Image of Pennsylvania sinkhole overlaid with formula for ethane. (Source: Shutterstock, Twitter, Hart Energy)

West Whiteland Township, Pa., 30 miles outside of Philadelphia in Chester County, was founded in 1765, is home to about 18,000 residents and offers, for those who register in advance, a series of three classes in March at the Exton Library that will qualify attendees to be certified master composters (assuming attendees complete the required six hours of volunteer composting).

It is also home to, well, a home in which a sinkhole developed in its backyard in January. The sinkhole exposed an eight-inch portion of Energy Transfer Partners LP’s Mariner East 1 pipeline that transports NGL from the Marcellus Shale to the company’s Marcus Hook, Pa., Industrial Complex export terminal. Except it can’t because it was shut down due to the aforementioned sinkhole, which measures five feet wide and 10 feet deep.

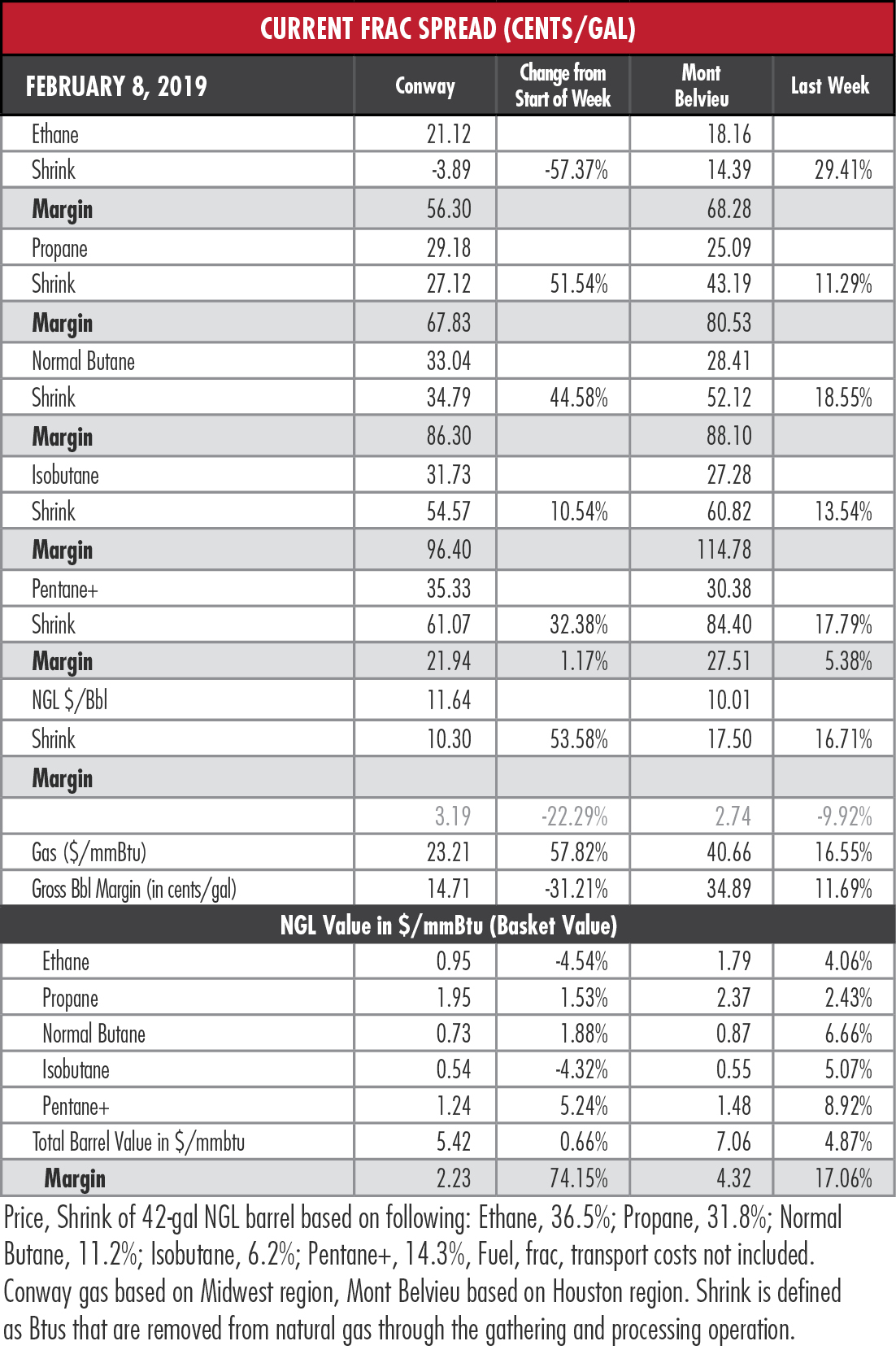

And that is why ethane prices have jumped 17.4% in the last three weeks. Ethane intended for export out of Marcus Hook has been redirected to the Morgan’s Point terminal on the Houston Ship Channel, which is operated by Enterprise Products Partners LP.

And that is why ethane prices have jumped 17.4% in the last three weeks. Ethane intended for export out of Marcus Hook has been redirected to the Morgan’s Point terminal on the Houston Ship Channel, which is operated by Enterprise Products Partners LP.

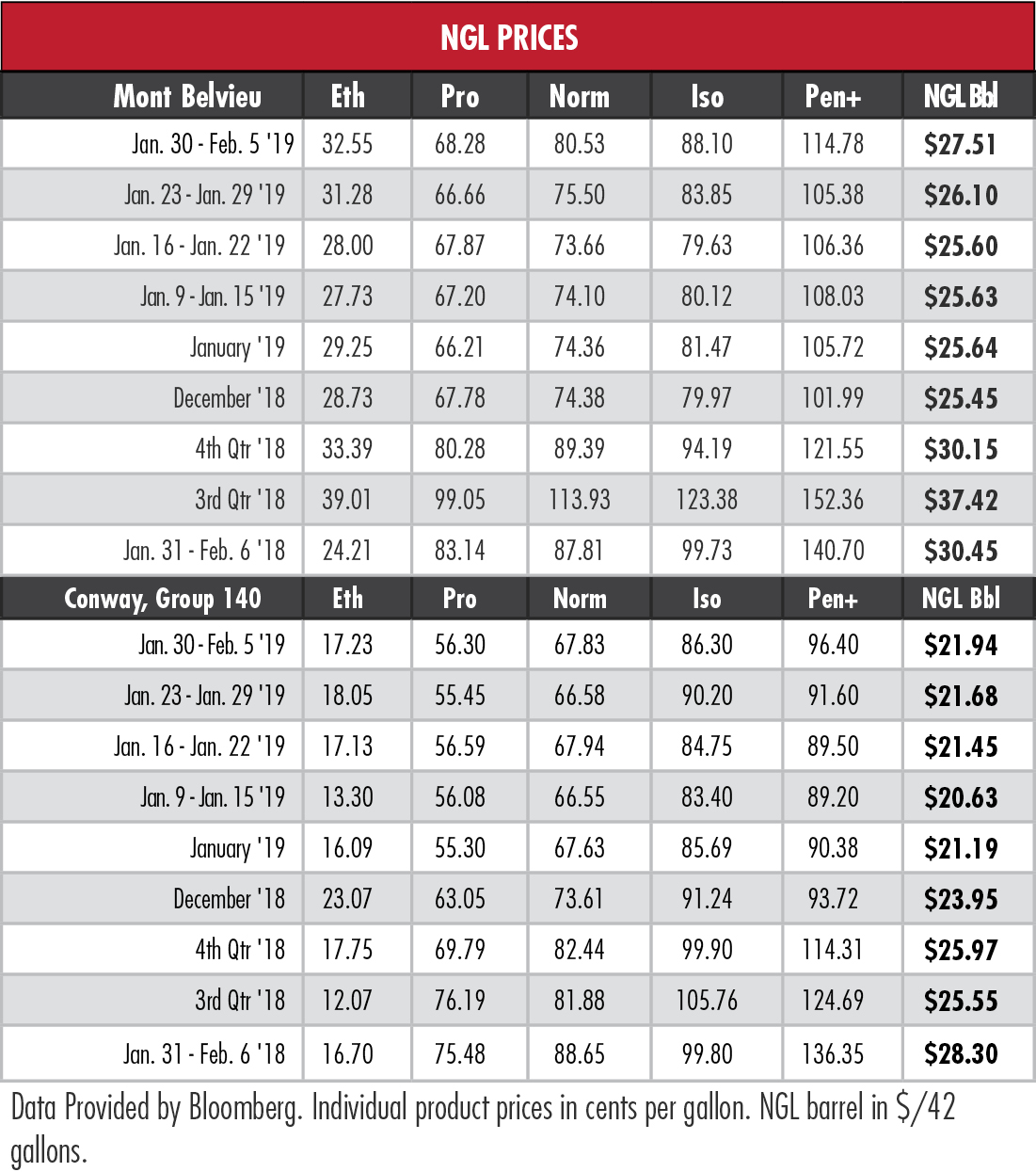

Ethane’s price jump to 32.55 cents per gallon (gal), the highest since late November, could be higher, said EnVantage Inc. in a report, except that ethane cracking demand is sluggish and exports from Morgan’s Point do not seem to be picking up as might be expected. Assuming that Mariner East 1 stays offline for a while, another 20,000 to 30,000 barrels per day (bbl/d) could flow into Morgan’s Point—not really a big deal, EnVantage said, with Gulf Coast ethane demand at around 1.5 million bbl/d to 1.6 million bbl/d.

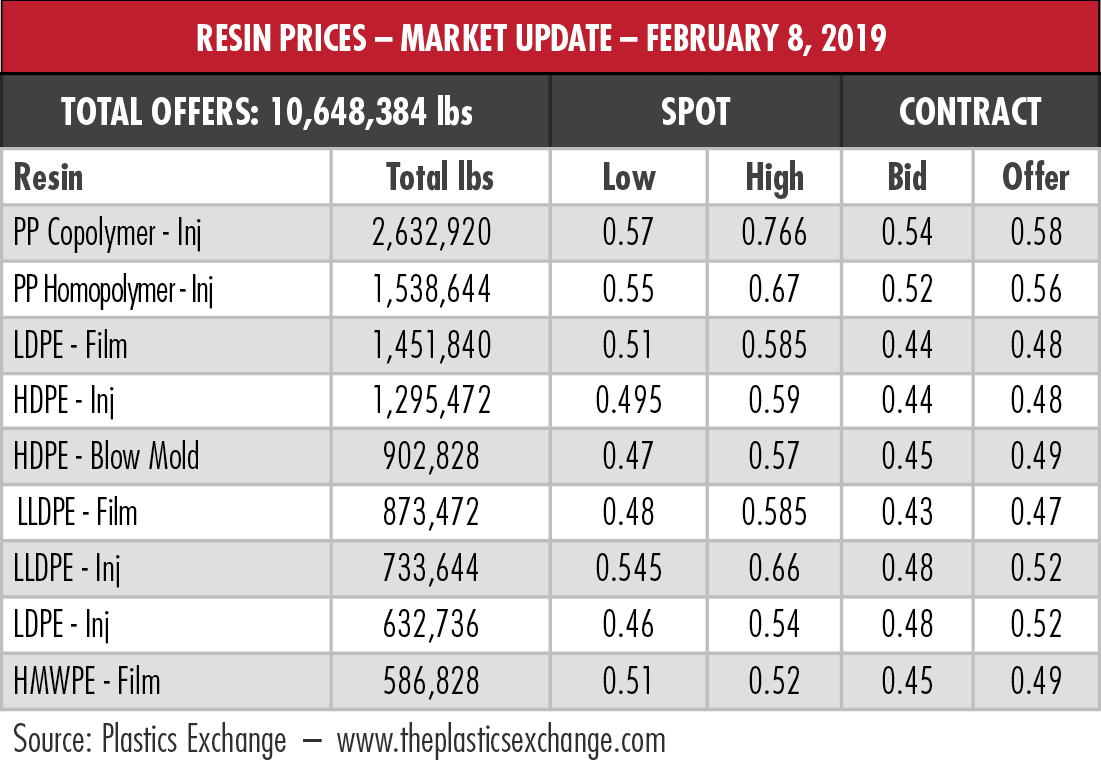

So, based on EnVantage’s assessment, the assumption of many analysts that ethane’s price is primed to increase in the first half of the year might need to be dumped into the “Seriously, Dudes?” file. Gulf Coast ethane inventories are up as demand has eased and ethylene demand is slow because stocks of ethylene and polyethylene are high. Crackers from Formosa and Sasol won’t make a difference until they come online in the second half of the year at the earliest.

And then there’s the challenge from propane and butane. The price of propane at Mont Belvieu inched up only 2.4% during the five-day period that included an arctic blast from a polar vortex that popped the Midwest the way J.J. Watt tackles a quarterback. There’s just too much of the stuff. EnVantage expects the oversupply of propane and butane in the spring and summer to cut into ethane’s market share, as they will be cheaper for crackers.

Prices were far above the last time Earth’s wounded inner Mr. Freeze acted up in January 2014. The hypothetical NGL barrel at Mont Belvieu peaked at $51.54 in the five-day period ending Jan. 28 and the price of propane peaked two weeks later at $1.61/gal. By comparison, the price of propane at Conway, Kan., was a whopping $3.97/gal that week.

Prices were far above the last time Earth’s wounded inner Mr. Freeze acted up in January 2014. The hypothetical NGL barrel at Mont Belvieu peaked at $51.54 in the five-day period ending Jan. 28 and the price of propane peaked two weeks later at $1.61/gal. By comparison, the price of propane at Conway, Kan., was a whopping $3.97/gal that week.

With natural gas well into its post-vortex decline, spreads widened across the board last week. Mont Belvieu ethane’s margin, which had climbed back to double-figures, expanded almost 30% to surpass 14 cents/gal. The hypothetical barrel’s margin expanded from $15 to $17.50.

In the week ended Feb. 1, storage of natural gas in the Lower 48 experienced a decrease of 237 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, compared to the Bloomberg consensus prediction of a 231 Bcf withdrawal. The figure resulted in a total of 1.96 trillion cubic feet (Tcf). That is 6.4% below the 2.095 Tcf figure at the same time in 2018 and 17.5% below the five-year average of 2.375 Tcf.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.