(Source: Shutterstock.com)

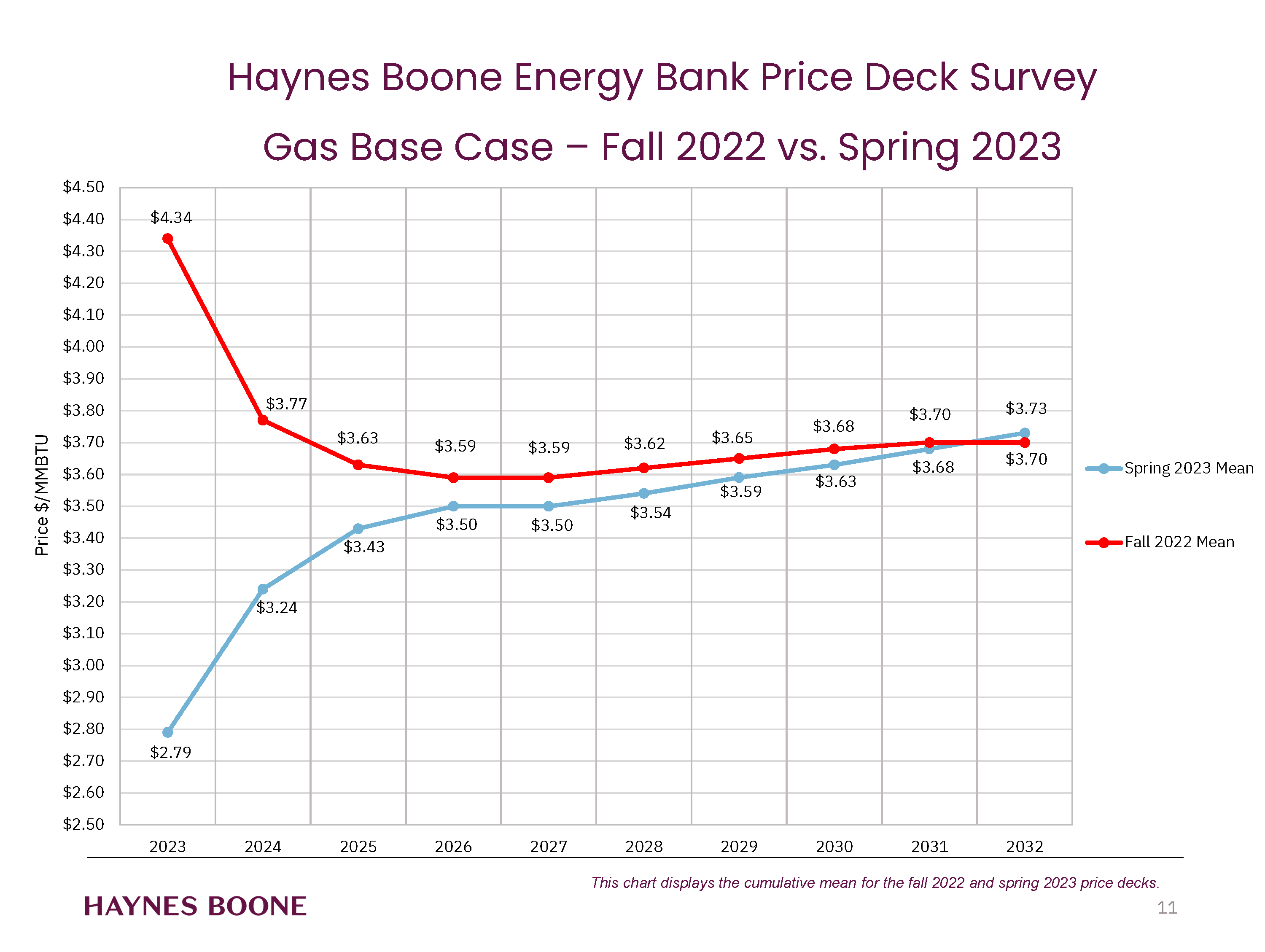

Banks are projecting this year’s gas prices at more than a third lower than they predicted in the fall of 2022, according to a survey of banks active in the energy sector.

The biannual calculations affect oil and gas producers’ access to bank loans.

“Gas producers are not as happy as oil producers today,” said Buddy Clark, energy practice co-chair at Haynes Boone, the law firm responsible for the banks’ oil and gas price decks survey. “If it had been a cold winter in Europe, the gas producers would have been way up.”

The banks are now predicting this year’s gas prices will average $2.79/MMBtu, a 36% drop compared to fall assumptions.

Banks calculate oil and gas price decks to inform their biannual loan resetting in reserve-base lending (RBL), which uses the company’s oil and gas reserves as a type of collateral.

The survey is less of an indicator of what gas price consumers will see at the pump and much more of an indicator of gas and oil producers’ access to capital. The banks forecast oil and gas prices much more conservatively than WTI crude pricing because of their specific banking business model.

The tightening of gas producers’ access to bank capital comes at a time when family offices’ investment in upstream is increasing, according to another Haynes Boone study, and when some are seeing a return of private equity to upstream.

Banks’ price decks for oil prices had a much less dramatic change than in the fall—just a 2% drop to $65.58/bbl.

Twenty-four banks were part of the survey, including Barclays, BOK Financial and Wells Fargo. Some European banks have left the reserve-base loan space.

Future expectations of commodity prices over the life of the loan are the principal variable, but not the only variable. Each bank has its own proprietary algorithm.

Recommended Reading

Permian Resources Continues Buying Spree in New Mexico

2024-01-30 - Permian Resources acquired two properties in New Mexico for approximately $175 million.

Eni, Vår Energi Wrap Up Acquisition of Neptune Energy Assets

2024-01-31 - Neptune retains its German operations, Vår takes over the Norwegian portfolio and Eni scoops up the rest of the assets under the $4.9 billion deal.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.