(Source: HartEnergy.com, Shutterstock.com)

The gut punch that crude oil prices took on March 9 was felt by NGL, too, and petrochemicals can expect to suffer body blows, as well.

By mid-morning of March 12, WTI was down 4.6% to $31.47 per barrel (bbl), Brent was down almost 7% to $33.34/bbl and, after trading was halted for 15 minutes for the second time in a week due to a 7% drop in the S&P 500 index, the S&P Oil and Gas index had fallen 12%. The U.S. benchmark Henry Hub price was down 3.2% to $1.818 per million British thermal units (MMBtu)

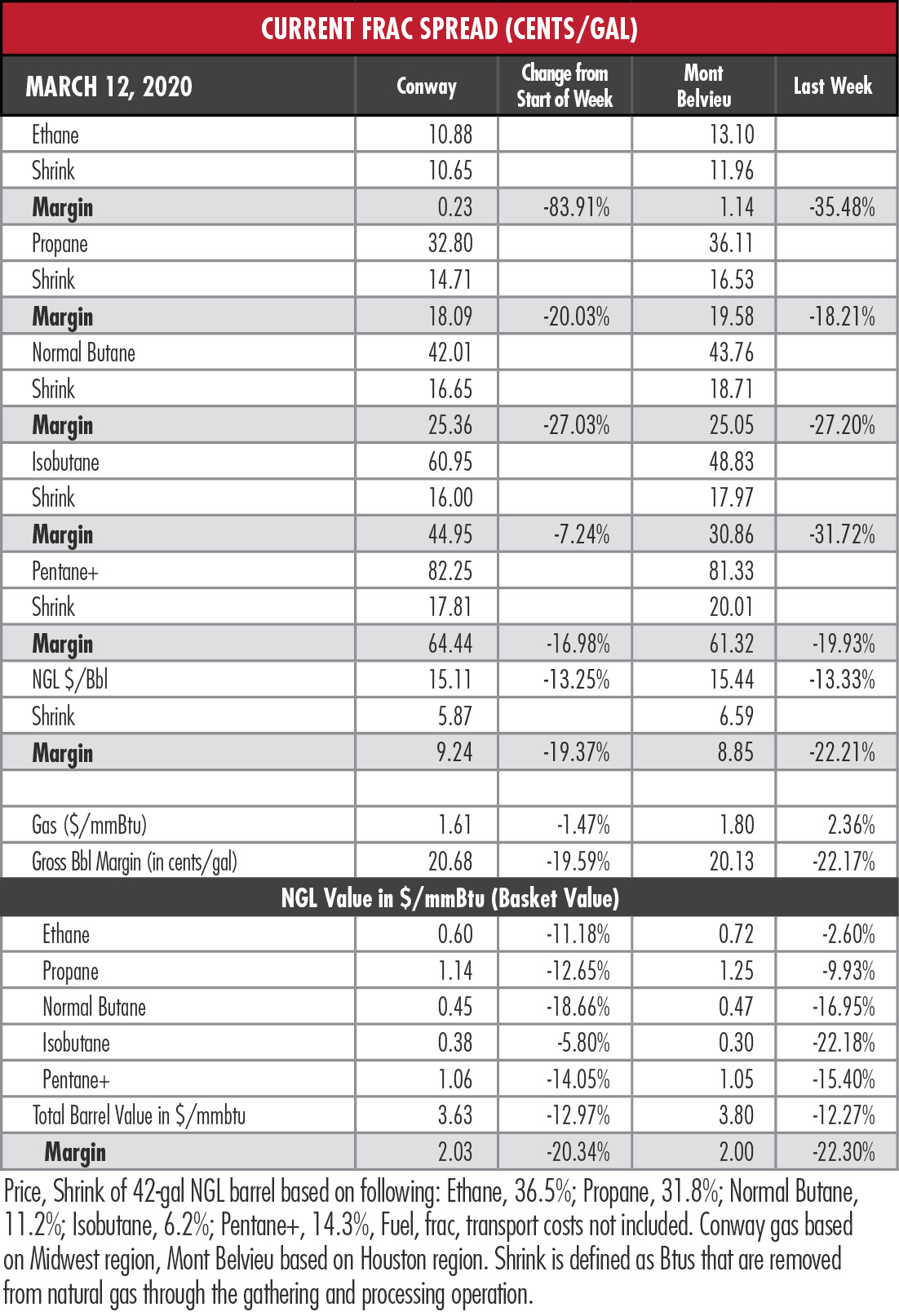

Last week’s hypothetical NGL barrel at Mont Belvieu, Texas, fell to a 50-month low of $15.44. It was a 13.3% week-over-week hit driven mostly by major losses from the butanes and natural gasoline.

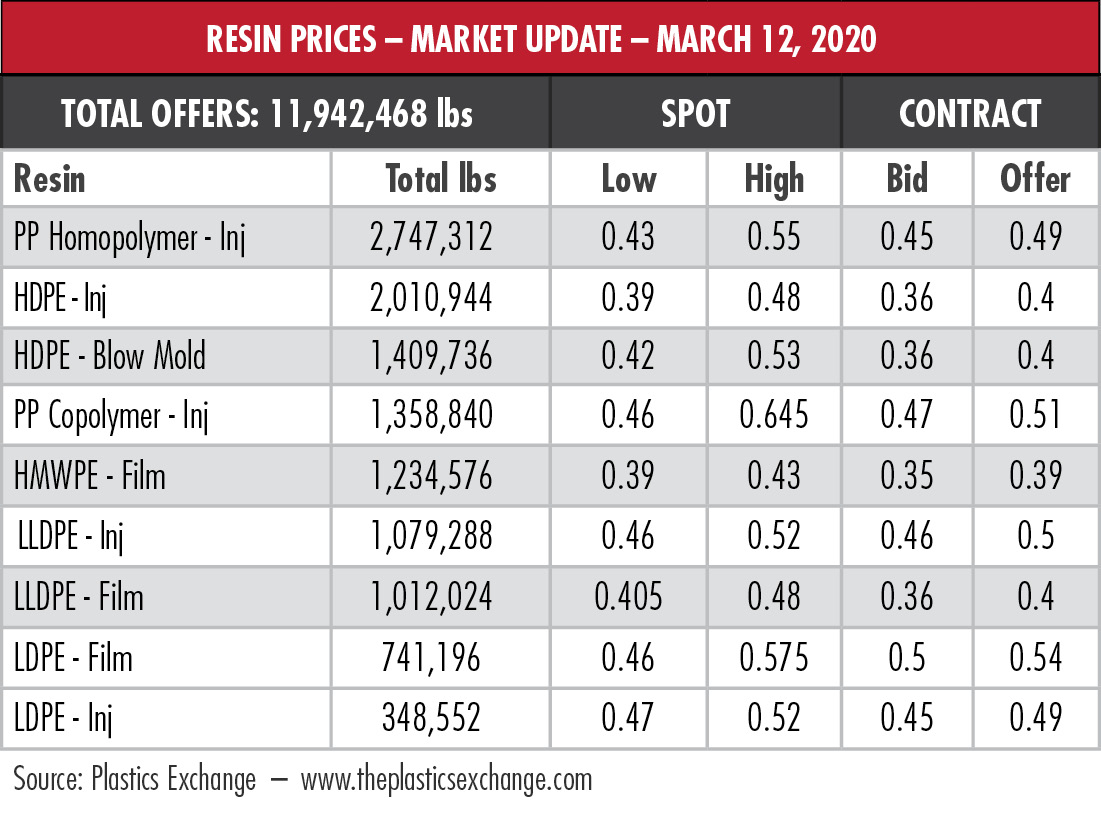

“U.S. producers using cheap NGL feedstock have enjoyed a competitive advantage in polyethylene (PE) production vs. their peers in Europe and Asia which largely use oil-based naphtha,” wrote Joseph Chang, global editor for ICIS Chemical Business. “However, with a major decline in crude oil prices, the U.S. advantage dissipates.”

EnVantage Inc. agrees, noting that “as always, this too will pass at some date but the trip will be treacherous.” The recovery, the analysts said, will be a sharp one when demand returns to an undersupplied market.

But that might take a while.

“During the last price war, OPEC members were surprised by the resilience of U.S. shale producers, and eventually chose to cut their own production instead,” said Mark Finley, fellow in energy and global oil at the Baker Institute’s Center for Energy Studies at Rice University. “This time around, many observers expect U.S. producers to be under greater pressure from investors/lenders.”

OPEC producers will need to keep their own budget deficits in mind as they ramp up production, Finley added.

For now, it appears that they are doing both. The Saudis announced on March 10 they would increase output by 2.5 million barrels per day (bbl/d) beginning April 1. That could force the price of crude down to the low $20s before the global market rebalances, Rystad Energy said on March 11.

“Without OPEC+, the global oil market has lost its regulator and now only market mechanisms can dictate the balance between supply and demand,” said Espen Erlingsen, Rystad’s head of upstream research.

And Energy Intelligence has already reported that the Kingdom is developing an economic strategy should the global price drop into the $12/bbl to $20/bbl range. Or less. But the balance will return.

“Ultimately, this will sow the seeds of a recovery in oil but we’ve got to work through a challenging 2020 first,” Pearce W. Hammond, managing director of midstream and infrastructure equity research at Simmons Energy, told HartEnergy.com.

Before you calculate the damage that single-digit crude prices would do, remember that the U.S. benchmark Henry Hub natural gas price had a pretty good week.

Early on March 9, gas fell to a 21-year low of $1.61/MMBtu but popped up 20% by the following afternoon. By midday March 11, it peaked at $1.99/MMBtu, or 23.6% above its low point. The hike is related to anticipated oil production cutbacks.

“Oil production in the United States has been cut; associated gas production goes along with that oil, so you’re reducing gas production,” Hammond said. “That’s beneficial to the gas market.”

Indeed, Cabot Oil & Gas Corp. and EQT Corp. stocks both enjoyed strong days while other gas producers experienced minor damage to their share prices.

NGL prices follow oil and gas, and the results—with the exception of ethane, which has been in the dumps for a while, anyway—were brutal.

From the close of trading on Friday, March 6 to the close on Monday, March 9, propane lost 14% at Mont Belvieu, Texas; butane lost 16%; isobutane lost 15%; and natural gasoline lost 21%.

For ethane, the concern is the spread of the COVID-19 pandemic in Asia and Europe, EnVantage said. If international ethylene plants purchasing U.S. ethane are forced to scale back, so will U.S. exporters. And reporting by Platts of a surplus in Europe and plant slowdowns in Asia indicate that will be the case.

“The bottom line is that the oversupply of ethane will continue to make it difficult for ethane prices to materially differentiate from natural gas prices,” EnVantage said.

With winter ending, the price of propane can be expected to drop, but like the hypothetical barrel, the Mont Belvieu price collapsed to a 50-month low—hardly an entirely seasonal reason. On the plus side, EnVantage said there were indications that Chinese petrochemical producers have received waivers to import U.S. propane.

Heavy NGL like the butanes and natural gasoline would also be expected to experience price slides with the end of the wintertime gasoline blending season—but not 15% to 22% weekly jolts.

Hang on. This could be a long, tough fight.

In the week ended March 6, storage of natural gas in the Lower 48 experienced a decrease of 48 billion cubic feet (Bcf), the EIA reported, compared to the analyst consensus expectation of a 59 Bcf reduction. The EIA figure resulted in a total of 2.043 Tcf. That is 63.8% above the 1.247 Tcf figure at the same time in 2019 and 12.5% above the five-year average of 1.816 Tcf.

Recommended Reading

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.