[Editor's note: A version of this story appears in the June 2020 edition of Oil and Gas Investor. Subscribe to the magazine here. It was originally published June 1, 2020.]

It goes without saying that silver linings are hard to find these days. Just when you think you have found one, there is a caveat, and convincing others of an optimistic worldview has become an art form. Considering what COVID-19 has wrought upon the world in general, and how it and the oil price crash have hamstrung the industry in particular like never before, it is understandable that many currently view silver linings as far-flung dreams.

But someday these nightmares will fade, and today’s silver linings will become tomorrow’s realities. For those who look deep enough and prepare accordingly, they will become tomorrow’s opportunities.

That is what many of the producers and analysts that spoke with Hart Energy said about the U.S. natural gas market, ranging from the Haynesville Shale to the Barnett Shale, with a particular focus on the Marcellus and its abundance of dry gas and economics capable of handling sub-$3 natural gas prices.

“With lower oil production, they’ll probably shut in 2 million to 5 million barrels of oil per day. … So you should see support for gas prices assuming the economy gets better,” said Dan Pickering, founder and chief investment officer of Pickering Energy Partners, in a video interview with Hart Energy (See the full interview at HartEnergy.com/videos)

“We’re exporting a lot of LNG. That is economically dependent. We need factories running and burning natural gas. So demand has to get better as well as associated gas supply coming down. All things being equal, natural gas should be advantaged by what’s happening with oil,” Pickering said.

Natural gas producers also have noticed the possible opportunity ahead of them.

“While you certainly hate to see what has come about in our world with the coronavirus and the collapse of oil, it does appear that taking an amount of associated gas off the market is going to help balance the natural gas market a lot sooner than was otherwise anticipated,” said Trevor Rees-Jones, founder and CEO of Chief Oil & Gas LLC, which has achieved more than 2 Tcf of gas production in the Marcellus and holds close to 100,000 acres of net leasehold in Northeast Pennsylvania (NEPA).

“In all my years in the oil and gas business, I’ve never seen as dramatic a change in what people expected in pricing occur. In just a span of 60 or 90 days, there’s talk about prices being projected for next year [that] nobody would have thought about,” Rees-Jones said in an interview with Hart Energy. “It’s tragic how it happened, but it may serve to save certain natural gas producers that were heading for bankruptcy.”

However, Rees-Jones’ bullish outlook also comes with a warning.

“Traditionally, on the natural gas side with the oil price crash, you’re going to see a lot less capital allocated to oil drilling. And as oil drilling spins off a large volume of associated gas, you’re going to see reduced associated gas, which is then going to put upward pressure on or increase natural gas prices,” added Andy Levine, Chief’s senior vice president of marketing. “Of course, that benefit only perpetuates as long as oil prices stay low. Once that drilling comes back, that benefit then goes away.”

“In all my years in the oil and gas business, I’ve never seen as dramatic a change in what people expected in pricing occur.”

—Trevor Rees-Jones, Chief Oil & Gas

Nonetheless, many operators appear to be positioning themselves to seize the potential natural gas opportunity. In Texas, drilling permit filings are down with the record-low crude oil prices, but the percentage of natural gas wells is entering double-digit territory amid the oil price crash, according to a report by The Houston Chronicle.

On the surface, those moves stand to reason.

“A lot of the bears around natural gas had two primary arguments: We have an unlimited supply of natural gas, and we’re persistently oversupplied. Our pricing will never recover,” said Chris Kalnin, CEO of Kalnin Ventures LLC, which has committed $1 billion over the last five years in its Barnett Shale acquisition from Devon Energy. “We have this competition from associated gas, which was costless, effectively, and will swamp the market with additional oversupply. What you’re seeing today is that those bearish excuses are being taken away.”

While Kalnin remains steadfastly bullish on the longer-term value of U.S. natural gas in the Barnett, Kalnin Ventures also is well positioned in the Appalachia region through several acquisitions in the Marcellus.

“There is no basin that is cheaper from a dry gas perspective than the Marcellus,” Kalnin said. “In terms of low-cost supply and market where you’re running out of associated gas, you want to in the Marcellus because it is still the premier basin in terms of scale but also in terms of economics in bringing on dry gas.”

So, while the dark clouds that hovered over natural gas prices before the onset of COVID-19-induced demand/storage issues and the oil price crash provoked by Russia and Saudi Arabia may be thinning for now, even long-time Marcellus drillers warn that things are different this time around.

“While you see the gas market strengthening, you have very few companies within Appalachia that can really take part of that strength. The reason is that you still have companies with a tremendous amount of debt.”

—Chris Doyle, Olympus Energy

In addition to a bounce back in the economy, taking advantage of this unexpected opportunity also takes a well-capitalized, well-positioned company with a strong balance sheet, because a natural gas pricing boom still means about $3 prices, not the $8 prices that ushered in the rise of the Marcellus, Haynesville and other plays.

“I don’t foresee a time when gas gets back to where we were previously, certainly when this basin started. What really spurred this basin was $8 gas,” said Chris Doyle, CEO of Olympus Energy, in an interview with Hart Energy. Olympus has remained active in the southwestern Pennsylvania Marcellus, having endured the low natural gas prices of previous years when many pulled out of the basin.

“I don’t see a tremendous bull run. But what I do see is sustained gas prices above $2.50, and I think we have enough resource available that we can keep gas price in a fairly tight [band],” Doyle said.

To keep things in perspective, a decade ago that price environment would have sent many producers off a cliff.

Seizing the unexpected moment

Doyle, who heads a private operator backed by Blackstone, said Olympus is in a stronger position to take advantage of the uptick in natural gas prices than other companies. In fact, he said his stance on drilling in the Marcellus hasn’t changed since he addressed Hart Energy’s DUG East Conference & Exhibition in Pittsburgh in June 2019.

“What it takes to win in a commodity business is you have to have a number of things. You need to have core assets and quality assets, and to me that means high margins and great well returns,” he said. “You have to be well-capitalized. You have to be nimble as an organization. You have to be a learning organization.”

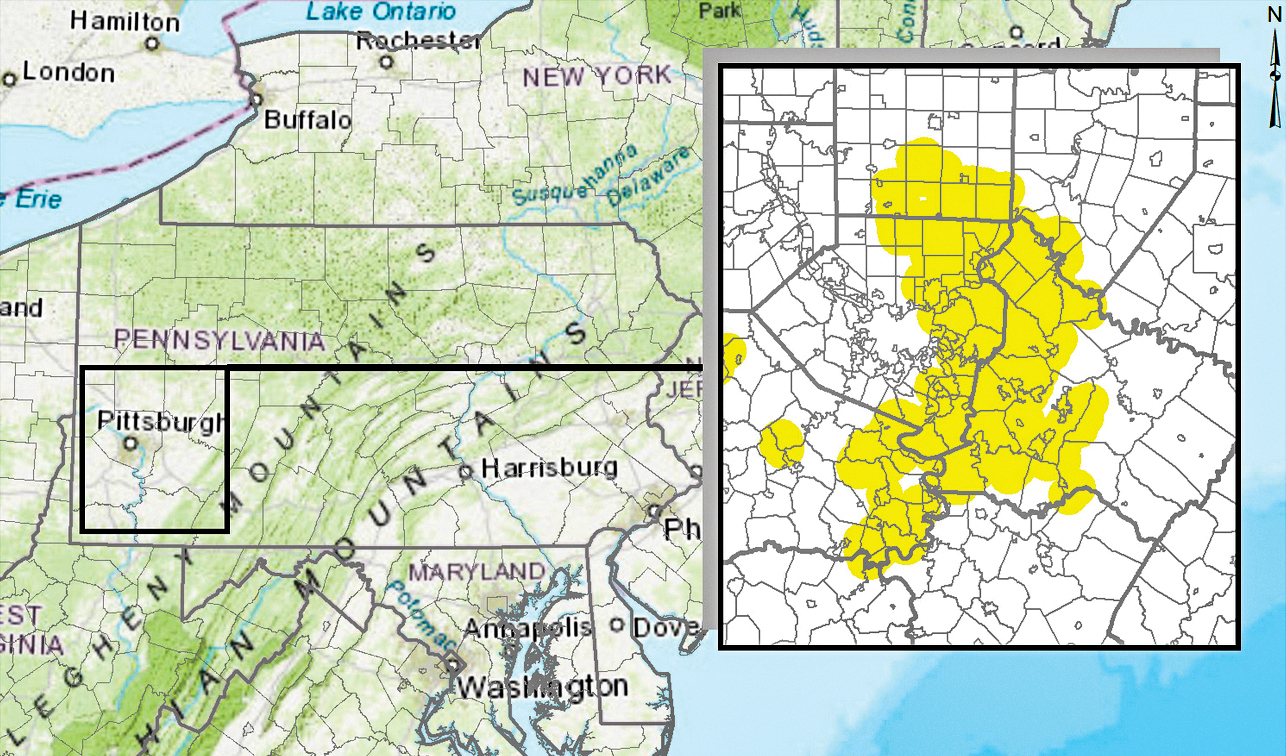

Olympus, which holds a 100,000 net acre position mostly in Westmoreland County, wrapping around the eastern suburbs of Pittsburgh and into Washington County to the south, has continued to drill, but Doyle said the company will pause after finishing its current pad. However, he added that the company will remain active in the near future because it can check off all of the aforementioned boxes.

While the strategy for drilling remains in place, Olympus plans to react to “what the market shows.” Right now, that’s an unexpected short-term future brought upon by COVID-19 and the expected rebalancing of the market due to the loss of associated gas from Texas oil fields.

Doyle said the company is well positioned to make a quick reaction to the market’s changes.

“You need to be able to react to what the market’s showing you. I think this is where many companies in Appalachia have really struggled,” he said. “In many instances, long-term commitments cloud the right capital allocation decisions for companies. Those complexities take away from a very real decision of whether they should be allocating capital today or not.”

Of course, private operator Olympus has access to capital via Blackstone.

“Part of [our ability to be nimble] is because we’re private. We’re very well-capitalized by Blackstone. [We have a] clean balance sheet and great assets,” Doyle said. “But we’re also not beholden to a production target or a quarterly mandate by the market, and that helps as it allows us to balance short-term decisions with long-term value.”

When asked if he was concerned about whether renewed interest in natural gas as prices inched up would create an even greater oversupply situation in Appalachian Basin gas, Doyle didn’t hesitate. He said that many companies are not positioned to enter the market or to obtain a core position in a now mature basin.

“From an industry perspective, when you’re looking for high-return opportunities, there’s not a whole lot out there currently that works at, call it, $20 oil and $2.50 gas,” he said. “The market sees the demand around the corner and knows that if you can deliver high margins and returns there will be a tremendous opportunity.

“We own our own midstream and have some of the highest margins in the basin, so we’re excited about what we have going at Olympus,” Doyle continued.

“We also know that the next few months will continue to present challenges and will require navigating through uncertainty. We’ll be looking to find balance between long-term value and short-term risk mitigation, which means making difficult decisions at the right time in order to optimize opportunity for Olympus,” he said, adding that Olympus requires fewer strategic changes to maneuver through the short term than companies without free cash flow and access to capital. Therein lies his confidence.

Managing the short term

Olympus’ pause was preplanned, not based on COVID-19 or the dramatic drop in oil prices in late April. However, Doyle admitted it’s a strategy that translates well into the uncertain 2020 and expected 2021 environment.

“What we’ve done over the past couple of years is the reason our balance sheet is in the position it is. We’ve been in the mode of drilling a handful of wells, bringing those wells online, cash flowing those wells and then drilling the next set,” he said. “Because of the uncertainty of the next few months, that strategy plays very well into that environment.”

Olympus is drilling on a four-well pad and will demobilize the rig after that. “We’ll complete the wells likely later this year into what we think is going to be a very strong and strengthening gas market,” Doyle said.

“We’ve positioned the company to go headlong into development of a continuous rig program, but we know that the right decision now is to pause and confirm that what we are predicting is accurate,” he said. “This is an exercise we work on continuously and one that helped frame the way we are thinking about the market. Once we have more clarity, we hope to allocate resources to continue Marcellus development and test our Utica assets.”

Doyle said once you get past the next few months, there will be more clarity. He believes the industry is “on the porch of a really strong or at least strengthening gas market.” It will take a low-cost approach to succeed in a $3 or less pricing environment, but Doyle also believes the Appalachia region is the ideal place to meet margins at that price versus other basins.

“We’ve been extremely successful at bringing on supply at very low cost, and that’s driven down that cost of marginal supply within Appalachia,” he said.

Making the most of experience

Across the state in NEPA, Chief is rolling along with its drilling programs with a similar eye on the positive-looking price signals and the differences in this price environment compared to those in the past.

“What we have experienced historically is we’ve tended to see activity lag price signals. That can be caused by producer hedging or longer-term service contracts. Sometimes it’s just a drill and hope attitude,” said Chief’s Levine.

“In this last downturn, things started to change somewhat, particularly in the lending arena. Banks were being more conservative on their lending practices, insisting on free cash flow,” he said. “I guess what I would say is [compared to] the phenomenon you saw in the past where you didn’t see the reaction to the price signal, we think in the future you’re going to see a more aligned reaction just because of the lending arena and difficulty of getting access to capital when pricing doesn’t justify it.”

Marcia Simpson, Chief’s senior vice president of engineering and operations, agreed that remaining disciplined over the past years set up Chief for an existing strategy tailor-made for the upcoming price hike.

“I think the larger companies and even the private-equity-backed [companies] have learned a very valuable lesson on growth strategy at all costs,” Simpson said. “We’ve been very disciplined in our company for the last four-plus years on [being] free-cash-flow positive. But our goal was not to grow production. It was to keep production flat and meet our commitments and make margins.”

That’s left Chief in “a pretty good position” and with an opportunity if there is some consolidation of businesses to possibly pick up some additional production, according to Simpson.

“We’ve been in this boat for years, so we are very prepared and have a great hedging strategy,” she said. “We’re very predictable. We have a two-year target to meet, and we’re meeting it.”

The OFS factor

A caveat to this optimism is the toll the oil price crash will take on the oilfield services (OFS) sector. Simpson, who oversees Chief’s well operations, is concerned with the sector’s health but also confident Chief is positioned to deal with the loss of suppliers.

“One of the significant exposures is the health of the service companies, and we’ve seen an impact [in the sector] because of their businesses relying on activity all over the world. We definitely have a concern of seeing those companies go out of business. That is a major potential downside of the oil price crash,” she said.

She said Chief has requested proposals with several vendors, and it relies on larger companies for major products. The impact will most likely land on companies that have a smaller footprint. “It’s harder [for them] to weather the storm,” she said.

The market ahead

“Long term, I think we have line of sight on a gas price that makes our business work really, really well,” Olympus’ Doyle said.

But that doesn’t mean there aren’t significant speed bumps along the road ahead for Appalachian Basin dry gas producers. Just like the economy in general as it reopens, the natural gas market ahead is sure to be full of ups and downs—and unfortunately, winners and losers.

“I do believe there is going to be additional volatility given the macro impacts of shut-ins in the Permian,” Doyle said.

Kalnin added that while the industry is staring at a renaissance of sorts for the natural gas market, it will come at a time of consolidation for the Appalachian Basin over the next couple of years.

“Companies need to work out their balance sheets and build up their cash,” he said. “The marginal gas supply for the country will need to come primarily from the Marcellus to supply what is going to be lost if oil prices continue to be the way they are.”

And that’s what he and others are betting on as they continue to drill and invest in the Marcellus dry gas fields.

“While you see the gas market strengthening, you have very few companies within Appalachia that can really take part of that strength,” Doyle said. “The reason is that you still have companies with a tremendous amount of debt. The spillover from what’s going on with oil is very real to the credit markets.”

That is where capitalization becomes extremely important, he explained.

“If you look at many of our neighbors and their balance sheets, they still need to be in the mode of paying off or restructuring debt, cleaning up their balance sheet. While the gut reaction from some of these companies will be ‘let’s get back to drilling’… I don’t know that they’ll have access to capital to do that,” he said. “That’s the interesting nuance in my mind where Olympus may yet further be advantaged. We actually do have access to capital. We have great rock to go drill and actually return capital to our stakeholders.”

“The other part is the core positions are very much known and they are held,” he added. “We’re now a mature basin, and if companies want to come in, they’ll have to acquire a core position that comes with a tight balance sheet or look for others.”

Doyle also said that Olympus’ proximity to markets and the Dominion South hub prime it for success for the lower cost structure needed in the natural gas market of 2021 and beyond.

“It’s been a real advantage for us because we are very close to one of the most liquid gas hubs in North America,” he said. “The differential to Nymex has typically been 40 to 50 cents. We’ve seen it tighten a little recently.”

Taking advantage of that proximity to the hub has been a key component of Olympus’ strategy in the past and will grow in importance in the future. Olympus owns its own midstream because its gathering needs to Dominion South are short. Doyle said he is not necessarily looking to manage the market over a long haul.

OLYMPUS ENERGY ACREAGE POSITION

gathering system. (Source: Olympus Energy)

“We have considered the path many companies have chosen which is, ‘I want to lock in gas all the way to the Gulf Coast.’ We think, ultimately, economics will work that out,” he said. “Rather than sign up for long-haul, long-term commitments, we can actually capture that margin by delivering so close to Dom South as we are.”

While the pipeline buildout in NEPA is not as thorough as the buildout in the southwest corner of the Marcellus, Chief’s executives expressed similar confidence in their proximity to large demand markets.

“The northeast doesn’t have as robust an infrastructure as the southwest. This owes to the fact that it’s farther down the pipe so there’s not as much legacy pipeline. Also, it’s closer to major metropolitan centers, which makes it more difficult to build,” Levine said.

“In NEPA, right now things seem to be unconstrained. For the very near term, they appear to be that way based upon what we see with drilling activity,” he continued. “Of course, with higher prices there could be an increase in activity, and there are scenarios where it could be constrained in the next year or two if activity increased.”

If NEPA becomes constrained again, Levine said it would be very difficult for Chief to sign up for an expansion because “They’ve gotten so costly and unpredictable that we would probably tend to operate within our existing asset.”

“You have to be well-capitalized. You have to be nimble as an organization. You have to be a learning organization.”

—Chris Doyle, Olympus Energy

“We feel like we have a pretty good situation laid out, and we’re happy and productive in staying level and not increasing,” he said.

Like Levine, Doyle is balancing his optimism with a bit of caution. “We’re feeling very confident, but we acknowledge the need to balance the issues we face as an industry and as an economy right now,” he said. “We’re immune to some of those challenges, but we will certainly need to remain nimble in order to adapt and overcome others.

“As our industry fuels the economy, we’re only as strong as the market environment,” Doyle said. “We have to be prudent, and again, that means weighing short-term risk mitigation with driving long-term value.”

Recommended Reading

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

McDermott Consortia Scoops Up Two Ruya Project Contracts

2024-02-01 - The EPCIC contracts support the expansion of the offshore Al-Shaheen Field, Qatar’s largest oil field.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.