The 2018 Marcellus-Utica Midstream Conference in Pittsburgh drew more than 1,000 attendees. Source: Hart Energy

Attendees at this week’s Marcellus-Utica Midstream Conference in Pittsburgh probably wouldn’t mind going back in time just to tell their 2016 selves, “It gets better.”

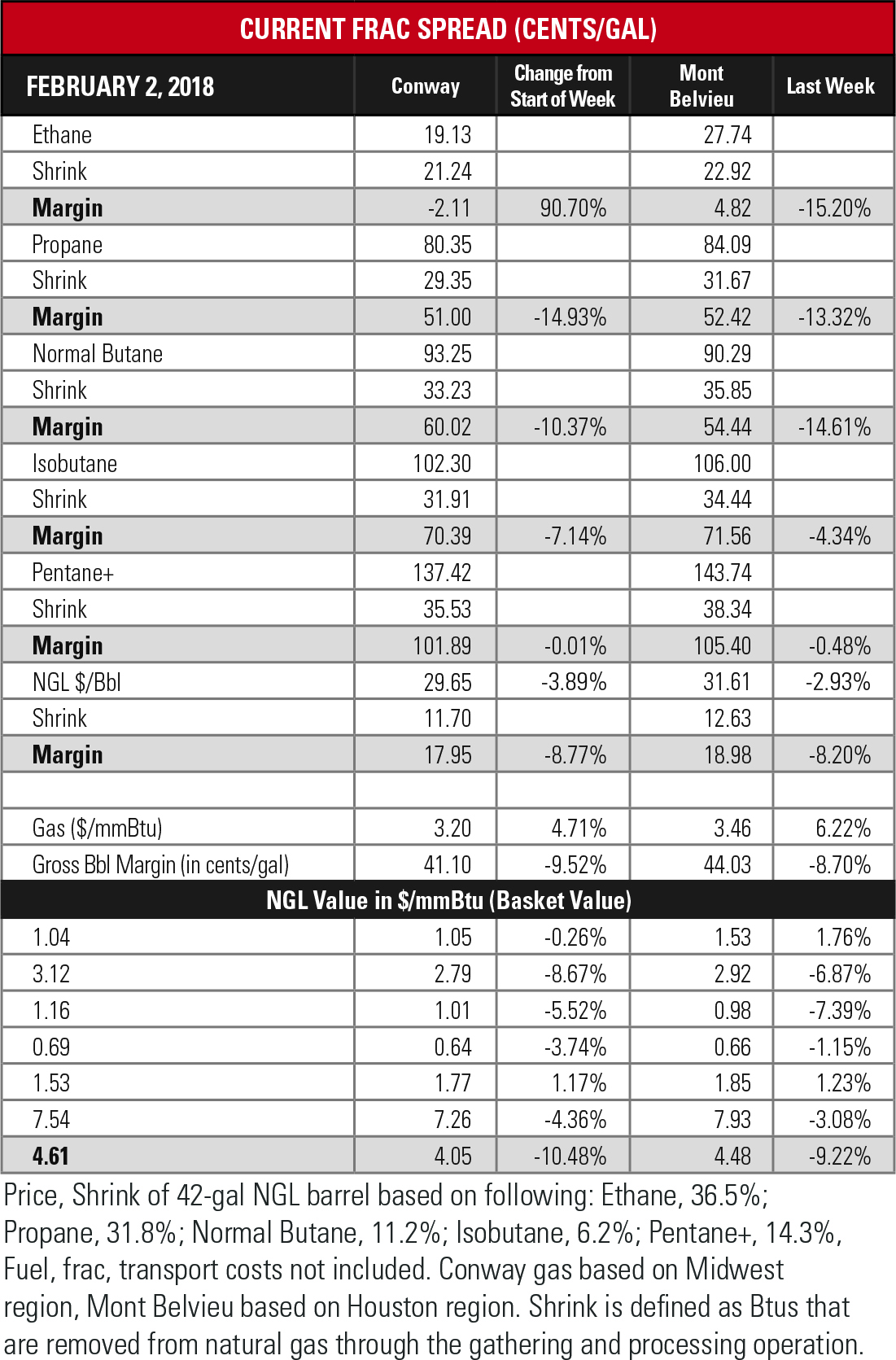

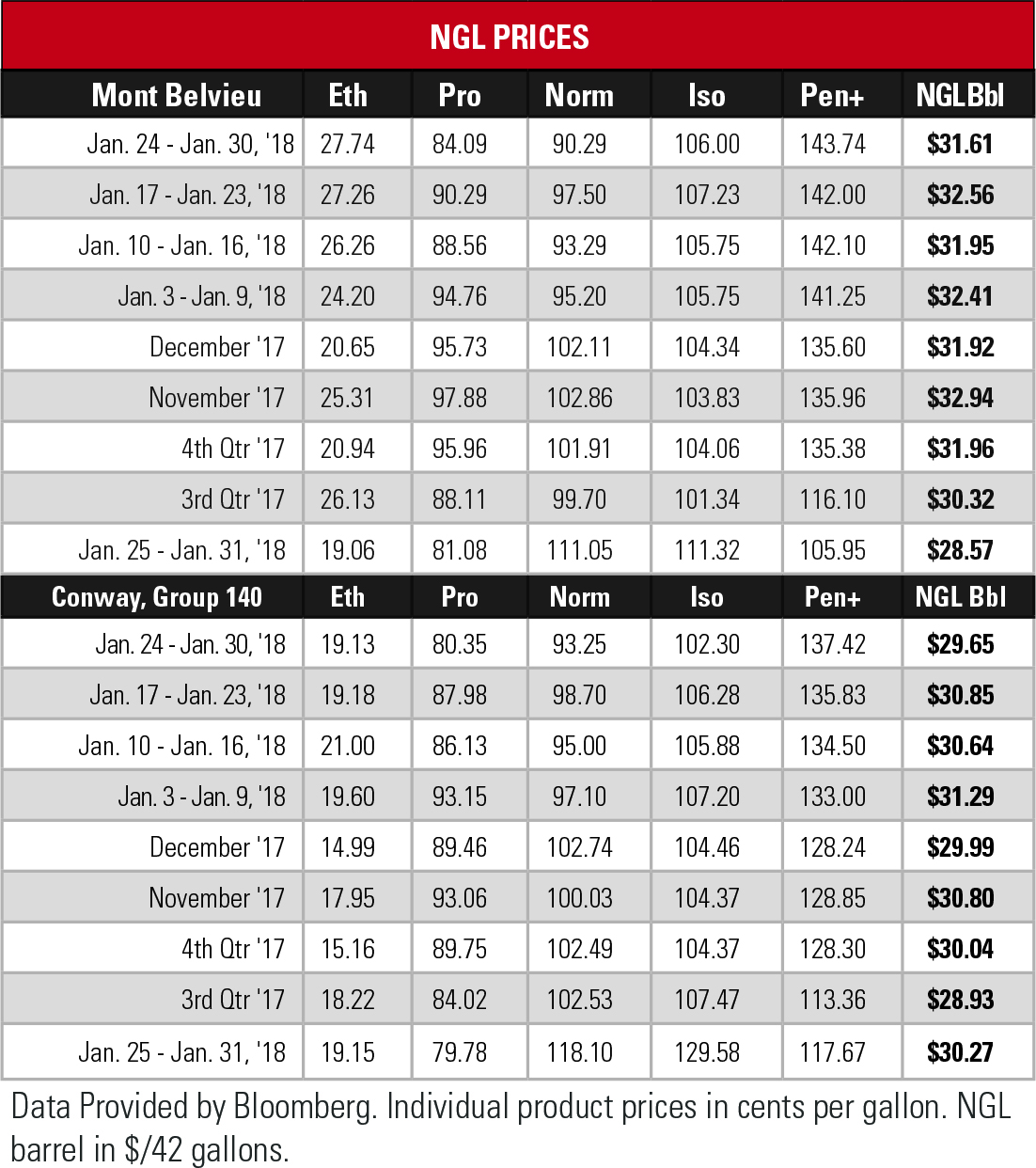

The upbeat vibe in the David L. Lawrence Convention Center was reflected in the past week’s 43-month high in the Mont Belvieu, Texas, ethane price. Looking ahead, though, domestic demand will not echo NGL production’s upward tilt. And it’s not just about ethane.

“The exports are growing, domestic demand is going down,” said Bernadette Johnson, vice president of market intelligence for Drillinginfo Inc., about her outlook for propane. “We’re growing supplies, and what does that mean? That puts even more pressure on the export piece and that’s because exports are key for LPG.”

“The exports are growing, domestic demand is going down,” said Bernadette Johnson, vice president of market intelligence for Drillinginfo Inc., about her outlook for propane. “We’re growing supplies, and what does that mean? That puts even more pressure on the export piece and that’s because exports are key for LPG.”

Drillinginfo sees propane exports growing from 848,000 barrels per day (bbl/d) in 2018 to 1.155 million bbl/d in 2022. In that time, domestic use, which jumped from 350,000 bbl/d in 2017 to 457,000 bbl/d in 2018, will remain static at about 450,000 bbl in 2022.

Total supply will increase from 1.305 million bbl/d to 1.605 million bbl/d during that time, so export growth needs to kick in.

Same for butanes, she said. Exports are expected to double to almost 400,000 bbl/d in that time frame as domestic demand dips by 5.5%. Natural gasoline paints a similar picture: domestic trends down as exports trend up.

Same for butanes, she said. Exports are expected to double to almost 400,000 bbl/d in that time frame as domestic demand dips by 5.5%. Natural gasoline paints a similar picture: domestic trends down as exports trend up.

The game-changer in Appalachia, Amol Wayangakar of Enkon Energy Advisors told attendees, is Sunoco Pipeline’s Mariner East 2 pipeline project. While progress has been delayed because Pennsylvania has suspended construction permits, the project’s eventual completion will transform the region’s transport of NGL from rail, which now moves 80% of volumes, to pipe.

On a more short-term basis, margins narrowed as natural gas prices at Chicago Citygate and Henry Hub surged. The subsequent drop in gas price closes on Jan. 31 and Feb. 1 are not factored into the five-day NGL price average, which runs from Wednesday to the following Tuesday.

In the week ended Jan. 26, storage of natural gas in the Lower 48 experienced a decrease of 99 Bcf, the U.S. Energy Information Administration reported, below the Bloomberg consensus of a 102 Bcf draw. The figure resulted in a total of 2.197 trillion cubic feet (Tcf). That is 19.3% below the 2.723 Tcf figure at the same time in 2017 and 16.2% below the five-year average of 2.622 Tcf.

In the week ended Jan. 26, storage of natural gas in the Lower 48 experienced a decrease of 99 Bcf, the U.S. Energy Information Administration reported, below the Bloomberg consensus of a 102 Bcf draw. The figure resulted in a total of 2.197 trillion cubic feet (Tcf). That is 19.3% below the 2.723 Tcf figure at the same time in 2017 and 16.2% below the five-year average of 2.622 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.