(Source: HartEnergy.com, Shutterstock)

Frac Spread will be on hiatus during the holidays and return on Jan. 9.

(To the tune of “Here Comes Santa Claus”)

Down goes ethane, down goes propane but the butanes are hanging in there

The price of crude has remained fairly steady but geopolitics gave us a scare

Natgas has been great at reducing greenhouse gases that mess up our atmosphere

But markets don’t like high inventories and Green New Dealers say it’s something to fear

OK, I will get down off my high wonder horse and stop trying to corrupt Gene Autry’s lyrics into an NGL summary. That said, the last round of comparisons didn’t fare well with figures from a year ago.

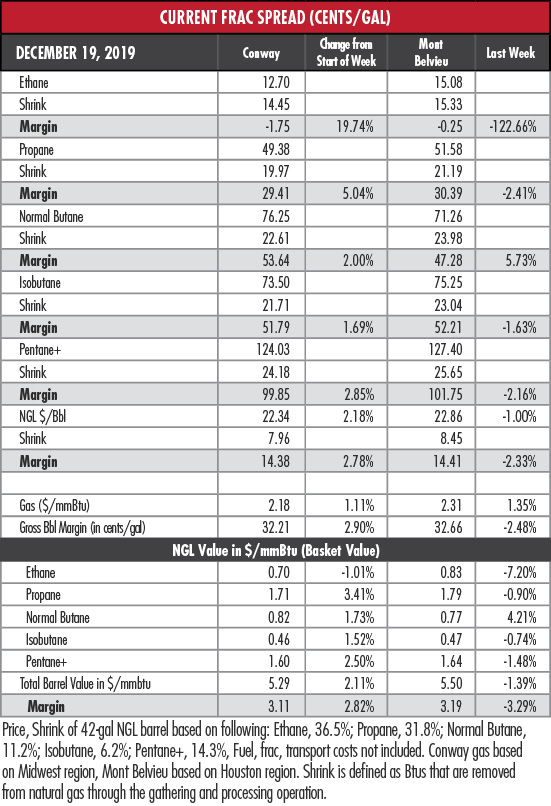

Ethane at Mont Belvieu, Texas, slumped to a four-month low last week and, despite a very slight rise in the price of natural gas, saw its margin slide into the negative. That’s a 45.1% falloff from the same week in 2018 and 16% in the last two weeks alone.

“Simply, ethane markets are oversupplied, leaving ethane to bob up and down with the movements in natural gas prices,” lamented EnVantage Inc. analysts in a recent report.

“For ethane to have any chance to work down a mountain of excess supplies, all existing plants and new crackers slated to start-up this year need to be near full operations, which may be asking a lot since the U.S. ethylene industry has found it very difficult in maintaining 90% of its existing nameplate capacity online at any time,” they wrote. “Plus, petrochemical companies have struggled to bring new capacity online in a timely fashion.”

Propane has also had a tough time finding its happy place.

“To say Mont Belvieu propane prices are struggling this winter season is an understatement,” the analysts wrote.

The price slipped less than 1% last week but is down 23.9% since the same period last year. EnVantage expressed concern about the increase in propane inventory for the week ending Dec. 6. U.S. storage declined by 2.54 million barrels in the week ending Dec. 13 but was still 24.2% above the level of the same week in 2018. On the Gulf Coast, the increase in inventory was 44.1%.

The Mont Belvieu price relative to West Texas Intermediate (WTI) crude oil was 35.3% on Dec. 17, compared to 61.3% a year ago when oil was in the mid-$40s.

Normal butane rebounded last week to above 70 cents per gallon (gal) at Mont Belvieu and its margin widened by almost 6%. The price is very close to where it was a year ago but its margin, at around 47 cents/gal is much higher than last year’s, which was just under 33 cents/gal.

The late-November explosion at the TPC butadiene plant in Port Neches, Texas, could limit normal butane cracking, EnVantage said. That’s because the plant received C4 olefin from many ethylene plants without integrated butadiene extraction or purification plants. As a result, those non-integrated plants that crack butanes will either cut back or switch to ethane cracking that minimizes crude C4 olefin production until the Port Neches facility comes back online.

In the week ended Dec. 13, storage of natural gas in the Lower 48 experienced a decrease of 107 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. That compared to the Stratas Advisors expectation of a 90 Bcf withdrawal. The EIA figure resulted in a total of 3.411 trillion cubic feet (Tcf). That is 22.1% above the 2.793 Tcf figure at the same time in 2018 and 0.3% below the five-year average of 3.42 Tcf.

Recommended Reading

Matador Stock Offering to Pay for New Permian A&D—Analyst

2024-03-26 - Matador Resources is offering more than 5 million shares of stock for proceeds of $347 million to pay for newly disclosed transactions in Texas and New Mexico.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.