks’ oil and gas price decks survey. “If it had been a cold winter in Europe, the gas producers would have been way up.”

The banks are now predicting this year’s gas prices will average $2.79/MMBtu, a 36% drop compared to fall assumptions.

Banks calculate oil and gas price decks to inform their biannual loan resetting in reserve-base lending (RBL), which uses the company’s oil and gas reserves as a type of collateral.

The survey is less of an indicator of what gas price consumers will see at the pump and much more of an indicator of gas and oil producers’ access to capital. The banks forecast oil and gas prices much more conservatively than WTI crude pricing because of their specific banking business model.

The tightening of gas producers’ access to bank capital comes at a time when family offices’ investment in upstream is increasing, according to another Haynes Boone study, and when some are seeing a return of private equity to upstream.

Banks’ price decks for oil prices had a much less dramatic change than in the fall—just a 2% drop to $65.58/bbl.

Twenty-four banks were part of the survey, including Barclays, BOK Financial and Wells Fargo. Some European banks have left the reserve-base loan space.

Future expectations of commodity prices over the life of the loan are the principal variable, but not the only variable. Each bank has its own proprietary algorithm.

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.