When the movie “Tron” was released in 1982, virtual reality seemed like nothing more than science fiction. While much of the movie still remains fantasy—there are no light cycles yet—inventions like the Microsoft HoloLens and Samsung Gear VR are making virtual worlds a reality.

Nearly a decade after that movie was released, the U.S. Clean Air Act was updated by Congress in 1990 to include protections from power plant emissions. These amendments promoted the increased use of natural gas, but it took 25 years for natural gas to achieve parity with coal-fired power generation.

While the power generation industry has known for years it was going to switch from coal to another energy source to meet carbon emission reductions sought on both the federal and state levels, the decision on what this future source was going to be was up for debate. There was hydroelectric, solar, wind, “clean” coal and other sources.

Pros/cons

All had their advantages along with a long list of disadvantages. The cleaner fuels had problems with 24-hour deliverability rates while the fuels that could be depended upon as baseload fuels were far dirtier than alternative sources. There was also the issue of cost involved with newer technologies that would significantly increase the price of electricity on the consumer end.

The plan by the power sector at the start of this century was to increase the use of natural gas for electric generation as a bridge fuel to renewables. The problem was that gas production out of the U.S. was on a long decline and much of the gas that would be utilized as baseload fuel was going to have to be imported as very expensive LNG. Then along came the shale gale, which greatly reduced the cost of natural gas prices over much of the past decade. Suddenly, coal’s lifespan was shortened significantly as the switch to gas by power generators was sped up and the future was arriving much faster than expected.

Nuclear power, once a promising baseload power source, has been hamstrung by federal regulations and anti-nuclear public sentiment following Japan’s Fukushima disaster five years ago. Still, there is some new development of domestic nuclear plants, such as Georgia Power’s Vogtle Units 3 and 4, now under construction near Waynesboro, Ga. Unit 3 is scheduled to go online in 2019 and Unit 4 in 2020. Nuclear’s share of the power generation business is expected to change little in the foreseeable future with the concurrent retirement of older plants.

Power play

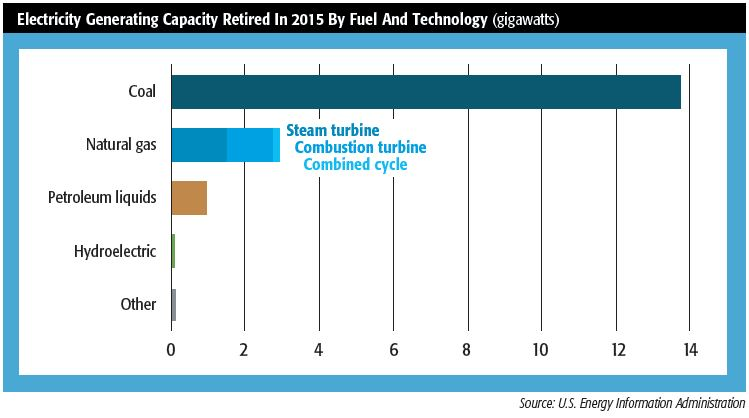

According to data from the U.S. Energy Information Administration, gas power generation has increased 76% in the decade from 2005 to 2015 while coal-fired power generation has fallen by 33%. Renewables are getting a great deal of attention and picking up market share, but gas is proving to be the big beneficiary of coal conversions. Last year, the coal fleet diminished by 6%, with 29% of that capacity picked up by natural gas with renewables behind gas conversions.

“Renewables are making gains because companies are increasingly reducing their dependence on baseload power generation, but you’re never going to see renewables take over the majority of the electricity mix because generators can’t rely on them the way they can natural gas or coal,” Chris Cothran, gasification analyst at Stratas Advisors, told Midstream Business.

Indeed, natural gas will only continue to increase its share of the power generation market as new plants are built and coal plants are converted to gas.

“We see more gas coming online to our energy mix. We don’t have a hard and fast number, but we would consider a third of the mix for gas, coal and renewables to be a healthy diversified mix in the near term,” Tom Williams, director, external relations at Duke Energy, told Midstream Business.

Duke Energy is one of the largest utilities in the U.S. and a prime example of the impact natural gas is having on the country’s power generation sector and carbon emission rates. In the past decade, the company has reduced its carbon emissions more than 25% from 2005 levels. The company has five utilities in six states, including Florida and the Carolinas. These states are part of the fastest-growing region in the country in its conversion from coal to gas power generation.

New South

Ten years ago Duke Energy’s energy mix in North and South Carolina was approximately 1% from natural gas, which was only used during the summer or winter peaks. Today that figure is 25% and expected to continue to grow. Williams said that the energy mix varies by region, but gas will eventually likely have the largest share of the mix, followed by nuclear, coal and renewables.

“Our industry is undergoing transformation with new technologies, evolving customer expectations, increasingly impactful public policies and abundant low-cost natural gas. These factors will have a profound impact on our business in the years ahead and are informing our strategic investments,” Lynn Good, chair, president and CEO of Duke Energy, said during the company’s fourth-quarter 2015 earnings call.

The company’s five-year business plan running through 2020 includes the retirement of 2,200 megawatts (MW) of coal capacity along with the investment of $4 billion in new efficient natural gas facilities and $3 billion to expand renewables.

The South has been at the forefront of this switch to gas because of the cheaper economics of transporting gas compared to transporting coal.

For instance, Duke Energy’s Midwest operations are much more focused on coal power generation because of how much closer these markets are to coal mines. In addition, a lot of the coal-to-gas conversions are taking place in the Southeast because that is where a lot of the duplicate capacity with coal and gas exists, Cothran said.

“Cheaper and more plentiful natural gas has fundamentally shifted our entire generation fleet. We’ve shut down 40 coal units since 2011 and almost all of that capacity has been replaced by natural gas plants,” Williams said. “By 2022, we forecast up to 7,000 MW of new gas generation in our portfolio. Natural gas has been our primary driver of reducing carbon and other emissions from our plants. These reductions have been driven by the market and the market has been driven by shale gas.”

Improving costs

Technology is also playing a large part in helping make gas-fired power plants more economical. Combined-cycle power plants utilize a series of heat exchangers that work together to improve the efficiency of the plant by extracting energy from one exchanger’s waste heat and utilizing it across all four exchangers. The net efficiency can improve by up to 60% compared with a single-cycle plant.

The current downturn in gas prices is proving a tough go for producers, but it is a boon to utilities and their customers. Based on current gas and coal prices, in order to be “in the money,” Duke Energy’s North Carolina and South Carolina combined-cycle plants require gas to be below $3.25 to $4 per million Btu (MMBtu). Given the price of Henry Hub gas over a two-year period, that threshold hasn’t been difficult to achieve. In fact, these prices have even allowed some of the company’s simple-cycle plants to be competitive with its most efficient coal plants.

“Converting from coal to gas also allows us to save our customers on their power bill. Fuel accounts for 30% to 40% of our customers’ power bill, so if we can buy fuel cheaper that savings is passed on dollar-for-dollar to our customers,” Williams said.

An example of this is Duke Energy’s Asheville plant in Skyland, N.C. This 376-MW, fully retrofitted coal plant is being shut down early and will be replaced by a two combined-cycle power plants with a combined capacity of 560 MW. This new facility is expected to generate electricity at a 35% cheaper rate than the current plant.

The bulk of the company’s conversions are brownfield, which helps reduce the projects’ costs since they help in establishing air permits, as well as already having water intakes, switch yards, transformers and grid infrastructure in place.

“It saves money in the long run to build a whole new plant,” Williams said. In addition, Duke Energy is recycling nearly all of its demolished coal power plants to help offset the construction costs of the new plants.

New infrastructure needs

Though gas is plentiful and the Southeast is in somewhat better shape than parts of the Northeast and New England in terms of a gas system build-out, there are still issues to resolve.

“Some of our plants were used as dual-fuel facilities that primarily ran on oil because gas wasn’t fully available in the winter. Even today we often have to run certain simple-cycle peakers on oil over gas because we can’t get gas to the plants in times of extreme cold weather. It’s not that there is a lack of gas; there is a lack of infrastructure to move the gas,” Williams said.

This pipeline constraint and the need to access new shale gas fields is what motivated Duke Energy to propose the construction of the $5 billion, 594-mile Atlantic Coast Pipeline, which will transport up to 1.5 billion cubic feet per day (Bcf/d) of natural gas from Harrison County, W.Va., to four utilities in Virginia and North Carolina. The project involves Duke Energy, Piedmont Natural Gas, AGL Resources and Dominion Resources, which will also build and operate the system. Duke owns 40% of the system with Dominion holding a 45% interest, Piedmont a 10%interest and AGL the remaining 5%.

“This will bring significant amounts of gas to the gas-starved eastern North Carolina region and essentially track the Interstate 95 corridor in the state. This project was conceived by Duke Energy and Piedmont Natural gas and is being permitted and constructed for the utilities by Dominion. We think it’s a wonderful way to invest in infrastructure on behalf of our customers and lower their costs,” Williams said.

The project is more than 95% subscribed while in the middle stages of the U.S. Federal Energy Regulatory approval process, which is a strong indicator of the market’s interest in the project. The company is also a part owner in the 515-mile Sabal Trail Pipeline with Spectra Energy and NextEra Energy to bring gas to Florida, which receives about 70% of its power generation from gas. These projects are also reflective of Duke Energy’s return to the midstream sector.

It wasn’t that long ago that Duke Energy had largely exited the sector with the 2006 spinoff of Spectra Energy. At the time of the spinoff, natural gas markets were very expensive and Duke Energy decided to focus on its core electric utility businesses.

“This is a different day and market conditions are fundamentally different. We’re also much bigger and this is a growing business we want to get back into,” Williams said.

Acquisitions to lead to growth

This re-entry into the midstream was evident with the $4.9 billion acquisition of Piedmont Natural Gas, which was made in part to develop more pipelines. The agreement, expected to close by the end of the year, will combine two of the largest energy companies in the Carolinas. Piedmont is a regulated gas infrastructure and local distribution company (LDC) with more than 1 million customers in North Carolina, South Carolina and Tennessee.

“Piedmont’s business is growing rapidly and they’re a significant player in the LDC business who are known for excellent customer service. They’re also experienced in building and operating higher-pressure lines to serve big plants like ours. That’s a business we want to be in—it has a higher growth margin and can also be leveraged to serve our utility customers. We see it growing across the sector. After the transaction, they will be part of a larger company with access to less expensive capital. They should also have the ability to grow faster using our balance sheet,” Williams said.

Duke Energy is already Piedmont’s largest customer and will further benefit from Piedmont’s plans to invest approximately $180 million in laterals from the Atlantic Coast Pipeline to Duke plants and other customers across eastern North Carolina. In addition, both of their service territories largely overlap.

The acquisition also helps with the transformation of Charlotte into an emerging energy hub. This concept was conceived by Duke Energy’s former CEO Jim Rogers in 2007, who felt there was a critical mass of energy companies in the Charlotte region that should work together to grow the sector. This includes various forms of energy, not just natural gas, but gas is taking on a major role in this effort.

Southern Co. is another large utility that is undergoing profound changes in its operations and strategies due to the proliferation of natural gas. The company, which serves 4.4 million customers in Alabama, Georgia, Mississippi and Florida, is in the process of acquiring AGL Resources in a $12 billion deal to further position itself to grow gas infrastructure, not only in the Southeast, but the Upper Midwest and parts of the Mid-Atlantic.

“The future of natural gas is expected to be influenced by continued low natural gas prices, federal environmental regulations and customers who will have more and more options when it comes to energy consumption. We believe that the acquisition of AGL Resources better positions Southern Co. to succeed in that future, particularly a future in which there is a need for more gas infrastructure,” Tom Fanning, chair, president and CEO of Southern Co. said during a conference call to discuss the acquisition.

Once the merger is complete, Southern Co. will have 9 million utility customers, the second-most in the U.S. Many of these customers already utilize natural gas and even more will do so in the coming years, which speaks well for the growth of natural gas in the power generation sector. Southern Co.’s use of natural gas increased to 1.8 Bcf/d in 2015, a 20% increase over the previous three years.

“Our natural gas usage has nearly doubled in the last 10 years, and by 2020 this number could grow to as much as 2.2 Bcf/d. The throughput on the AGL Resources system currently averages more than 2 Bcf/d … Combined, our use of natural gas [will] grow to well over 4 Bcf/d, making Southern Co. the most important consumer of natural gas in the U.S. The long-term outlook would indicate that even more natural gas will be needed when you consider sustained low natural gas prices, a growing U.S. economy, LNG export facilities and the potential impacts of federal environmental regulations,” Fanning said.

Like Duke Energy’s Piedmont acquisition, part of Southern Co.’s AGL Resources acquisition is to help meet infrastructure demand.

“Southern Co. has been exploring opportunities to participate in new natural gas infrastructure for some time. AGL Resources, at a modest scale, is already a participant in several major projects, and has an experienced midstream management team. We expect the combined company will be able to compete for more, and larger, opportunities in the future and to further increase supply,” Fanning added.

Lessons to learn

Market dynamics aren’t the only thing helping to fuel natural gas’ role in the power generation sector. U.S. Environmental Protection Agency

(EPA) regulations effectively ended the further development of the coal industry in the U.S. The intention may have been to foster cleaner coal solutions, but when you have low-cost natural gas and renewables taking up more of the energy mix there’s no incentive to invest in the higher costs involved in cleaner coal unless the markets recover to a price level of $14 per MMBtu.

“The biggest change for power generation has been EPA regulations on power plants, which effectively ended all coal plant proposals because they would have to integrate carbon capture and sequestration (CCS) technology. There’s no real reason to do that if you’re a utility if you can build a renewable or gas plant even though coal is more reliably low cost,” Cothran said.

Natural gas is now adjusting to its new role as the dominant power source in the U.S., but this role brings its own challenges. Though gas beats renewables on price in the open market, coal beats them both and is losing market share. Federal and state regulations on carbon emissions may have helped bring natural gas its current market share, but those same regulations may eventually cost gas market share. It is important to work with legislators and regulators or the gas industry could wind up in a similar fate to the coal industry in the coming decades.

While speaking at the Capital Link MLP Investing Forum in New York City in March, Christopher A. Smith, assistant secretary for fossil energy at the U.S. Department of Energy (DOE), told attendees that many of the coal industry’s wounds were self-inflicted.

“There wasn’t a lot of collaboration with the coal industry. In fact, they have had the mindset of ‘this too shall pass’ when it comes to challenges of climate change and haven’t really contributed anything to address the problem. When you look at the top coal companies in the U.S., over the past few years they shed almost $28 billion in market capitalization. In addition to challenges from natural gas, the ability for coal generation to have this unmitigated, uncontrolled release of CO2 into the environment can’t go on in perpetuity,” Smith said.

While the EPA and many states are heavily supporting renewable energy sources, the DOE remains committed to natural gas as an important part of the nation’s energy mix though increased use of carbon capture will be necessary, Smith added.

“The use of natural gas remains very important. We at DOE very explicitly care about natural gas and natural gas opportunities. There are challenges since natural gas has emissions and can’t create all of the emission reductions that the U.S. is targeting on its own. Natural gas has much lower emissions than coal, but the fact is we’ll have to develop carbon capture for natural gas-fired power plants as well,” he said.

Regulatory uncertainty

The EPA’s proposed Clean Power Plan would seek to limit the use of non-CCS coal-fired power generation in favor of gas fired and renewables power generation, but as Smith makes clear there will be changes aimed at natural gas generation eventually.

Announced last August, the final version of the plan would seek to reduce CO2 emission levels from power generation back to 2005 levels in the next 15 years. This regulation is one of the most litigated in history with 39 lawsuits filed to date, including by 27 states, and there are questions surrounding it.

“There’s a lot of uncertainty regarding the implementation of the Clean Power Plan. In particular, the time lines that may take place because of the litigation,” John Kneiss, director, macroeconomics, geopolitics and policy, Stratas Advisors, told Midstream Business.

In February, the U.S. Supreme Court issued a stay of implementation of the plan by a 5-4 vote while litigation concerning the plan takes place in the D.C. Circuit Court. It is likely that any ruling could take well into next year at which point the decision will undoubtedly be appealed to the Supreme Court. The outcome of this appeal was further clouded by the passing of Associate Justice Antonin Scalia.

Since Republicans in Congress have made it clear that they will not vote on any of President Obama’s nominees to replace Scalia on the bench, it is likely that the next president will be nominating Scalia’s replacement.

The court awaits

“It is unclear how they will wind up ruling with the changes that will take place in the Supreme Court with a new justice. This case is big enough and significant enough that it will wait until there are nine justices. If it is someone liberal or moderate on the bench, they will likely uphold EPA’s interpretation of its authority. There was a good chance the Supreme Court would have found faults with it and remanded it back to EPA to make some changes based on the way the agency took its authority to regulate under the Clean Air Act,” Kneiss said.

The Supreme Court’s stay of implementation means that there is no requirement for states to proceed with the Clean Power Plan’s initiatives. This will require EPA to adjust its time lines because of the lack of a legal requirement for states to follow the currently outlined ones.

Williams told Midstream Business that Duke Energy would hold off on certain investment decisions related to the Clean Power Plan until the courts complete their review and provide more clarity and certainty. However, Good noted that the company is still moving toward lower-carbon sources of power generation with its five-year plan.

“I think the clarity that will come from this legal review will be helpful, but more helpful to set pace and timing of decisions in the next decade,” she said during the company’s fourth-quarter earnings call. “We’re trying to find solutions that make the most sense for our customers and communities. In the near term, the strategy will be to watch the litigation, and then execute the plan we already have in front of us in terms of modernizing our system.”

One of the biggest arguments against the Clean Power Plan is that it would force states to find mechanisms outside of the direct implementation of technologies on the power plants.

“They’ll have to do things like trade with other states on credits and force some fuel switching. They’ll also have to seek out novel ways to reduce emissions, including restricting carbon emissions from other point sources because the states will need the power generation,” Kneiss said.

This is the crux of the argument against the Clean Power Plan: that EPA has overstepped the authority it was given in the Clean Air Act, which allowed the agency to regulate emissions from a point source at that source. In the Clean Power Plan, the agency is reducing emissions from a power plant elsewhere if it is deemed that the power plant is necessary.

“The intent by EPA was to have some level of flexibility for the states to decide how they want to reduce emissions with the agency’s thought process being that states would work together to come up with plans. However, the Clean Air Act doesn’t work like that by pushing states to work together on regional plans,” Kneiss said. Should it be implemented, the Clean Power Plan will in many ways serve as a de-facto national energy policy, which is something the country has never really had in the past.

Recommended Reading

Battalion in Compliance with NYSE American after 2023 Meeting

2024-02-13 - Previously, Battalion Oil was not in compliance with the NYSE after failing to hold an annual meeting of stockholders during the fiscal year ending Dec. 31.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

enCore Energy Appoints Robert Willette as Chief Legal Officer

2024-02-01 - enCore Energy’s new chief legal officer Robert Willette has over 29 years of corporate legal experience.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.