(Source: HartEnergy.com, Shutterstock)

Propane rose at Mont Belvieu, Texas, for the fifth week in a row, reaching its highest price since the end of May. However, the price relative to West Texas Intermediate (WTI) crude oil, 38.3%, is far below the five-year average for early November of 53%.

“The much lower valuation to WTI reflects the current overhang in propane stocks that has existed since the first quarter of this year,” said EnVantage Inc. in a recent report.

Digging deeper, the analysts discovered the source of the relationship difficulty: the Gulf Coast.

In the week ending Nov. 1, the U.S. Energy Information Administration (EIA) reported that the U.S. propane inventory totaled slightly over 100 million barrels after an increase of about 320,000 barrels in the previous week. That was a 15.64 million barrel, or 18.5% increase, over the total at the same time in 2018.

That compares to an increase in inventory of 15.44 million barrels of propane in PADD 3 (Petroleum Administration for Defense Districts) which is the Gulf Coast.

“That means that virtually all of the U.S. surplus of propane resides in storage facilities on the Gulf Coast and it is a major reason why Mont Belvieu propane prices are at a well-below-normal price relationship to WTI for this time of year,” said EnVantage.

Why so much down south? One word: Permian. Increased flows of NGL are flowing into the Gulf Coast as production keeps chugging along in the Permian Basin.

That’s not the case elsewhere. Propane inventories are down in the Midcontinent and in Wisconsin, supplies were critically tight due to the late corn harvest and cold weather.

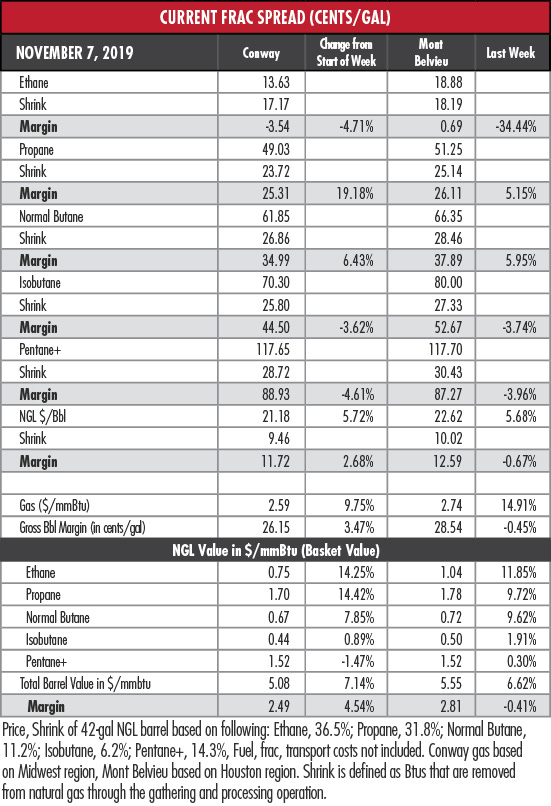

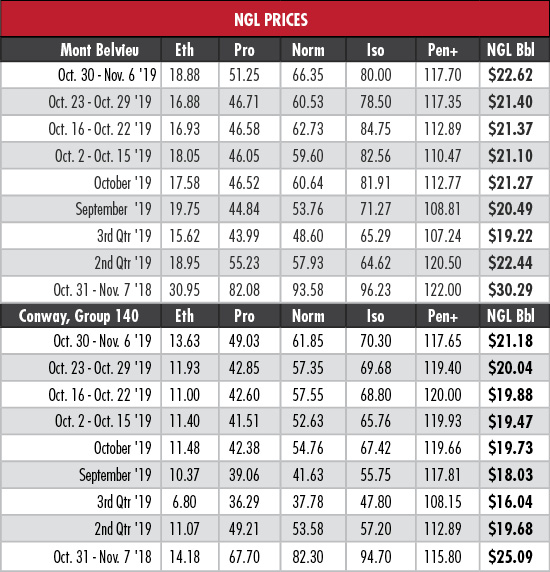

The result can be seen on the NGL price table. The spread between the price of propane at Mont Belvieu, 51.25 cents per gallon (gal), and Conway, Kan., 49.03 cents/gal, is only 2.22 cents. Just three months ago, the spread was 6.2 cents/gal. A year ago, the difference was 14.4 cents/gal.

NGL prices in general trended upward in the last week. Mont Belvieu ethane was up 11.8% and Conway ethane rose to its highest level since April. Mont Belvieu butane hit a 27-week high and the Mont Belvieu hypothetical NGL barrel reached its highest point in 24 weeks.

In the week ended Nov. 1, storage of natural gas in the Lower 48 experienced an increase of 34 billion cubic feet (Bcf), the EIA reported. That compared to the Stratas Advisors expectation of a 49 Bcf build and the consensus expectation of 52 Bcf. The EIA figure resulted in a total of 3.729 trillion cubic feet (Tcf). That is 16.6% above the 3.199 Tcf figure at the same time in 2018 and 0.8% above the five-year average of 3.7 Tcf.

Recommended Reading

Energy Transfer Asks FERC to Weigh in on Williams Gas Project

2024-04-08 - Energy Transfer's filing continues the dispute over Williams’ development of the Louisiana Energy Gateway.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Ozark Gas Transmission’s Pipeline Supply Access Project in Service

2024-04-18 - Black Bear Transmission’s subsidiary Ozark Gas Transmission placed its supply access project in service on April 8, providing increased gas supply reliability for Ozark shippers.

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.