The outline of Venezuela is overset with an image of demonstrators opposed to President Nicolás Maduro during a recent protest. (Source: Shutterstock, HartEnergy.com)

Like evenly matched sumo wrestlers, geopolitical strife and bloated inventory have countered each other in a battle to influence oil prices.

Geopolitics appeared to have gained an advantage in the past week, with heightened tensions over Venezuela’s internal power struggle and the Trump administration following through on its commitment to reduce Iran’s oil exports to zero.

But when push came to shove, traders backed crude stockpiles, which the U.S. Energy Information Administration said rose 9.9 million barrels in the week ended April 26 to reach its highest level in 19 months. Inventories in the Gulf Coast region accounted for 9.2 million barrels of that total.

That the price of West Texas Intermediate (WTI) could fall by 31 cents a barrel to $63.30 a day after Venezuela’s opposition leader Juan Guaidó called on the armed forces to switch sides and oust President Nicolás Maduro speaks to the weight traders give to the power of U.S. oil production.

In the Middle East, Iran has threatened to block the Strait of Hormuz to retaliate for the U.S. decision to eliminate waivers on sanctions to eight countries allowed to buy Iranian oil. Following through on the threat and risking a military confrontation with the U.S. is unlikely, Paul Sheldon, chief geopolitical adviser at S&P Global Platts Analytics, told MarketWatch.

In the Middle East, Iran has threatened to block the Strait of Hormuz to retaliate for the U.S. decision to eliminate waivers on sanctions to eight countries allowed to buy Iranian oil. Following through on the threat and risking a military confrontation with the U.S. is unlikely, Paul Sheldon, chief geopolitical adviser at S&P Global Platts Analytics, told MarketWatch.

Weakening the geopolitical factor is the assessment by the International Energy Agency (IEA) that Saudi Arabia and other producers are capable of making up the shortfall caused by the loss of Iranian and Venezuelan crude. EnVantage Inc. analysts are not so sure.

“IEA makes the assumption OPEC+ will break their production cut agreement,” EnVantage said in a report. “It is likely that Saudi Arabia will wait until a significant number of barrels are taken off the market before they ask OPEC+ to open the taps. Recall that the Saudis got burned in 2018 when the U.S. granted the waivers.”

But even if the Saudis were to convince its partners in OPEC and Russia to keep barrels off the market, there is no certainty that prices would rise. That’s because the global economy may be weaker that many want to acknowledge and creating a the possibility for a major downside risk to oil prices, wrote Nick Cunningham on OilPrice.com.

But even if the Saudis were to convince its partners in OPEC and Russia to keep barrels off the market, there is no certainty that prices would rise. That’s because the global economy may be weaker that many want to acknowledge and creating a the possibility for a major downside risk to oil prices, wrote Nick Cunningham on OilPrice.com.

Reuters has reported that global trade volumes are declining for the first time since the end of the 2008-2009 financial crisis. Cunningham quoted John Kemp, a Reuters market analyst, as saying the global economy is “one more shock away from recession.”

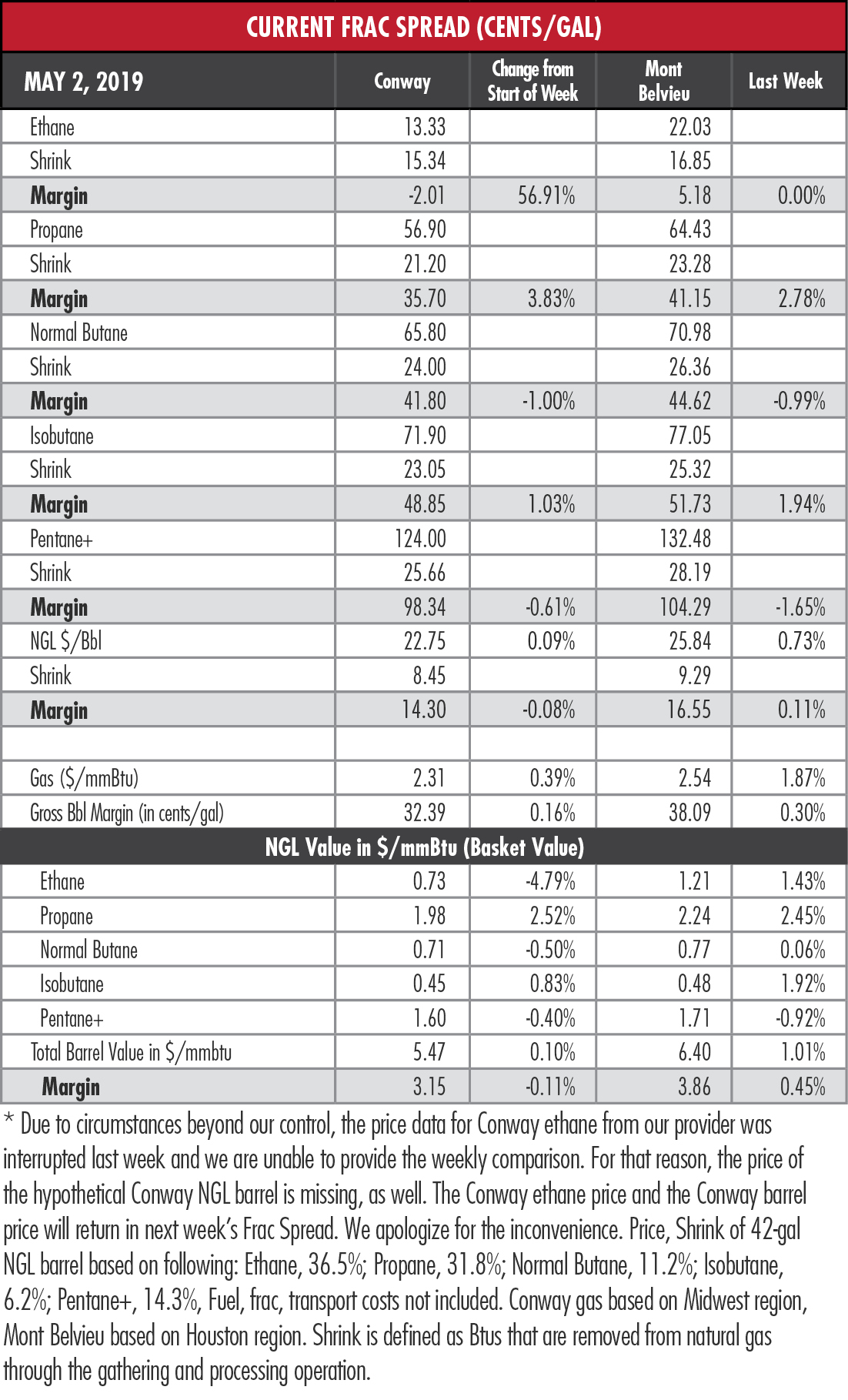

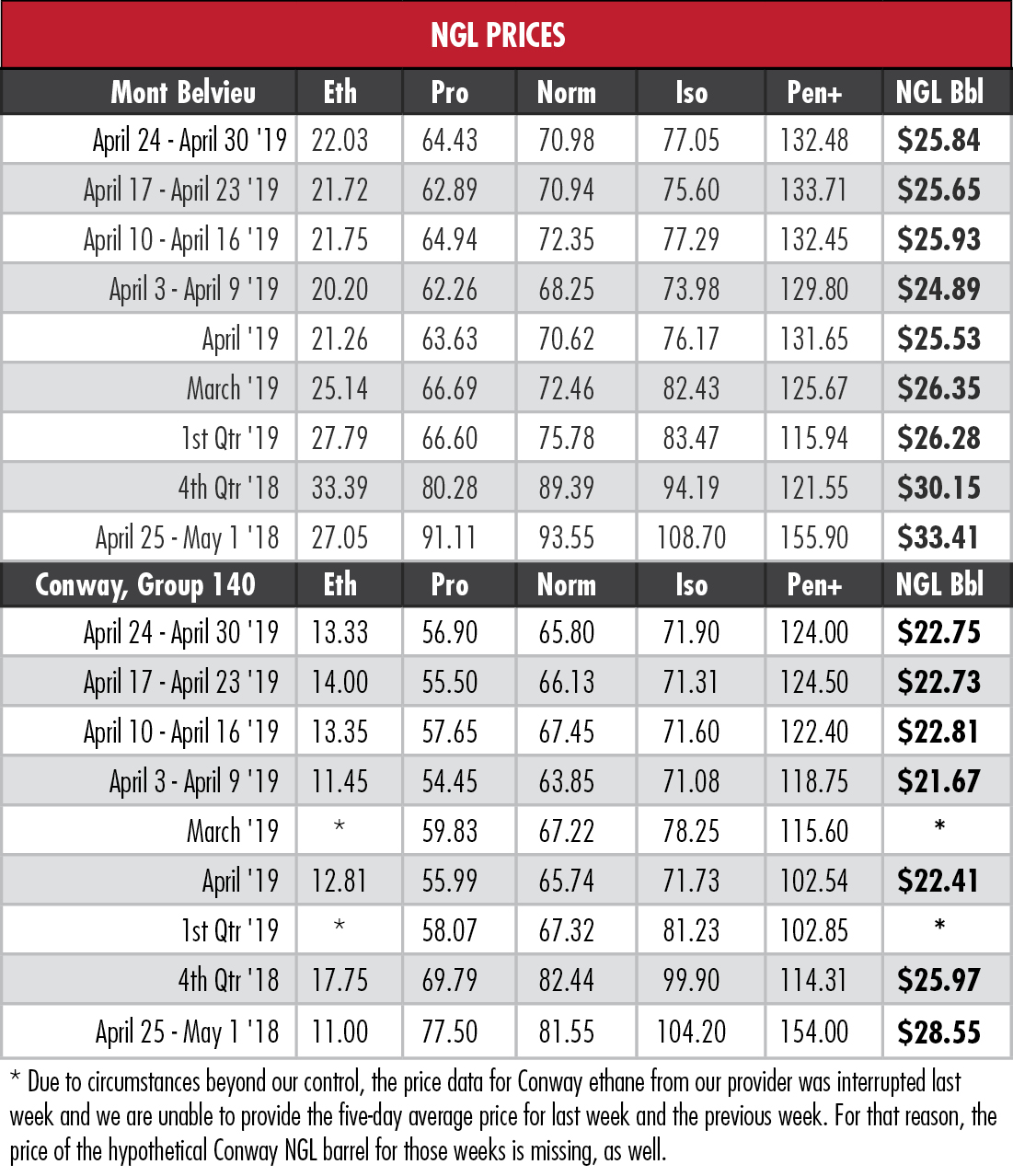

Mont Belvieu, Texas, ethane hit a five-week high, its average barely cresting 22 cents per gallon (gal) last week. EnVantage attributes the slow recovery to five crackers either starting or returning to operations this month. The analysts also said that the restart of the ethane exports from Marcus Hook, Pa., will not cut into exports from Enterprise Products Partners LP’s (NYSE: EPD) terminal at Morgan’s Point on the Houston Ship Channel.

Mont Belvieu, Texas, ethane hit a five-week high, its average barely cresting 22 cents per gallon (gal) last week. EnVantage attributes the slow recovery to five crackers either starting or returning to operations this month. The analysts also said that the restart of the ethane exports from Marcus Hook, Pa., will not cut into exports from Enterprise Products Partners LP’s (NYSE: EPD) terminal at Morgan’s Point on the Houston Ship Channel.

In the week ended April 26, storage of natural gas in the Lower 48 experienced an increase of 123 billion cubic feet (Bcf), the EIA reported, compared to the Stratas Advisors prediction of a 108 Bcf increase and the Bloomberg consensus of a 114 Bcf increase. The figure resulted in a total of 1.462 trillion cubic feet (Tcf). That is 9.6% above the 1.284 Tcf figure at the same time in 2018 and 17.8% below the five-year average of 1.778 Tcf.

Technical issues with Hart Energy’s data provider do not allow us to provide the price of ethane from Conway, Kan., for the last week of March because of a loss of pricing data for that time period. For the same reason, we cannot compare the price of the hypothetical Conway NGL barrel to the previous week. Conway ethane prices are not available for March 2019 and first-quarter 2019. We apologize for the inconvenience.

Recommended Reading

EDF Renewables, SCPPA Sign PPA for Bonanza Solar

2024-02-28 - The site is expected to start delivering electricity to SCPPA’s customers by Dec. 31, 2028.

SCF Acquires Flowchem, Val-Tex and Sealweld

2024-03-04 - Flowchem, Val-Tex and Sealweld were formerly part of Entegris Inc.

Enbridge Closes First Utility Transaction with Dominion for $6.6B

2024-03-07 - Enbridge’s purchase of The East Ohio Gas Co. from Dominion is part of $14 billion in M&A the companies announced in September.

Pembina Cleared to Buy Enbridge's Pipeline, NGL JV Interests for $2.2B

2024-03-19 - Pembina Pipeline received a no-action letter from the Canadian Competition Bureau, meaning that the government will not challenge the company’s acquisition of Enbridge’s interest in a joint venture with the Alliance Pipeline and Aux Sable NGL fractionation facilities.

Global Partners Buys Four Liquid Energy Terminals from Gulf Oil

2024-04-10 - Global Partners initially set out to buy five terminals from Gulf Oil but the purchase of a terminal in Portland was abandoned after antitrust concerns were raised by the FTC and the Maine attorney general.