(Source: HartEnergy.com, Shutterstock)

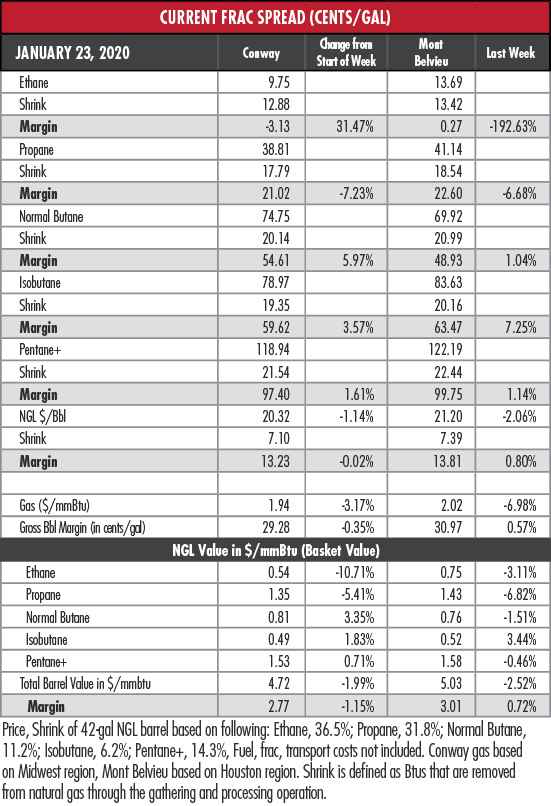

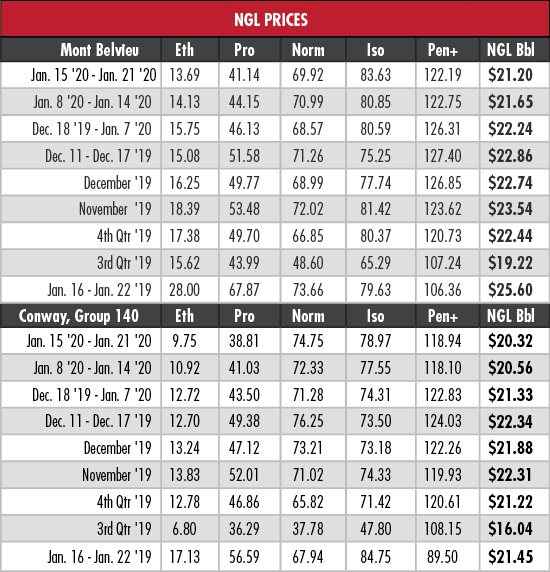

The price of Mont Belvieu, Texas, ethane continued its slide last week to its lowest point since mid-August, which is 27.5% below the fourth-quarter high of nearly 19 cents per gallon (gal) in the first week of November. Complicating matters is increased competition from propane as a feedstock.

But the benchmark Henry Hub price of natural gas has nosedived as well in that time, bolstering ethane’s margin. On Nov. 5, the gas price was $2.86 per million British thermal units (MMBtu)—on Jan. 21 it had fallen below $1.90/MMBtu, a 34% plunge that resulted in the margin improving last week and re-entering positive territory.

Ethane’s price decline has been aggravated by bloated inventory on the Gulf Coast, in spite of ramp-ups of the Formosa and Shintech crackers. But propane, another NGL under market siege, is vying for market share.

“We estimate that increased propane cracking will reduce ethane cracking demand by 50,000 barrels per day (bbl/d) to 100,000 bbl/d,” said EnVantage Inc. “It does not seem much, but with ethane stocks on the Gulf Coast at record levels and more fractionation capacity on the way, any competition from propane at the flexi-crackers will further pressure ethane prices.”

Ethane’s surplus, EnVantage maintains, will continue to grow during the first half of this year, “increasing the chances that ethane prices will drop to near single digits.” The analysts suggest that it will not be until the second half of the year that ethane is strong enough to support prices in the 25 cents/gal to 30 cents/gal range.

Propane’s high storage troubles are ongoing, as well. The U.S. inventory for the week ended Jan. 10, the U.S. Energy Information Administration (EIA) reported, was 30.3% above the total for the same time in 2019. On the Gulf Coast, the Jan. 10 figure was 52.5% above the same time last year.

For comparison, propane’s price on Jan. 21 was 29.3% of the price of U.S. benchmark West Texas Intermediate (WTI). A year ago, that price comparison was 52.5%. EnVantage does not see a strengthening anytime soon.

“The fundamentals will continue to deteriorate for propane over the next several months,” the analysts wrote. “Even if February is colder than normal, forecasts are indicating that March could be warmer than normal. Our latest forecasts are indicating that by the start of the spring, U.S. propane inventories could easily be 60% above 2019 springtime levels, with Mont Belvieu propane prices dipping to 25% of WTI prices.”

The Mont Belvieu normal butane price slipped last week but has remained fairly steady since the second week of November. On Jan. 21, the price was 52% of WTI. A year ago, it was at 58%.

The outlook is not terribly bright for butane either, which also must compete against propane.

“This may be as good as it gets for normal butane,” EnVantage said. “Normal butane cracking should decrease as ethylene producers switch to propane. Winter gasoline blending demand for normal butane will end by mid-February.”

Supplies of butane will grow as fractionators are completed, EnVantage said, and excess volumes will compete with propane for export dock capacity and space on tankers.

“Last summer, normal butane prices got below 35% of WTI,” the analysts said, “and we would not be surprised if normal butane reaches that low of a valuation this spring.”

In the week ended Jan. 17, storage of natural gas in the Lower 48 experienced a decrease of 92 billion cubic feet (Bcf), the EIA reported, compared to the Bloomberg analyst median of 88 Bcf and the Reuters forecast of 91 Bcf. The EIA figure resulted in a total of 2.947 trillion cubic feet (Tcf). That is 23.2% above the 2.393 Tcf figure at the same time in 2019 and 9.3% above the five-year average of 2.696 Tcf.

Recommended Reading

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.