Greg Haas of Stratas Advisors speaks at the Marcellus-Utica Midstream Conference in early December in Pittsburgh. (Source: Joseph Markman/HartEnergy.com)

PITTSBURGH—Natural gas prices could spike into the $3 per million British thermal units range if temperatures plunge this winter, but strong inventory will ensure they won’t stay there long, an analyst said at Hart Energy’s recent Marcellus-Utica Midstream Conference.

“We’re sitting very well within the normal range for natural gas storage, which portends normal pricing for natural gas this winter,” said Greg Haas, director of integrated energy research for Stratas Advisors.

While average annual natural gas storage levels were low earlier in the year, “look at how fast we’ve climbed,” Haas said. “We’ve really come back and now we’re basically well above average.”

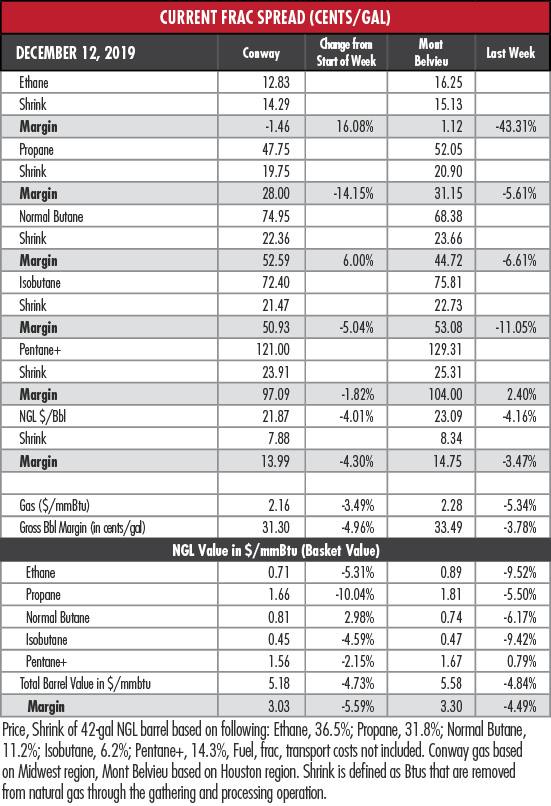

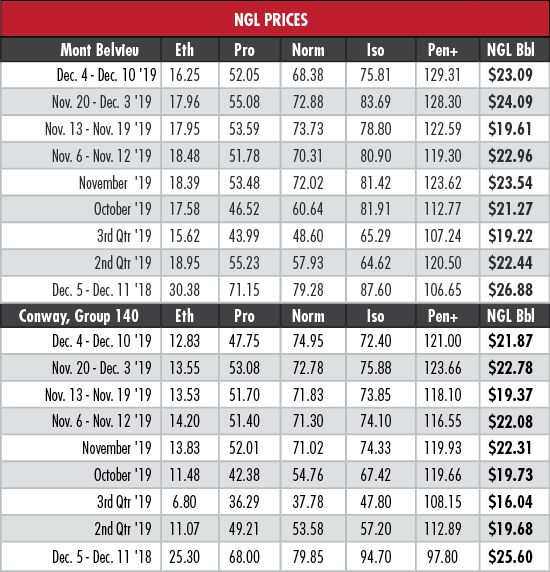

NGL Price Struggles

NGL prices struggled in the past week, with Mont Belvieu, Texas, ethane tumbling 9.5% to a 15-week low. Isobutane also took a 9.4% hit, sliding to an 11-week low and the hypothetical NGL barrel dropped $1, or 4.2%.

The solution for NGL, Haas said, is the same as for natural gas: exports. Propane and butane are exported increasingly via southern terminals and through markets in Pennsylvania.

Propane and butane producers have found the Asia-Pacific region to be a rich opportunity for exports, according to a Dec. 10 report by Haas’ colleagues at Stratas Advisors.

“One of the key trends is that U.S. LPG has been rapidly penetrating Asia LPG markets, thus eroding Middle East exporters’ market shares,” the report said. “One of the key reasons is price competitiveness of U.S. LPG compared to the Middle East.”

In 2019, Asia-Pacific nations accounted for about 49% of total U.S. LPG exports. Japan, in particular, has ratcheted up U.S. imports to compensate for its 65% reduction in Middle East imports since 2017. Propane makes up about 70% of U.S. LPG exports to Asia-Pacific.

Ethane, however, is another matter.

“We really need to see more ethane demand generated in the U.S.,” he said. “Hopefully we’ll see another cracker announced in Appalachia.”

Not experiencing a spike in ethane demand could prove troublesome.

“The interplay between ethane and natural gas is interesting,” Haas said, “in that if there’s not enough ethane demand, the ethane can be rejected and that will then add onto the already high production of natural gas. It will be another form of natural gas that has to be consumed.”

Production Superstars

U.S. natural gas production has propelled the prodigious increase in inventory. The U.S. Energy Information Administration (EIA) expects output to average 92.1 billion cubic feet per day (Bcf/d) in 2019, up 10% over 2018. EIA forecasts the increase to be modest in 2020, with an anticipated average of 95.1 Bcf/d, according to its recently released Short-Term Energy Outlook.

“The Permian, Appalachian, Haynesville, even Bakken, I think, will be the gas production superstars of the coming era,” Haas said. “Midcon? Somewhat. Eagle Ford? Somewhat. Scoop/Stack? Somewhat, but Barnett and Fayetteville will probably be pretty quiet.”

That brings global waterborne LNG suppliers into the picture, he said. Exporters in Qatar, Australia and Africa are competing for shares in some of the markets that U.S. producers are targeting. U.S. LNG exports, which averaged about 0.5 Bcf/d as recently as 2016, were estimated to average 4.9 Bcf/d in 2019 with a projected 6.5 Bcf/d in 2020, according to the EIA.

In the week ended Dec. 6, storage of natural gas in the Lower 48 experienced a decrease of 73 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. That compared to the Stratas Advisors expectation of a 76 Bcf withdrawal. The EIA figure resulted in a total of 3.518 trillion cubic feet (Tcf). That is 20.3% above the 2.925 Tcf figure at the same time in 2018 and 0.4% below the five-year average of 3.532 Tcf.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Stockholder Groups to Sell 48.5MM of Permian Resources’ Stock

2024-03-06 - A number of private equity firms will sell about 48.5 million shares of Permian Resources Corp.’s Class A common stock valued at about $764 million.

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.