No animals or ethane molecules were harmed in the making of this image. (Source: Shutterstock, HartEnergy.com)

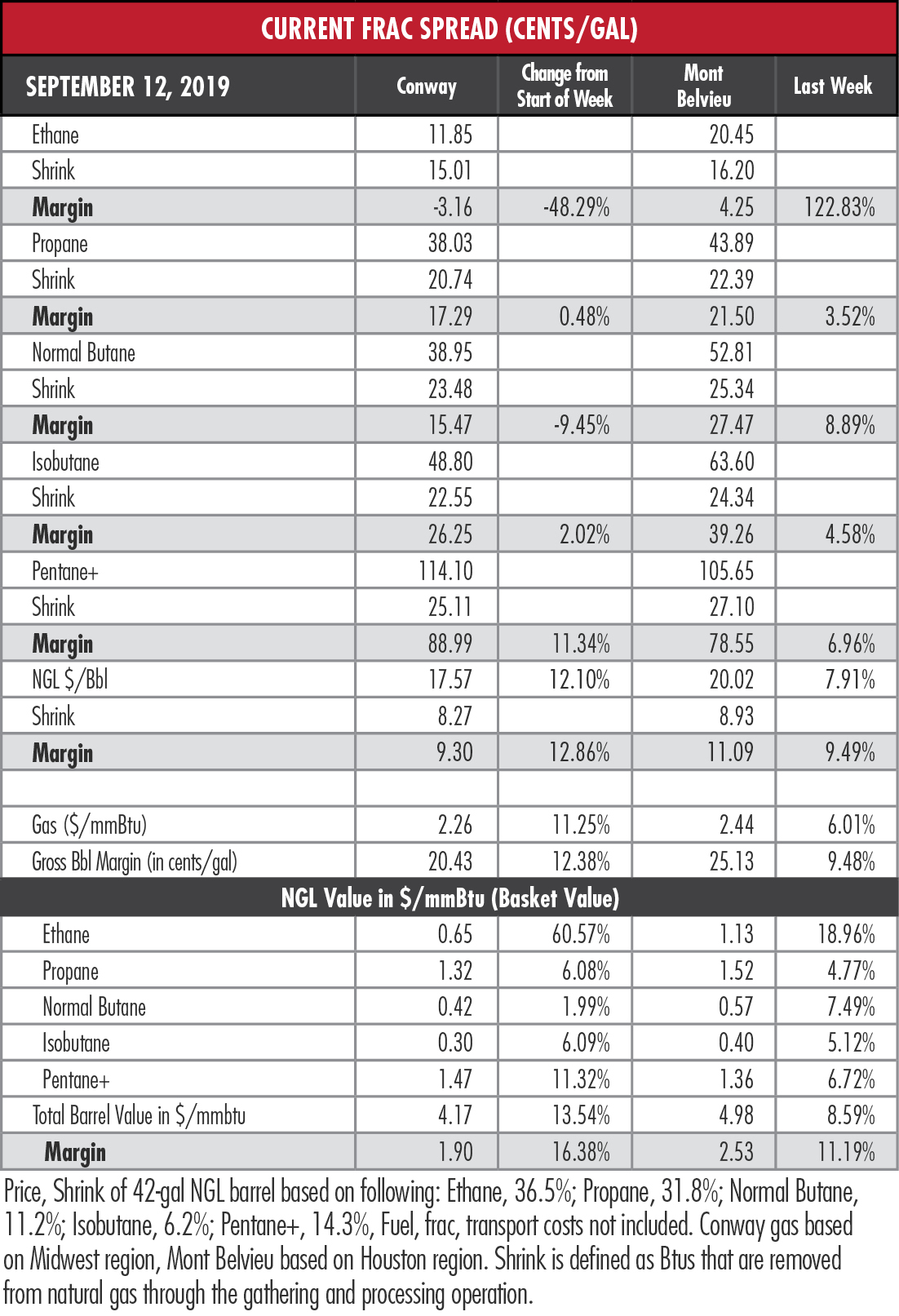

Ethane’s rally continued last week with the Mont Belvieu, Texas, price doubling since its collapse to near-single digits in late July. Adding to the giddiness, the hub’s hypothetical NGL barrel’s average price climbed above $20 for only the second time in the last 13 weeks.

Ethane’s margin also more than doubled in the past week to above 4 cents per gallon (gal). That type of movement, combined with the steadily increasing benchmark Henry Hub natural gas price, signals improving balances, EnVantage Inc. said in a report.

But it’s not just the surge in natural gas prices (up 12.9% for the month through Sept. 10) that is driving ethane’s skyward trajectory. EnVantage cited the reduction of ethylene plant outages and expectations that Sasol Ltd.’s 1.5 million-ton-per-year Lake Charles Chemicals Project and Shintech’s Plaquemine, La., crackers would soon be fully operational.

EnVantage’s optimism is guarded, however.

“Problems bringing new crackers online and unscheduled outages at existing crackers remain real threats to a sustainable increase in ethane demand and prices,” the analysts said. “Consequently, ethane balances will be very vulnerable for the next several months causing price volatility for ethane.”

There is also reason to believe that gas prices could be primed for a steep dive. IHS Markit said in a report released Sept. 12 that a persistent oversupply of natural gas, particularly from the Permian Basin, will push the average price for 2020 below $2 per million British thermal units, a level not seen in decades.

“It is simply too much too fast,” Sam Andrus, who covers North American gas markets for IHS Markit, said in a statement. “Drillers are now able to increase supply faster than domestic or global markets can consume it. Before market forces can correct the imbalance, here comes a fresh surge of supply from somewhere else.”

Two factors—the surge of associated gas from oil wells and additional pipeline capacity coming online—will drive the oversupply and force prices lower, the analytical firm said.

West Texas Intermediate (WTI) is up about 13% in the past month, lifting natural gas and propane with it. But propane’s boost lacks support from strong fundamentals, EnVantage notes. U.S. Energy Information Administration (EIA) data show U.S. storage 31% higher than last year at this time and Gulf Coast storage is 55% higher.

Price comparisons relative to that data reflect this trend. On Sept. 10, the Mont Belvieu propane price was 32.6% of WTI. The ratio on Sept. 10, 2018, was 65.6%.

“With more propane supplies on the way, propane disparately needs more demand pull to prevent a major surplus from occurring,” EnVantage said. “The height crop drying may not occur until mid- to late-October and the propane demand associated with crop drying will only last a few weeks. An early winter would be helpful but there are no guarantees that will happen.”

Mont Belvieu normal butane, having jumped 30.2% in the last three weeks, is at its highest point since late May. Its margin expanded by almost 9% last week. Good news, but only relatively so.

Like its comrades in the NGL community, butane has lost 55% of its value in the last year and its robust margin of 89.42 cents/gal a year ago, has diminished to 27.47 cents/gal. Mont Belvieu isobutane’s price is down 53.9% and its margin has narrowed from about $1.10/gal to 39.26 cents/gal.

Natural gasoline is struggling as well. The Mont Belvieu price is off by almost one-third compared to the price a year ago and last year’s $1.21/gal margin is now at 78.55 cents/gal.

Natural gasoline is struggling as well. The Mont Belvieu price is off by almost one-third compared to the price a year ago and last year’s $1.21/gal margin is now at 78.55 cents/gal.

“Natural gasoline has established a lower relationship to WTI due to lower export demand for natural gasoline as a diluent for oil sand production.” EnVantage said, “along with increased competition for markets from greater U.S. condensate production.”

In the week ended Sept. 6, storage of natural gas in the Lower 48 experienced an increase of 78 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. That compared to the Stratas Advisors expectation of an 83 Bcf build and the Bloomberg median consensus of an 81 Bcf build. The EIA figure resulted in a total of 3.019 trillion cubic feet (Tcf). That is 15% above the 2.626 Tcf figure at the same time in 2018 and 2.5% below the five-year average of 3.096 Tcf.

Recommended Reading

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.

US Oil Stockpiles Surge as Prices Dip, Production Remains Elevated

2024-02-14 - EIA reported crude oil stocks increased by 12.8 MMbbl as February began, far outstripping expectations.

Oil Settles at Highest in Nearly 8 Weeks on Strong Economic Growth

2024-01-26 - Oil prices settled at their highest in nearly two months on Jan. 26 as positive U.S. economic growth and signs of Chinese stimulus boosted demand expectations.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.