(Source: HartEnergy.com, Shutterstock)

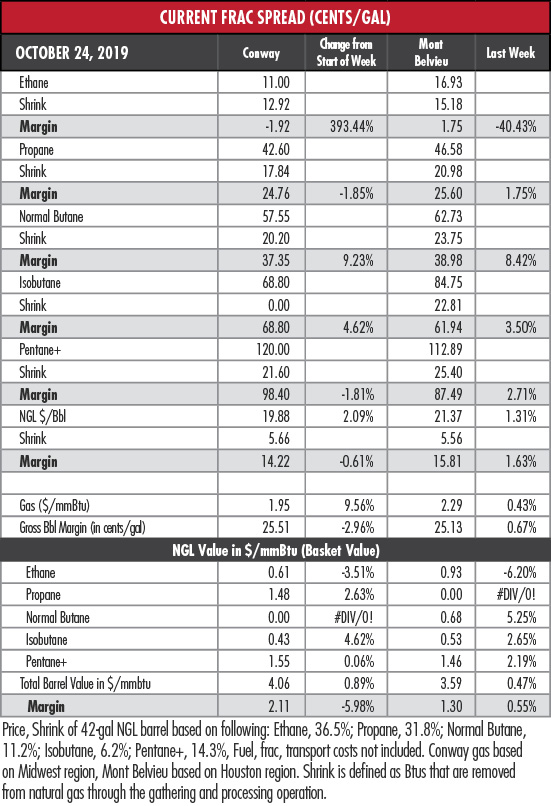

The hypothetical NGL barrel at Mont Belvieu, Texas, rose again last week, remaining above $20 for the seventh straight week despite another hit to the price of ethane.

Mont Belvieu propane continued to inch up, as well, and is now 20.5% above its low for the year, reached in mid-August. Propane fundamentals are improving and prices could be primed for a seasonal pickup. EnVantage Inc. noted in a recent report that Midcontinent inventories have declined, crop drying is underway and temperatures are cooling.

The price of West Texas Intermediate crude jumped 2.7% on news that oil inventories were reduced by 1.7 million barrels in the week ending Oct. 18. Increased refinery runs and traders took into account the chances that OPEC will trim output.

EnVantage attributed ethane’s recent troubles to market impatience over when the Sasol, Shintech and Indorama crackers will be fully operational. Outages at Exxon Mobil’s Baytown crackers aren’t helping, either.

“In this demand vacuum, ethane prices are rudderless and are basically trending with natural gas prices, which have been drifting lower,” the analysts said. The Mont Belvieu ethane margin also contracted last week from almost 3 cents per gallon (gal) to less than 2 cents/gal.

Mont Belvieu normal butane’s price rose 5.3% last week to its highest point since late April. The margin also widened by 8.4%. The reason goes beyond winter gasoline blending season, said EnVantage.

“Export arbs remain very strong for n-butane with the price spread between Northwest Europe and Mont Belvieu is around 34 cents/gal, indicating that exports of n-butane should increase now that Enterprise’s export terminal expansion is online,” the analysts wrote.

In the week ended Oct. 18, storage of natural gas in the Lower 48 experienced an increase of 87 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. That compared to the Stratas Advisors expectation of an 85 Bcf build and the consensus expectation of 86 Bcf. The EIA figure resulted in a total of 3.606 trillion cubic feet (Tcf). That is 16.8% above the 3.087 Tcf figure at the same time in 2018 and 0.8% above the five-year average of 3.578 Tcf.

Recommended Reading

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

Carlson: $17B Chesapeake, Southwestern Merger Leaves Midstream Hanging

2024-02-09 - East Daley Analytics expects the $17 billion Chesapeake and Southwestern merger to shift the risk and reward outlook for several midstream services providers.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

Exclusive: Renewables Won't Promise Affordable Security without NatGas

2024-03-25 - Greg Ebel, president and CEO of midstream company Enbridge, says renewables needs backing from natural gas to create a "nice foundation" for affordable and sustainable industrial growth, in this Hart Energy Exclusive interview.