Snow covers a car during an October storm in Denver. (Source: Shutterstock)

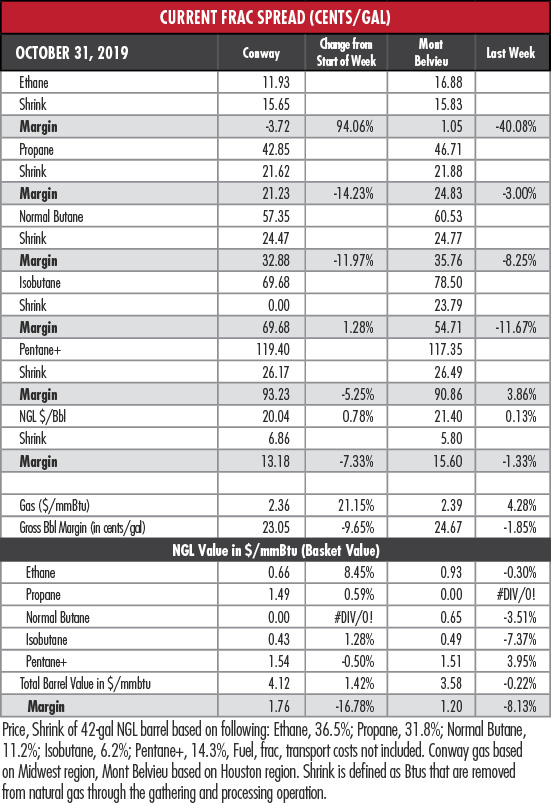

The benchmark Henry Hub natural gas price rose sharply as temperatures fell sharply across the U.S. last week, with even colder weather expected through Nov. 1. NGL prices held steady so the costlier gas battered NGL margins. Mont Belvieu, Texas, ethane barely clung to 1 cent per gallon (gal) in the positive.

News of an imminent resolution to the U.S.-China trade war delighted equity markets, with the Dow Jones industrial average springing back over 27,000. Commodity markets, however, were not as impressed and West Texas Intermediate (WTI) crude oil retreated on Oct. 30 after the U.S. Energy Information Administration reported an increase of 5.7 million barrels to inventories.

Despite the recent spike, natural gas prices in the U.S. are on track to set a 25-year low in 2019 and the trend does not appear ready to end soon.

BP Plc is “very bearish” on natural gas prices through 2021, Financial Times reported, quoting CFO Brian Gilvary. “We don’t think this is going to get better over the next two to three years,” he said.

Low U.S. gas prices mean that producers depend on higher gas prices in Europe to goose sales of LNG. But European prices have been low, too.

“Those LNG suppliers need some cold weather in Europe to make the spreads work,” EnVantage Inc. said in a recent report.

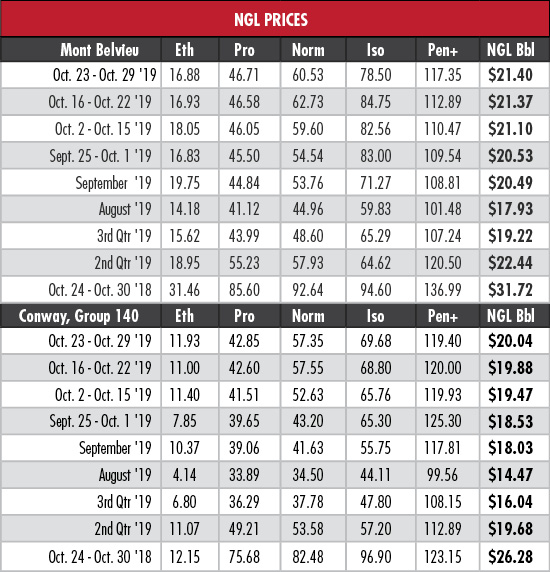

The fundamentals for propane are turning more bullish, EnVantage said, but prices remain sluggish. Mont Belvieu’s price moved very little and the margin was trimmed by 3%. Propane’s price was 37.4% relative to WTI on Oct. 29, up slightly from 36.4% two weeks earlier.

“Although the environment for propane should turn positive from a seasonal point of view, seasonal demand and greater exports must pick up,” the analysts warned. “If these two demand factors fail to meet expectations then propane prices could easily reverse as more supplies are on the way over the next six months.”

Mont Belvieu isobutane took a 7.4% hit last week but still maintained an 18 cent/gal premium over normal butane, an unusual occurrence for this time of the year as noted by EnVantage. Last year’s spread was about 2 cents/gal. During the same week in 2017, the spread was only 0.3 cent/gal.

In the week ended Oct. 25, storage of natural gas in the Lower 48 experienced an increase of 89 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. That compared to the Stratas Advisors expectation of an 87 Bcf build and the consensus expectation of 88 Bcf. The EIA figure resulted in a total of 3.695 trillion cubic feet (Tcf). That is 17.8% above the 3.136 Tcf figure at the same time in 2018 and 1.4% above the five-year average of 3.643 Tcf.

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.