The U.S. Energy Information Administration’s crude oil inventory report is superimposed on storage tanks in the Midland Basin. (Source: Shutterstock, EIA)

Last week’s drop in U.S. crude oil inventories was not just counter-seasonal but counter-intuitive. Don’t oil stocks typically rise in the first quarter? And shouldn’t the country’s production—which is expanding faster than the waistline of an enthusiastic patron of an all-you-can-eat dessert buffet—eliminate the possibility of there being less oil in this country?

Oil inventories dropped 8.6 million barrels (MMbbl) during the week ending Feb. 22, the U.S. Energy Information Administration (EIA) reported on Feb. 27, attributing the reduction to lower imports. The news confounded analysts who collectively expected a 2.8 MMbbl increase. Traders responded by boosting the day’s price of U.S. benchmark West Texas Intermediate (WTI) by $1.44/bbl, or 2.6%.

But markets reacted not only to the EIA’s report, but to Saudi Arabia’s rather cold response to a tweet from President Donald Trump on Feb. 25.

“Oil prices getting too high,” the president tweeted. “OPEC, please relax and take it easy. World cannot take a price hike - fragile!”

“Oil prices getting too high,” the president tweeted. “OPEC, please relax and take it easy. World cannot take a price hike - fragile!”

Saudi Energy Minister Khalid al-Falih said that the 25 members of the OPEC-plus group had taken a slow and measured approach in its production cut agreement, agreeing to reduce output by 1.2 MMbbl/d.

“We are as focused on the interests of the global economy and consumers around the world as we are focused on the interests of producers,” al-Falih said. The U.S., as a result of the shale revolution, is now counted among countries in the producer group. Analysts, however, speculated that Trump’s tweet reflected the impact of suddenly higher gasoline on American consumers. Gasoline inventories dropped 1.9 MMbbl while analysts surveyed by Reuters expected a reduction of only 1.7 MMbbl.

EnVantage Inc. analysts seemed to prefer old-school supply and demand reasons for oil price movements but the results are similar.

“Market psychology appears to becoming more bullish compared to extreme bearishness that was displayed last December,” the analysts said in a report. “As refinery turnarounds are completed later this spring it looks more likely that WTI will break the $60 level.”

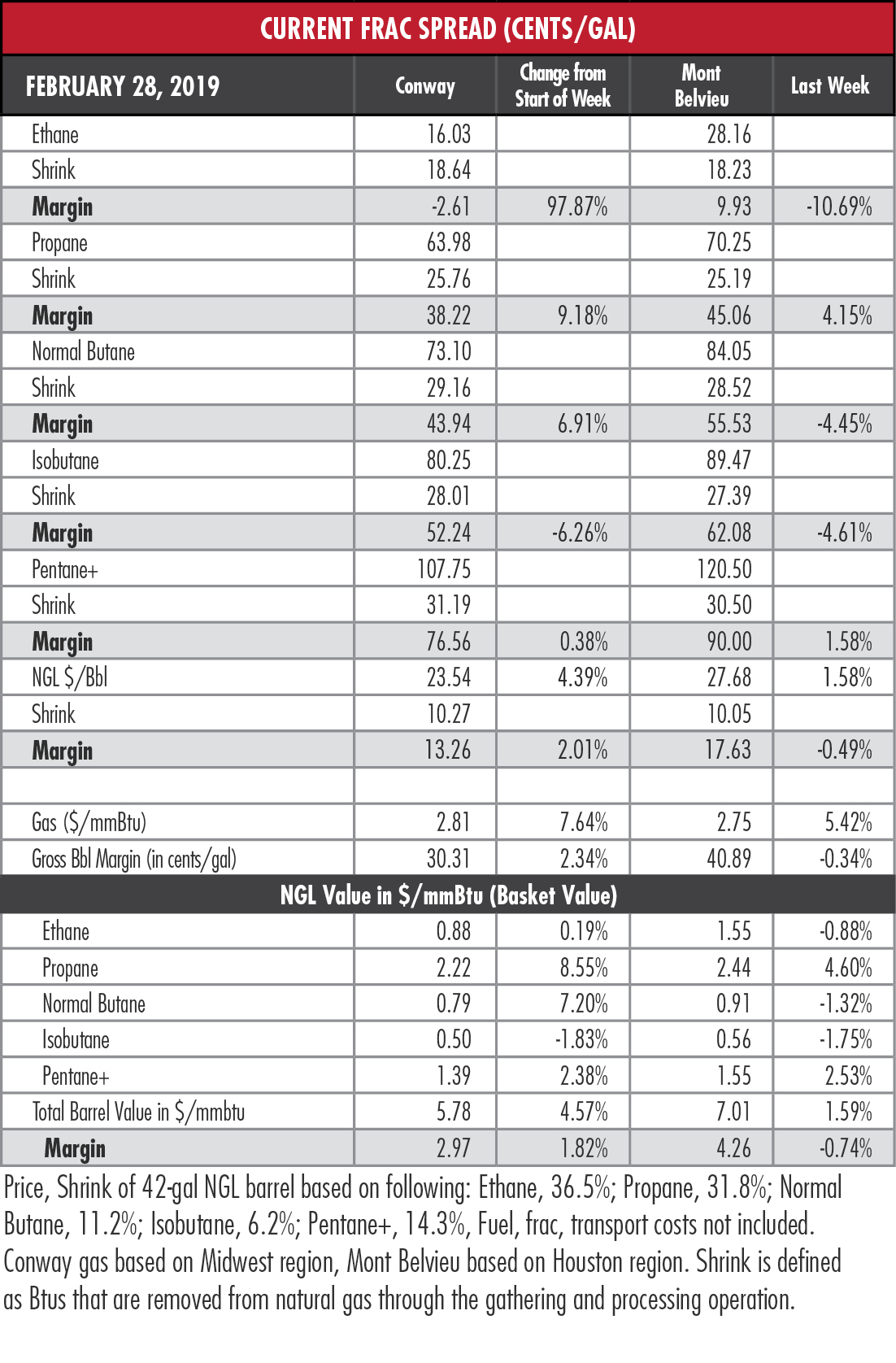

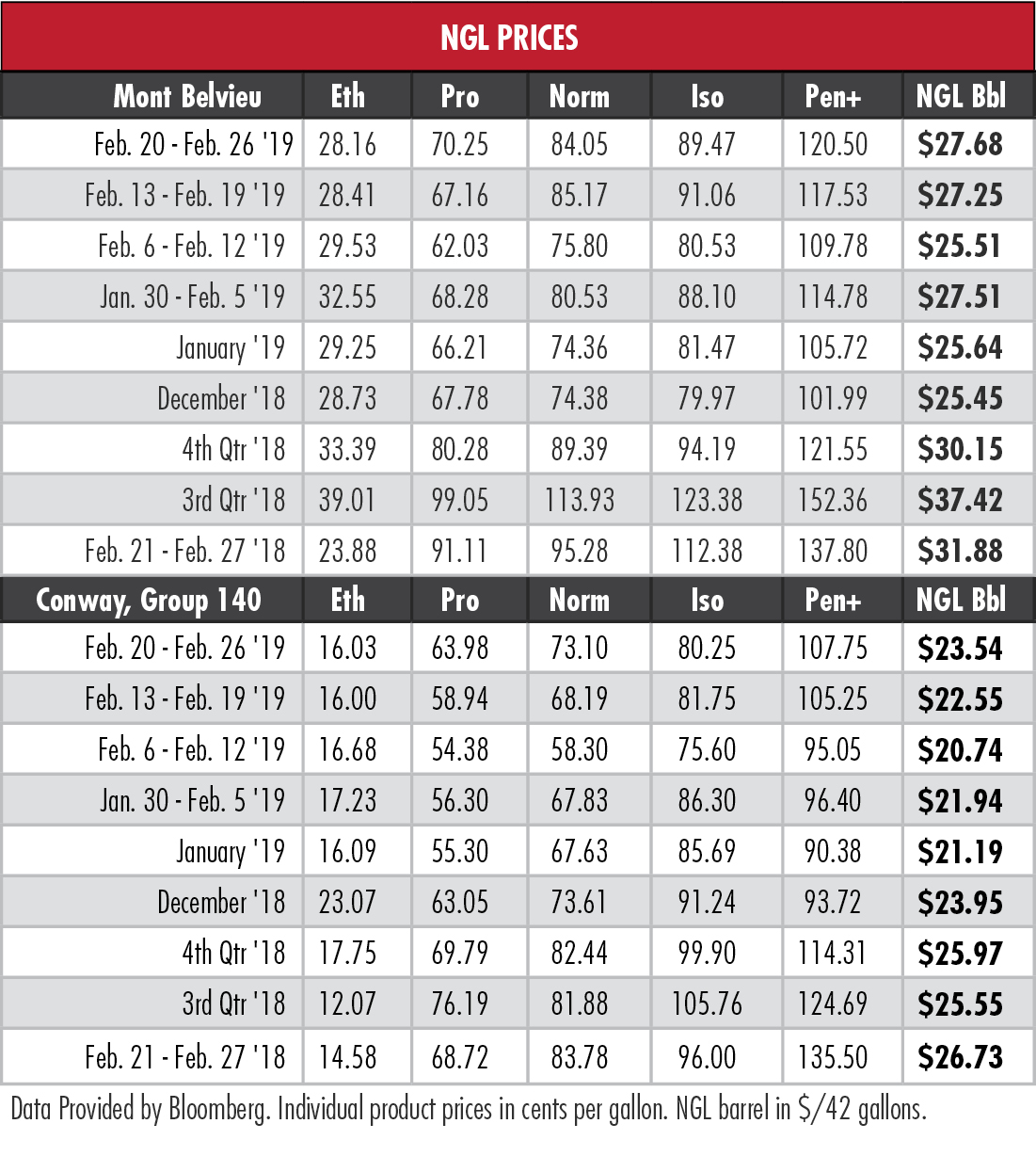

Price gains for propane and pentanes-plus lifted the hypothetical NGL barrel at Mont Belvieu, Texas to its highest point since early November. The barrel’s margin slipped only 9 cents. Propane returned to 70 cents per gallon (gal) territory for the first time in 10 weeks and pentanes-plus cracked $1.20/gal for the first time in 14 weeks.

Propane’s price elevation won’t continue, EnVantage said, because propane supplies will grow during the spring and summer months. Exports will need to expand to at least 1.2 MMbbl/d to avert a major surplus. Propane exports now average about 950,000 bbl/d.

Propane’s price elevation won’t continue, EnVantage said, because propane supplies will grow during the spring and summer months. Exports will need to expand to at least 1.2 MMbbl/d to avert a major surplus. Propane exports now average about 950,000 bbl/d.

Ethane continued to languish below 30 cents/gal for the third week in a row and its Mont Belvieu margin slipped 12% to just under 10 cents/gal.

In the week ended Feb. 22, storage of natural gas in the Lower 48 experienced a decrease of 166 billion cubic feet (Bcf), the EIA reported, compared to the Stratas Advisors prediction of a 185 Bcf withdrawal. The figure resulted in a total of 1.539 trillion cubic feet (Tcf). That is 9.1% below the 1.778 Tcf figure at the same time in 2018 and 21.6% below the five-year average of 1.963 Tcf.

In the week ended Feb. 22, storage of natural gas in the Lower 48 experienced a decrease of 166 billion cubic feet (Bcf), the EIA reported, compared to the Stratas Advisors prediction of a 185 Bcf withdrawal. The figure resulted in a total of 1.539 trillion cubic feet (Tcf). That is 9.1% below the 1.778 Tcf figure at the same time in 2018 and 21.6% below the five-year average of 1.963 Tcf.

Recommended Reading

EU Expected to Sue Germany Over Gas Tariff, Sources Say

2024-04-17 - The German tariff is a legacy of the European energy crisis that peaked in 2022 after Moscow slashed gas flows to Europe and an undersea explosion shut down the Nord Stream pipeline.

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.

Kinder Morgan Exec: Building Pipelines ‘Challenging, but Manageable’

2024-04-05 - Allen Fore, vice president of public affairs for Kinder Morgan, said building anything, from a new road to an ice cream shop, can be tough but dealing with stakeholders up front can move projects along.

FERC Again Approves TC Energy Pipeline Expansion in Northwest US

2024-04-19 - The Federal Energy Regulatory Commission shot down opposition by environmental groups and states to stay TC Energy’s $75 million project.