An image of an explosion is overlaid with an image of Saudi Aramco’s Abqaiq processing plant from Google Earth. (Source: Shutterstock, Google Earth)

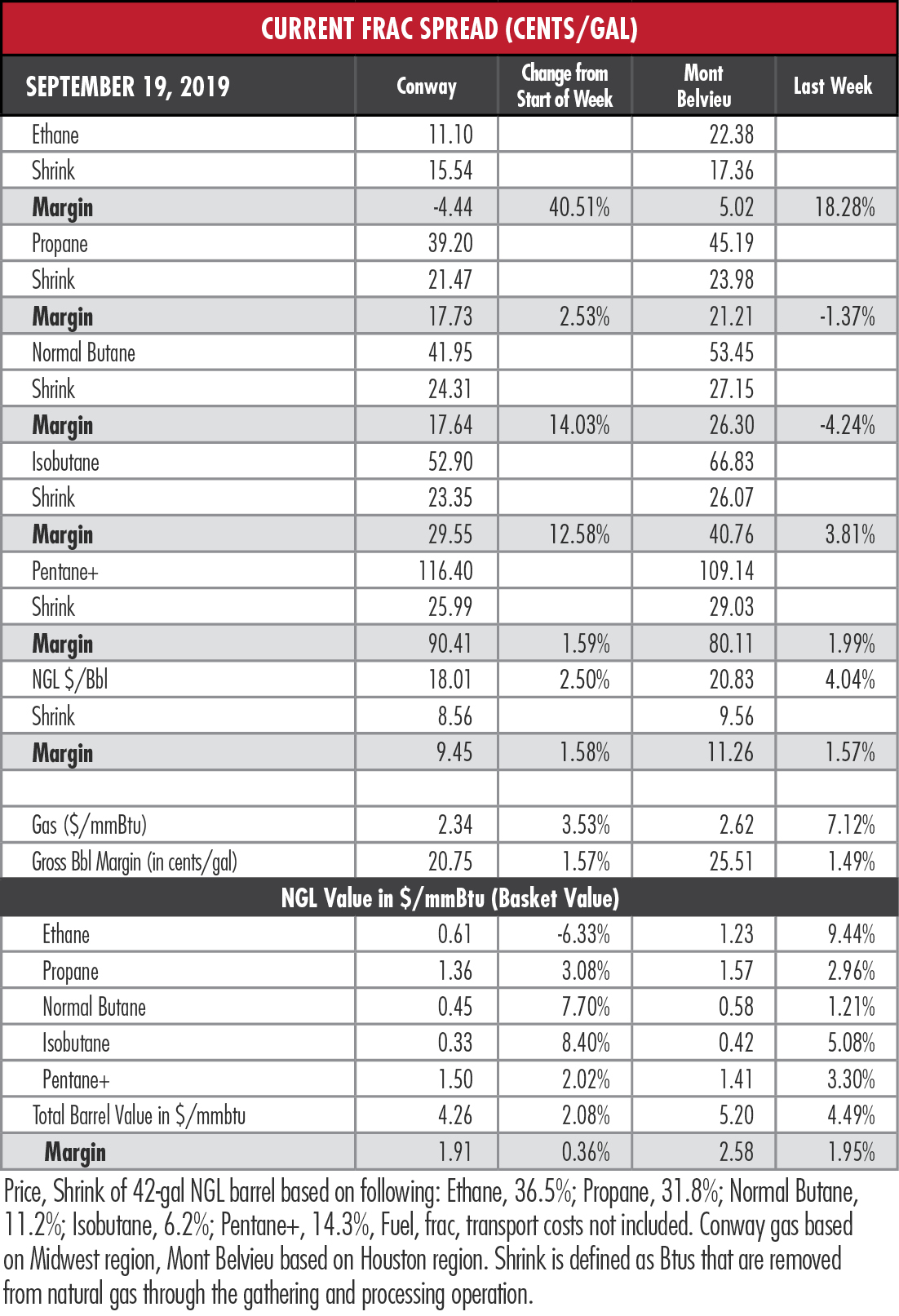

The attack on Saudi oil processing facilities drove NGL prices sharply higher on Sept. 16 and, though they retreated some on positive news the following day, still recorded week-on-week increases across the board at Mont Belvieu, Texas.

Ethane’s price continued to rise at Mont Belvieu to its highest level in almost six months, while the hypothetical barrel reached a 15-week high. The benchmark Henry Hub natural gas price did not experience a dramatic jump following the attack but it continued its nearly month-long upward trend.

But in the aftermath of the attack, believed to have come from Iran, several questions remain unanswered. For example, what about products other than crude oil?

Joseph Chang, global editor of ICIS Chemical Business, noted in a report that the Sept. 17 statement from Saudi Aramco that oil output would likely be restored by the end of September did not mention ethane or natural gas. And he quoted Dan Lippe of Petral Consulting as saying, “without definitive information, we can reasonably say that NGL supply will be reduced for a few months to several months.”

Joseph Chang, global editor of ICIS Chemical Business, noted in a report that the Sept. 17 statement from Saudi Aramco that oil output would likely be restored by the end of September did not mention ethane or natural gas. And he quoted Dan Lippe of Petral Consulting as saying, “without definitive information, we can reasonably say that NGL supply will be reduced for a few months to several months.”

The initial estimate from Saudi Oil Minister Abdulaziz bin Salman was that ethane and NGL production had been cut by 50%. An analysis by ICIS estimated that the attacks threatened 10% of the global ethylene supply.

But even if the estimates for recovery of the oilfield and processing site are accurate, there remains the potential for future disruptions, given the volatility of the region. The Saudi oilfields remain vulnerable to attack.

Thomas Buonomo, Washington-based energy and geopolitical analyst, told HartEnergy.com that U.S.-supplied Patriot missile systems protect the kingdom’s oilfields and infrastructure but have been reported to have a success rate of less than 50% in intercepting ballistic missiles. Drones, he said have a significantly lower radar profile and their use is a relatively new tactic for the Iranians.

“If this continues to escalate and that is where the momentum is going, certainly, I think it’s possible that it could drive the global economy back into a recession,” he said.

On Sept. 18, President Trump said he had told Treasury Secretary Mnuchin to devise further sanctions against Iran. And Iran could be encouraged to continue attacks against Saudi Arabia after its recent success, Buonomo said, endangering as much as 10% of the world’s oil supply.

On Sept. 18, President Trump said he had told Treasury Secretary Mnuchin to devise further sanctions against Iran. And Iran could be encouraged to continue attacks against Saudi Arabia after its recent success, Buonomo said, endangering as much as 10% of the world’s oil supply.

But from a macro perspective, ongoing regional violence could have profound consequences for global energy markets.

“From a longer term oil market investor perspective, if this escalated into a full-blown conflict—as I believe is highly probable given that neither side has demonstrated a willingness thus far to make the compromises necessary for peace—I would expect it to generate significantly greater political impetus in favor of international diversification from oil over the next couple of decades,” he said.

“How dramatically this might impact efforts to stabilize our planet’s climate is a very interesting question,” he added, “particularly if an expanded regional war leads to seriously increased global economic and political volatility.”

“How dramatically this might impact efforts to stabilize our planet’s climate is a very interesting question,” he added, “particularly if an expanded regional war leads to seriously increased global economic and political volatility.”

In the week ended Sept. 13, storage of natural gas in the Lower 48 experienced an increase of 84 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. That compared to the Stratas Advisors expectation of an 76 Bcf build. The EIA figure resulted in a total of 3.103 trillion cubic feet (Tcf). That is 14.5% above the 2.71 Tcf figure at the same time in 2018 and 2.4% below the five-year average of 3.178 Tcf.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers.

Novo II Reloads, Aims for Delaware Deals After $1.5B Exit Last Year

2024-04-24 - After Novo I sold its Delaware Basin position for $1.5 billion last year, Novo Oil & Gas II is reloading with EnCap backing and aiming for more Delaware deals.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.