Forgive a newbie to this industry for assuming that all sentences that include “pipeline” must also include “constraints.” In deference to shale-era custom, let us get it out of our collective system at the start.

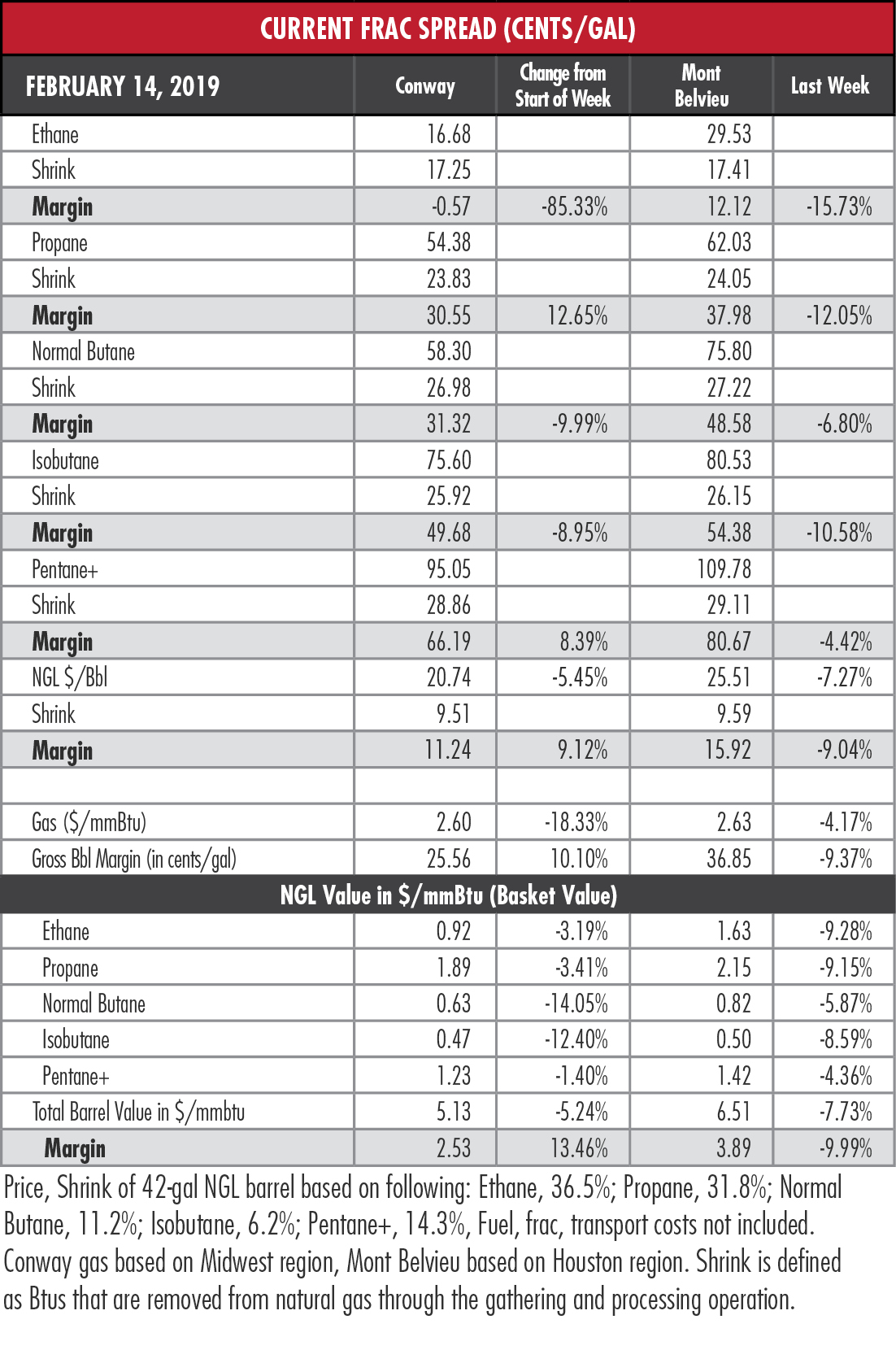

“NGL pipeline takeaway … has been an issue this year,” said Nicole Leonard, senior energy analyst, commodity consulting for S&P Global Platts, at the S&P Global Ratings oil and gas forum on Feb. 11. The problem is widespread, plaguing producers in the Bakken and Colorado plays and creating problems in the NGL hubs of Conway, Kan., and Mont Belvieu, Texas.

However, the ongoing infrastructure buildout in the Permian Basin should help alleviate some of those constraints in the most prolific basin by the end of 2019.

Finally, the constraints problem is on its way to being resolved. On to the next issue.

Finally, the constraints problem is on its way to being resolved. On to the next issue.

“We’re very constrained on fractionation,” Leonard said, invoking the unavoidable word again. “That goes all the way back to the wellhead. If the producer can’t get their Y-grade onto a pipeline because all the fracs are full, well they can’t produce their natural gas, they can’t produce their oil and that impacts their profit margins.”

On the plus side, she noted a buildout in fractionation over the next year or so which will help alleviate at least part of that issue. Five new ethane crackers are scheduled to come online in second-half 2019 with total capacity of about 280,000 barrels per day (bbl/d), so patient producers will have plenty of opportunity to profit over time but 2019 will be a tough one.

“This year is going to be very difficult to really deal with your NGLs, market them, get them out of the ground, get then to a processing plant, get them to a fractionator,” she said. This is in marked contrast to crude oil, which enjoys good export terminal capacity. But even that could change, Leonard said, if those terminals were to be repurposed to handle a high demand for exported refined products.

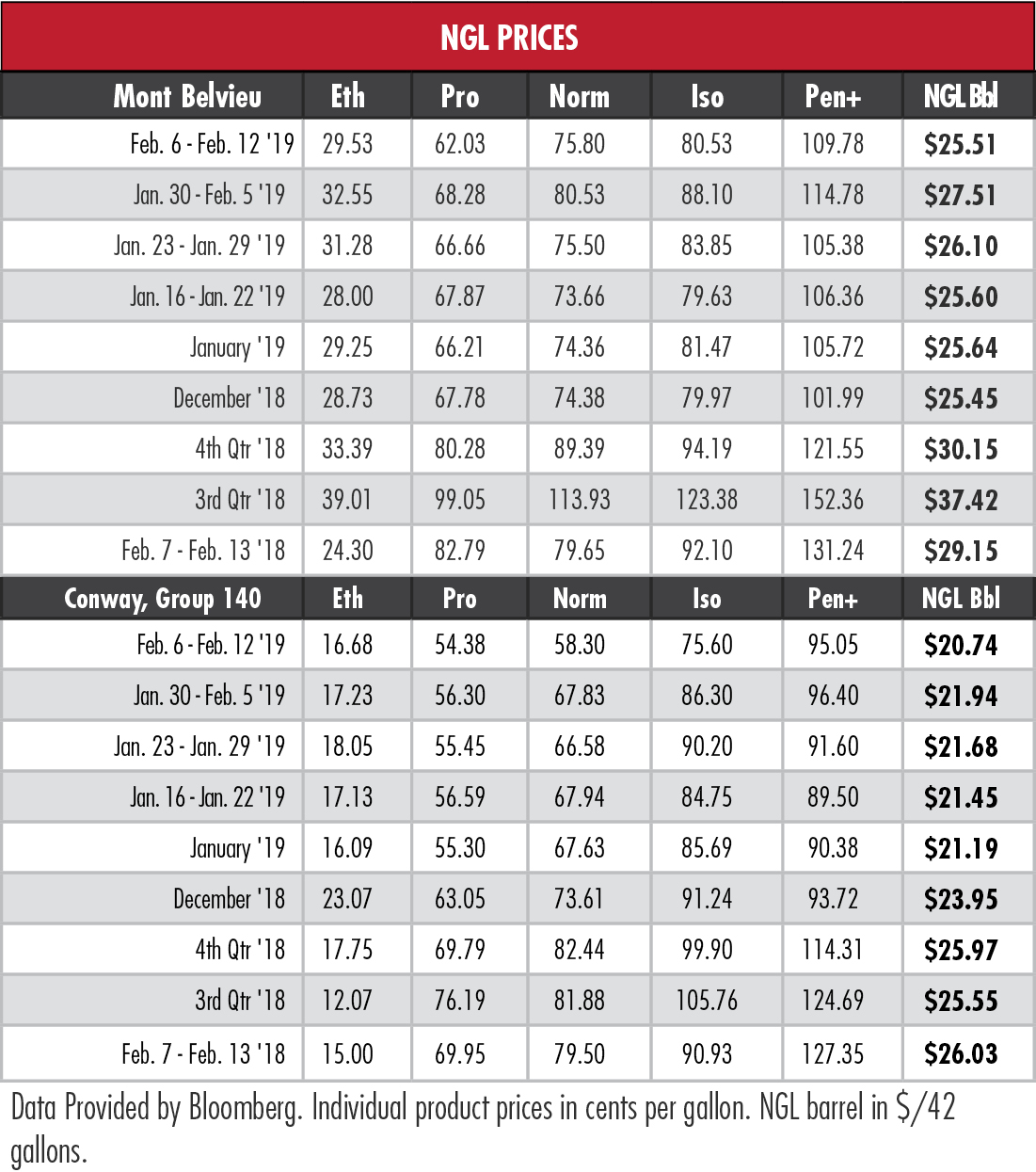

Propane exports may be primed to rise again, if only because the post-Vortex price is so cheap. Mont Belvieu’s propane price dropped to its lowest point in seven months last week and is 42% below the 2018 peak in mid-September.

“The year-over-year surplus in propane inventories will grow this year,” said EnVantage Inc. in a report. “By early October we are forecasting propane stocks to peak at around 93 million barrels. Propane exports will need to average near 1.2 million barrels per day to accommodate the excess propane supplies that should be available because of the increase in propane extraction.”

“The year-over-year surplus in propane inventories will grow this year,” said EnVantage Inc. in a report. “By early October we are forecasting propane stocks to peak at around 93 million barrels. Propane exports will need to average near 1.2 million barrels per day to accommodate the excess propane supplies that should be available because of the increase in propane extraction.”

EnVantage forecasts propane exports this year to approach the country’s terminal capacity for propane. As long as all of the export terminals continue to operate, especially Marcus Hook, Pa., the surplus should be manageable. Any outage of the Mariner East 2 pipeline, EnVantage said, would add to the surplus.

About that…

On Feb. 8, Pennsylvania’s Department of Environmental Protection halted construction permits for Energy Transfer LP because the company did not comply with an order following an explosion involving the Revolution pipeline in September. Last week’s action covers construction of Mariner East 2, while Mariner East 1 is shut down because part of it was exposed by a sinkhole in Chester County, Pa.

Other NGL did not fare well last week, as well. All prices fell at Mont Belvieu and all margins narrowed as well.

In the week ended Feb. 8, storage of natural gas in the Lower 48 experienced a decrease of 78 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, compared to the Stratas Advisors prediction of a 77 Bcf withdrawal. The figure resulted in a total of 1.882 trillion cubic feet (Tcf). That is 1.6% below the 1.912 Tcf figure at the same time in 2018 and 15% below the five-year average of 2.215 Tcf.

In the week ended Feb. 8, storage of natural gas in the Lower 48 experienced a decrease of 78 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, compared to the Stratas Advisors prediction of a 77 Bcf withdrawal. The figure resulted in a total of 1.882 trillion cubic feet (Tcf). That is 1.6% below the 1.912 Tcf figure at the same time in 2018 and 15% below the five-year average of 2.215 Tcf.

Recommended Reading

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.