(Source: Shutterstock, Hart Energy)

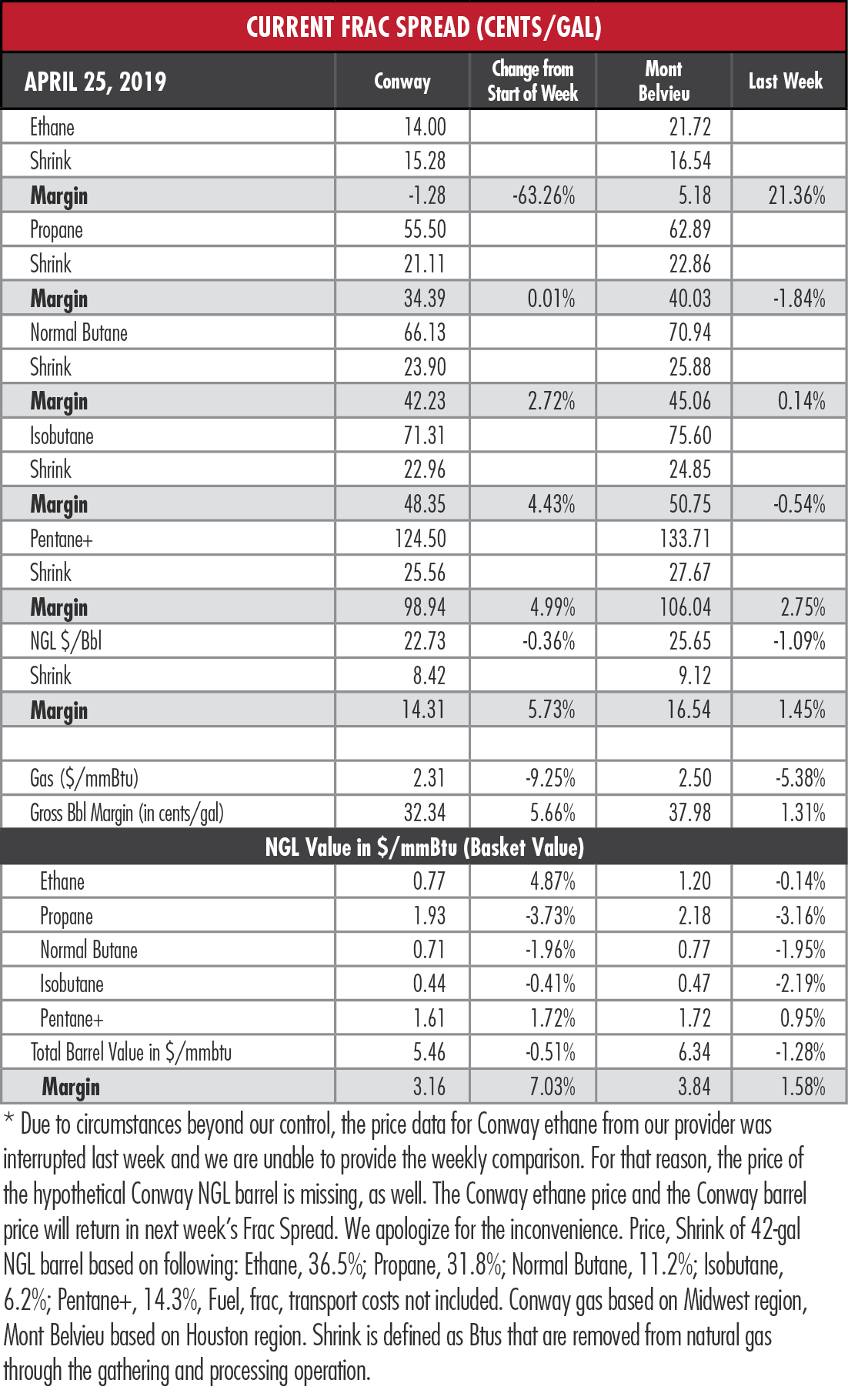

Natural gas prices sunk to 12-month lows at both Henry Hub and Chicago City Gate on April 23, helping to expand margins for most NGL, especially ethane, for the Good Friday holiday-shortened tracking week.

Crude oil prices slipped, too, unable to maintain the upward momentum from geopolitical factors including the Trump administration’s decision to end exemptions to sanctions against Iran, and Venezuela’s oil production for March averaging less than 1 million barrels per day (bbl/d), its lowest point since January 2003.

Oil was dragged down by a U.S. Energy Information Administration (EIA) report that U.S. crude inventories rose by 5.5 million barrels in the week ending April 19 to their highest level since October 2017. The total, 460 million barrels, does not include oil stored in the Strategic Petroleum Reserve.

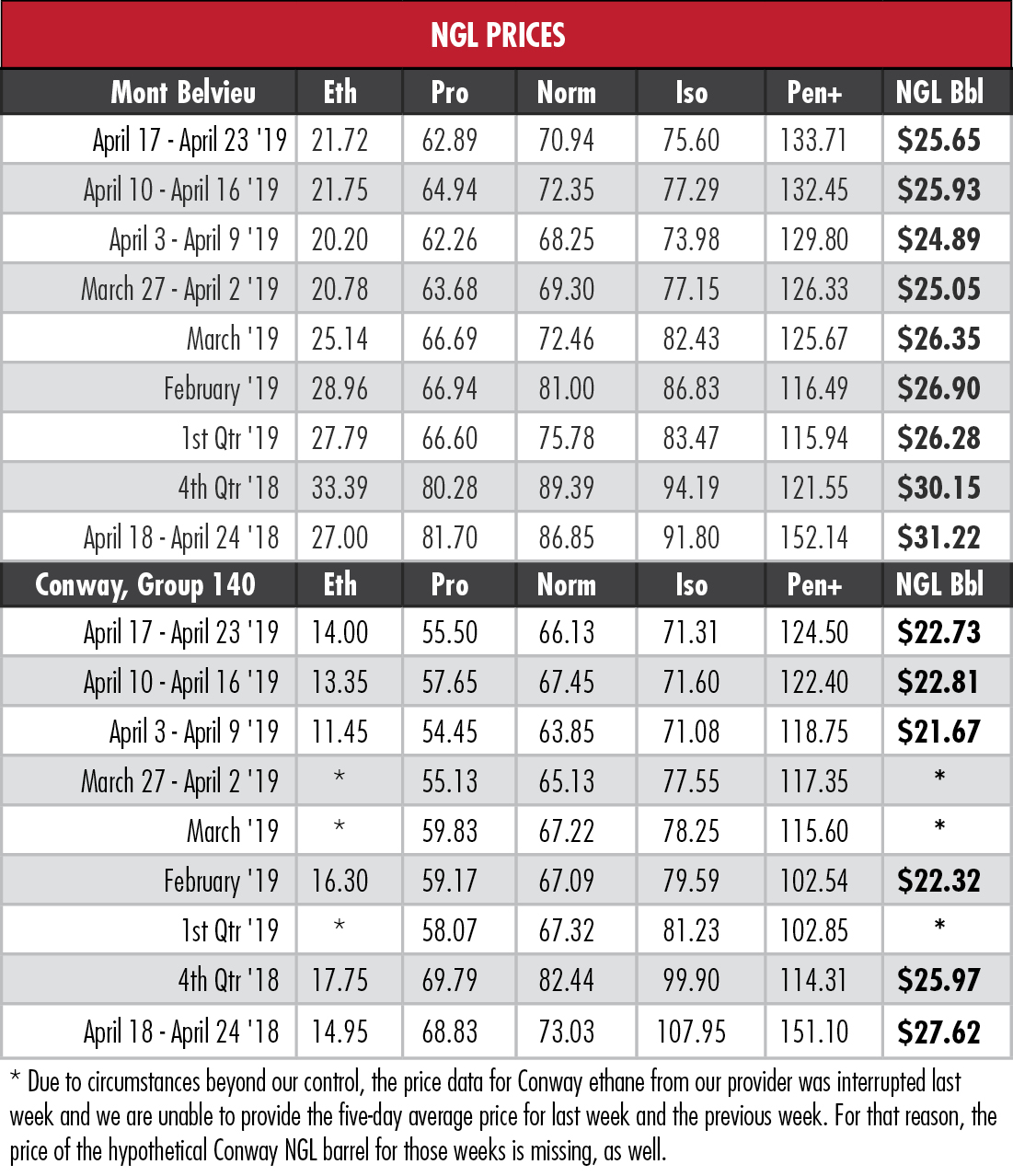

But oil prices have improved since its tumble in fourth-quarter 2018. NGL prices continue to struggle.

But oil prices have improved since its tumble in fourth-quarter 2018. NGL prices continue to struggle.

Guggenheim Securities LLC released a report April 18 that featured the views of Dan Lippe, founder of Houston-based Petral Consulting Co.

“Although excess naphtha production, a function of European refiners capturing strong distillate spreads, likely contributed, we believe Mont Belvieu logistics issues are the largest factor driving this decoupling,” said the report, citing Lippe. He noted that foggy weather in February and the tank fire/benzene leak in March contributed to more than 500 hours of Houston Ship Channel closures in the first quarter. That compared to 537 hours of closures in all of 2018.

The inability to get propane exports out to sea created an inventory build that has placed downward pressure on prices, Lippe said. Exports are now up strongly, but he expects the high stock levels to take around three months to clear.

The inability to get propane exports out to sea created an inventory build that has placed downward pressure on prices, Lippe said. Exports are now up strongly, but he expects the high stock levels to take around three months to clear.

Then there’s the Waha situation, in which natural gas prices have descended into negative territory and producers are forced to pay customers to take gas.

“With negative wellhead gas pricing in the Permian, the economics of ethane extraction could drive increased ethane production, putting further pressure on ethane prices and, in turn, reducing the floor price for propane,” said the report.

Not much fun, but Lippe thinks he sees some light at the end of the pipeline.

“Ultimately, overall sentiment seems to suggest that fourth-quarter 2018 and 2019 have peculiar dynamics, but the hope is that these should begin to normalize back to first-half 2018 levels as we exit the year,” said the report.

Ethane’s margin at Mont Belvieu, Texas, rose above 5 cents per gallon (gal), its highest since the week ending March 19. Last week’s price was 17% below the price of five weeks ago, a testament to how far natural gas prices have fallen, given the expanded margin. From its high for the year of $3.591 per million Btu (MMBtu) on Jan. 14, gas fell 32% as of April 23, the last day of the most recent Frac Spread tracking period.

Ethane’s margin at Mont Belvieu, Texas, rose above 5 cents per gallon (gal), its highest since the week ending March 19. Last week’s price was 17% below the price of five weeks ago, a testament to how far natural gas prices have fallen, given the expanded margin. From its high for the year of $3.591 per million Btu (MMBtu) on Jan. 14, gas fell 32% as of April 23, the last day of the most recent Frac Spread tracking period.

In the week ended April 19, storage of natural gas in the Lower 48 experienced an increase of 92 billion cubic feet (Bcf), the EIA reported, compared to the Stratas Advisors prediction of a 102 Bcf increase and the Bloomberg consensus of a 90 Bcf increase. The figure resulted in a total of 1.339 trillion cubic feet (Tcf). That is 4.3% above the 1.284 Tcf figure at the same time in 2018 and 21.6% below the five-year average of 1.708 Tcf.

Technical issues with Hart Energy’s data provider do not allow us to provide the price of ethane from Conway, Kan., for the last week of March because of a loss of pricing data for that time period. For the same reason, we cannot compare the price of the hypothetical Conway NGL barrel to the previous week. Conway ethane prices are not available for March 2019 and first-quarter 2019. We apologize for the inconvenience.

Recommended Reading

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

Plains All American Names Michelle Podavin Midstream Canada President

2024-03-05 - Michelle Podavin, who currently serves as senior vice president of NGL commercial assets for Plains Midstream Canada, will become president of the business unit in June.

Matador Completes NatGas Connections in Delaware Basin

2024-03-25 - Matador Resources completed natural gas pipeline connections between Pronto Midstream to San Mateo Midstream and to Matador’s acreage in the Delaware Basin.

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.

Kinetik Holdings Enters Agreement to Pay Debt

2024-04-04 - Kinetik Holdings entered an agreement with PNC Bank to pay down outstanding debt.