Freehold Royalties Ltd. agreed to a concentrated royalty land position in the core of the Eagle Ford oil basin, adding onto the Canadian company’s position in the South Texas shale play.

Based in Calgary, Alberta, Freehold is a dividend-paying oil and gas royalty company with assets located predominately in western Canada. The company, however, expanded southward earlier this year with the acquisition of a U.S. royalty package including assets in the Permian Basin as well as the Eagle Ford Shale.

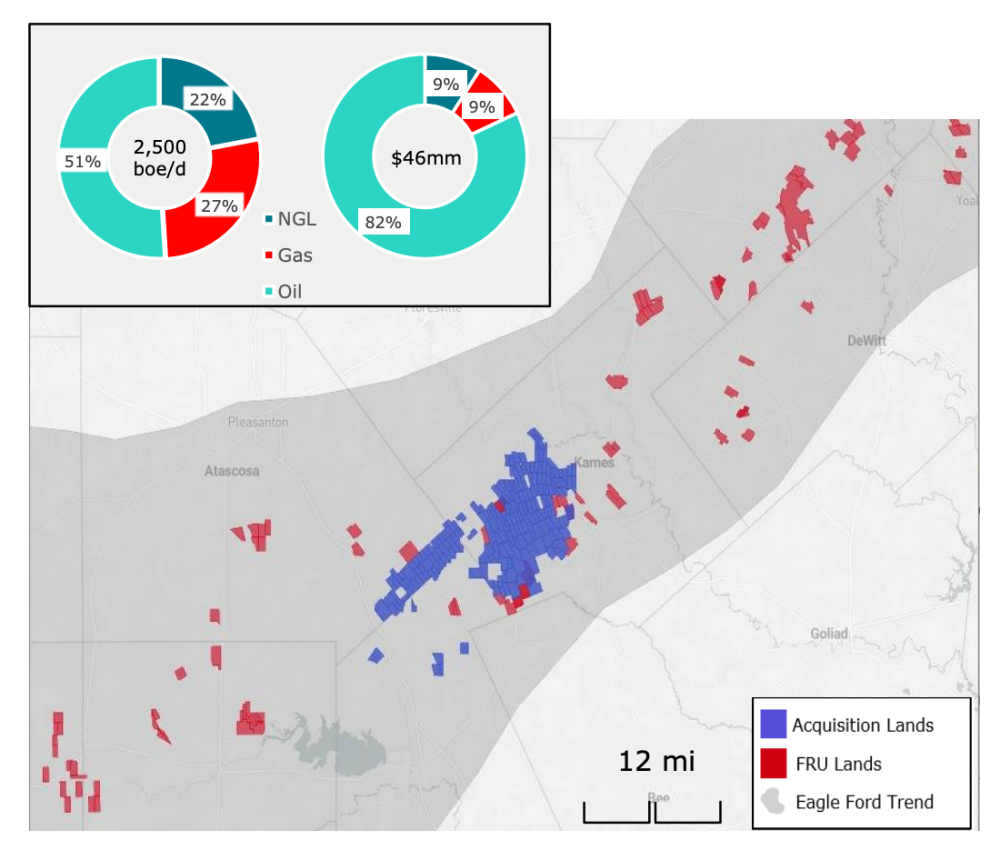

Freehold Royalties on Sept. 8 tacked onto its Eagle Ford position, according to a release from the company announcing an agreement with a private seller to acquire “high-quality U.S. royalty assets” in Texas’ Karnes, Atascosa and Live Oak counties for US$180 million (CA$227 million).

“The acquired assets significantly enhance the quality of Freehold’s North American royalty portfolio, improving both the near-term and long-term sustainability of Freehold’s dividend while providing further option value to return capital to our shareholders through multiple years of free cash flow growth,” Freehold said in the release.

The acquisition comprises of a concentrated royalty land position across approximately 92,000 gross drilling unit acres with an average royalty rate of approximately 1.8%. Development of the 500 gross future drilling locations included in the transaction is expected to be supported by a “well-capitalized investment grade producer,” according to the release.

Royalty production of 2,500 boe/d (73% liquids) is forecast for 2022 with roughly $46 million in funds projected to be generated from operations.

Freehold said it will fund the acquisition through a bought deal financing led by RBC Capital Markets and TD Securities Inc. and the company’s existing credit facility. The transaction is expected to close by Sept. 28.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.