(Source: Shutterstock)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

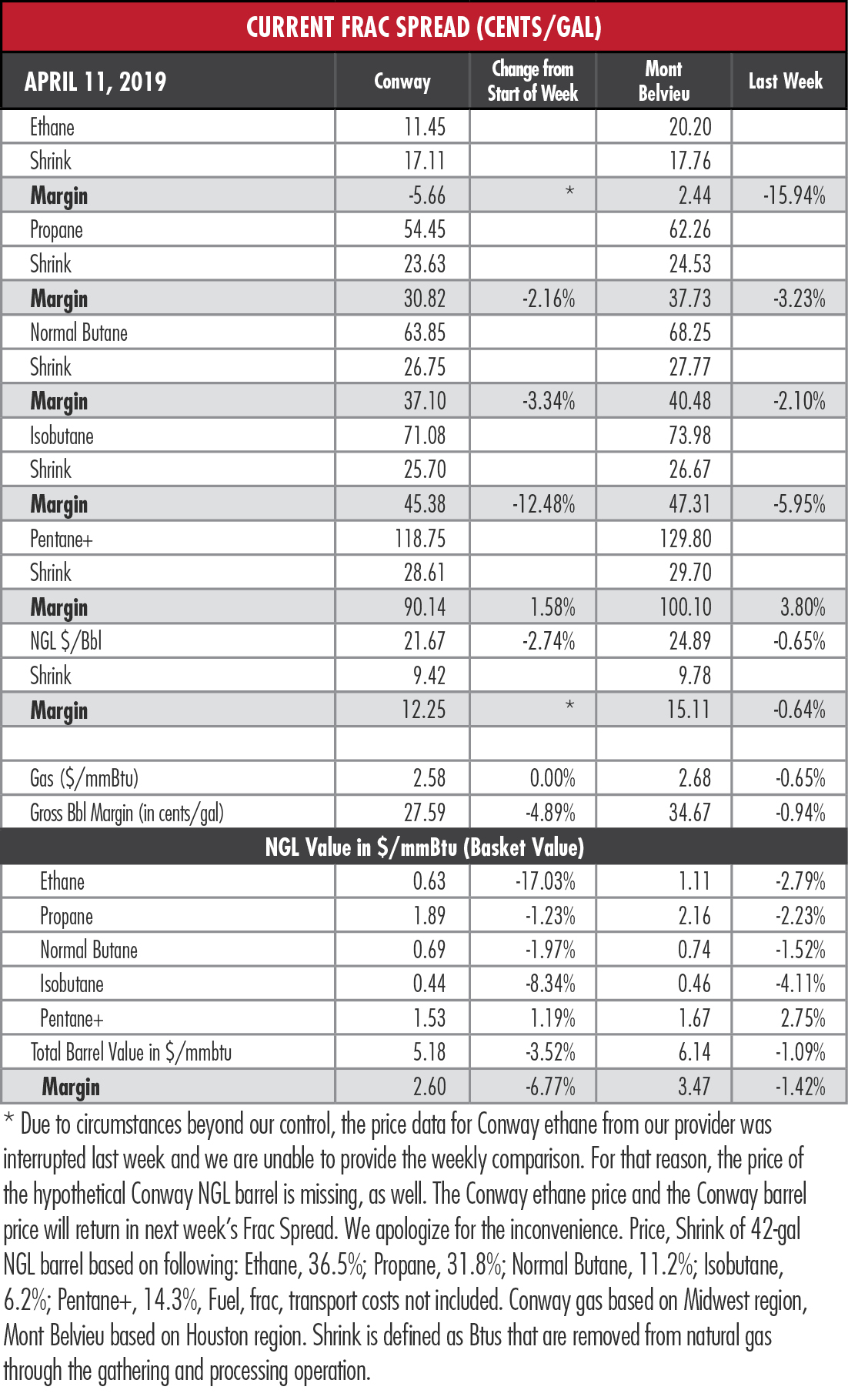

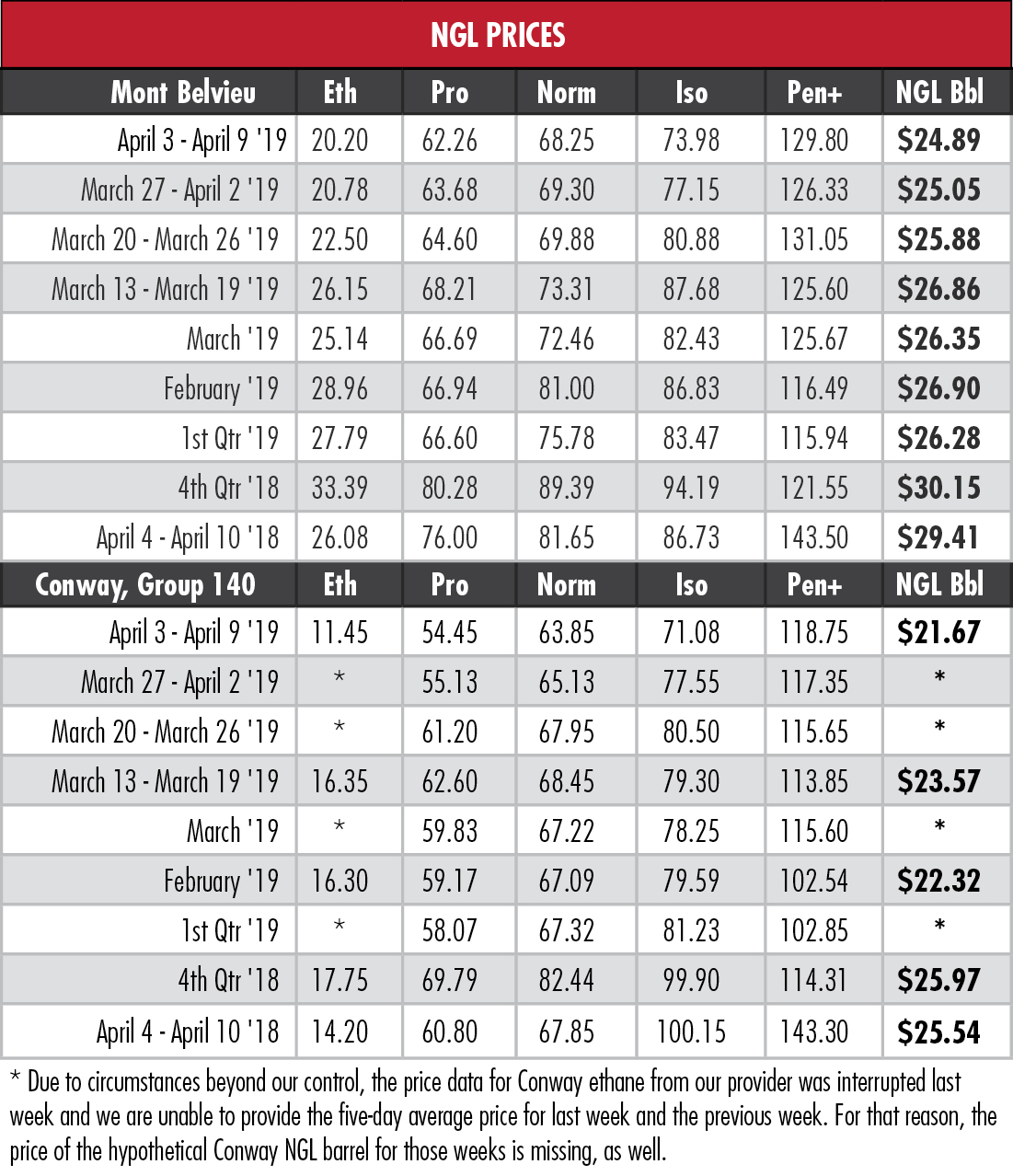

The last time the Mont Belvieu, Texas, price of ethane was this low, folks were kicking themselves for not betting on Bitcoin when they had the chance.

That was in December 2017, when the price dipped just below 20 cents per gallon (gal). It would then rally mightily to almost 28 cents/gal by the end of January 2018. This time? Probably not.

Natural gas prices in the Permian Basin have bottomed to the point where producers are paying as much as $8.50 per million Btu at the Waha Hub to move their excess gas supplies, EnVantage Inc. reported. The underlying problem has been the rapid expansion of associated gas production as crude oil production continues to grow in the world’s most celebrated unconventional play.

“The Permian is like a three-sided Rubik’s cube (oil, gas and NGLs) where takeaway capacity for all three commodities has to be all aligned for each commodity to be efficiently handled,” EnVantage said. Additional crude takeaway capacity in the form of the Plains All American Pipeline LP’s (NYSE: PAA) Sunrise, Enterprise Products Partners LP’s (NYSE: EPD) conversion of one of its Seminole lines to crude and the expansion of the Midland/Sealy pipeline has helped in terms of getting oil out of the play.

“The Permian is like a three-sided Rubik’s cube (oil, gas and NGLs) where takeaway capacity for all three commodities has to be all aligned for each commodity to be efficiently handled,” EnVantage said. Additional crude takeaway capacity in the form of the Plains All American Pipeline LP’s (NYSE: PAA) Sunrise, Enterprise Products Partners LP’s (NYSE: EPD) conversion of one of its Seminole lines to crude and the expansion of the Midland/Sealy pipeline has helped in terms of getting oil out of the play.

It has also hurt in the sense that it has increased production of natural gas, which is still waiting on a break in terms of takeaway capacity. The Gulf Coast Express Pipeline from Kinder Morgan Inc. (NYSE: KMI) will help, but it is not scheduled to be completed until October.

Ethylene prices are low as a result of high inventories, and with several ethylene plants idled for economic and unplanned reasons, cracking demand is down by 130,000 barrels per day (bbl/d). Prices should rebound by the end of the year, EnVantage predicts, when crackers come online and throw some 300,000 bbl/d of demand into the mix.

Ethylene prices are low as a result of high inventories, and with several ethylene plants idled for economic and unplanned reasons, cracking demand is down by 130,000 barrels per day (bbl/d). Prices should rebound by the end of the year, EnVantage predicts, when crackers come online and throw some 300,000 bbl/d of demand into the mix.

Propane inventories rose by 1.17 million barrels in the week ended April 5, the U.S. Energy Information Administration (EIA) reported, 34.1% above inventories one year ago at the same time. Exports have picked up, EnVantage said, but not enough to offset the rise in supply.

Last week’s price dipped 2.2% to its second-lowest point this year. As of April 9, the price was 42.2% of a barrel of West Texas Intermediate. Prior to this, the price of Mont Belvieu propane last hovered at the 62 cents/gal level back in July 2017. The margin shrunk by a little over 3% in the last week.

Last week’s price dipped 2.2% to its second-lowest point this year. As of April 9, the price was 42.2% of a barrel of West Texas Intermediate. Prior to this, the price of Mont Belvieu propane last hovered at the 62 cents/gal level back in July 2017. The margin shrunk by a little over 3% in the last week.

In the week ended April 5, storage of natural gas in the Lower 48 experienced an increase of 25 billion cubic feet (Bcf), the EIA reported, compared to the Bloomberg consensus of a 32 Bcf increase and the Stratas Advisors prediction of a 22 Bcf increase. The figure resulted in a total of 1.155 trillion cubic feet (Tcf). That is 13.7% below the 1.338 Tcf figure at the same time in 2018 and 29.6% below the five-year average of 1.64 Tcf.

Technical issues with Hart Energy’s data provider do not allow us to compare the price of ethane from Conway, Kan., to last week because of a loss of pricing data for that time period. For the same reason, we cannot compare the price of the hypothetical Conway NGL barrel to the previous week. Conway ethane prices are not available for March 2019 and first-quarter 2019. We apologize for the inconvenience.

Recommended Reading

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.