(Source: HartEnergy.com, Shutterstock)

Divining the short-term impact of the coronavirus outbreak on energy prices is tricky because of the multiple factors involved. Here’s a hint: it’s not good.

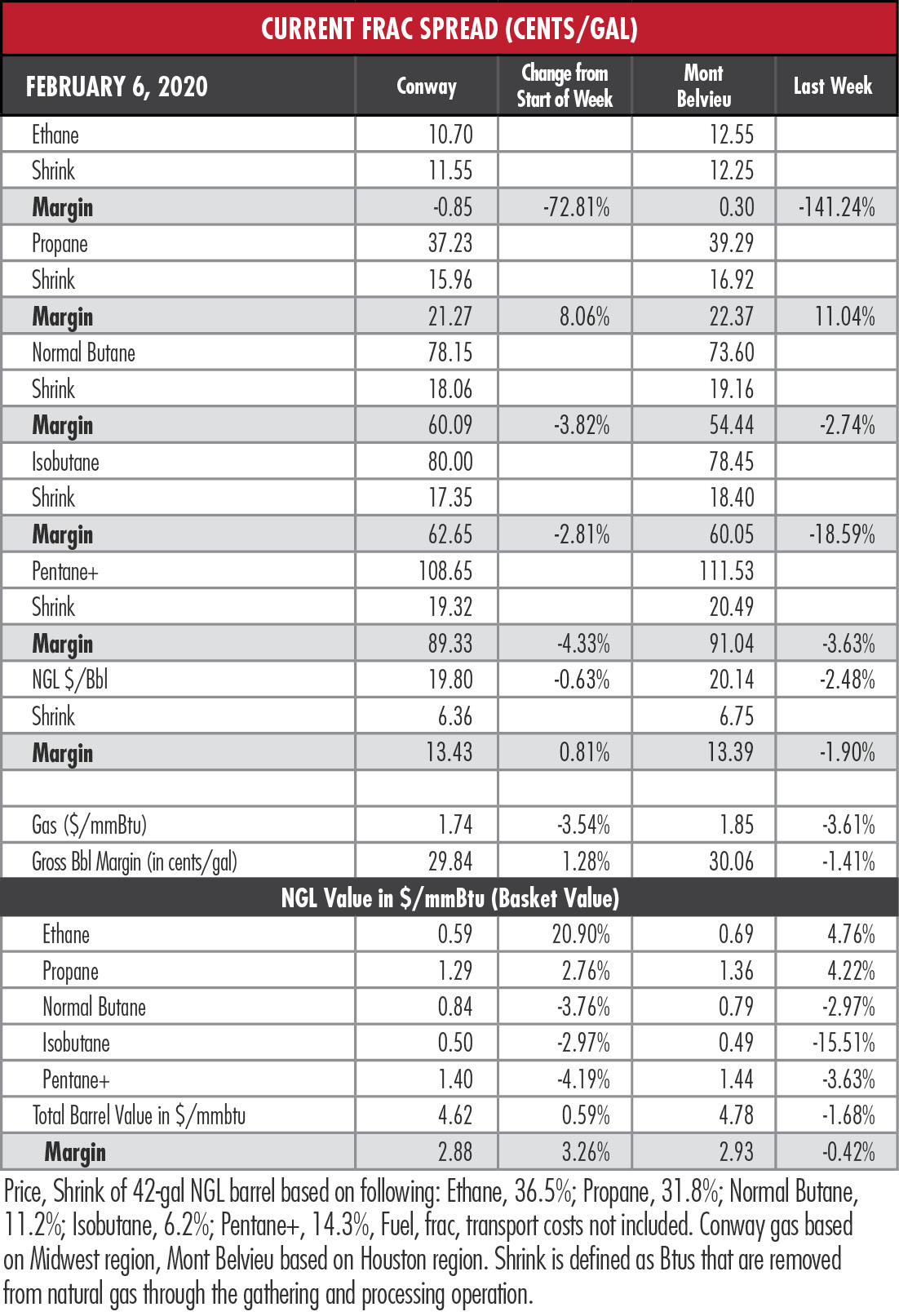

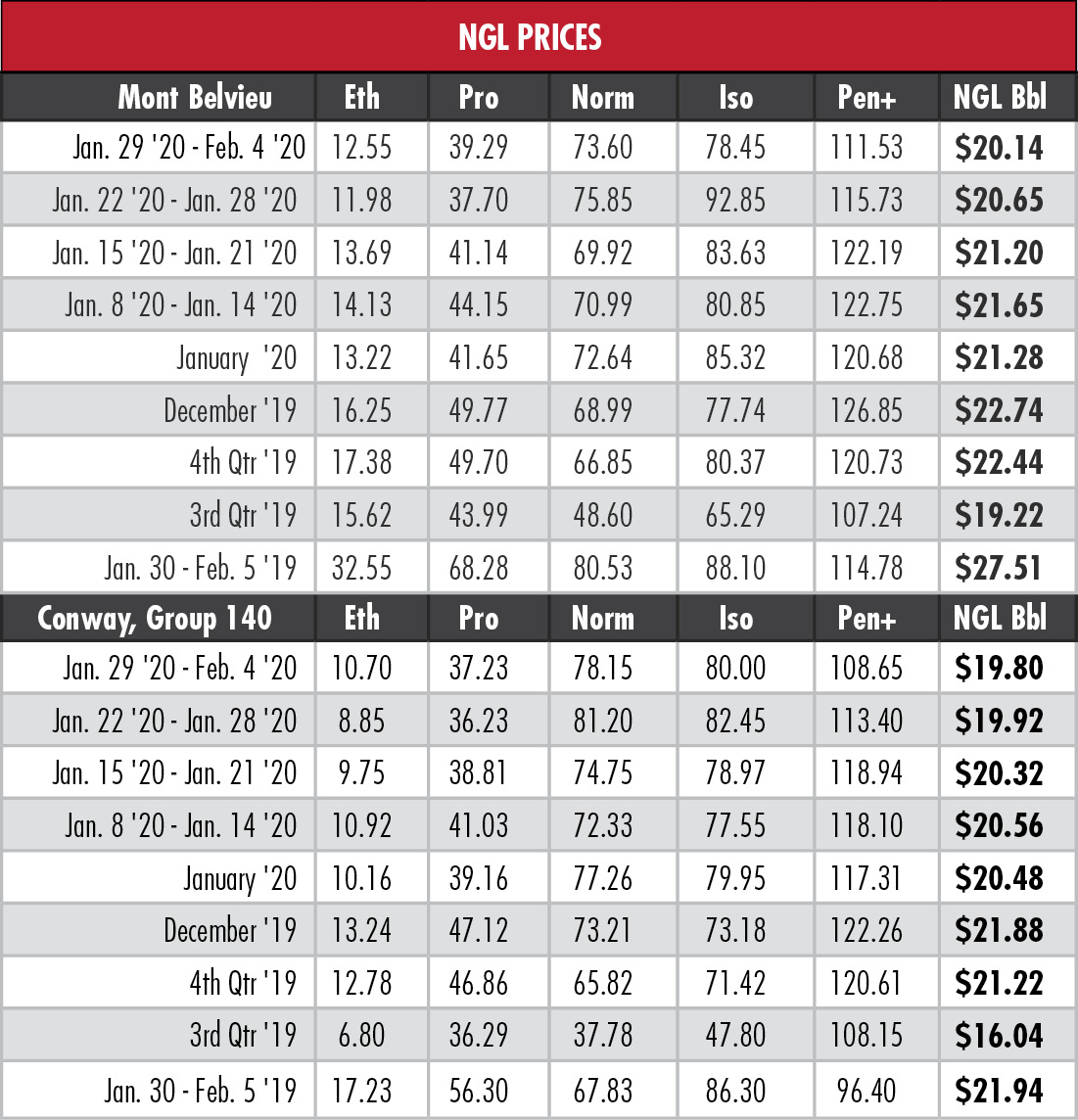

Last week’s hypothetical barrel at Mont Belvieu, Texas, fell to its lowest point in 21 weeks. Ethane and propane broke out of multiweek slumps, but comparisons to the same weeks in 2019—down 61.4% for ethane and down 42.5% for propane—are not encouraging.

The 2019 Novel Coronavirus outbreak is part of a global package deal of downers: Libyan oil production is down to about 204,000 barrels per day (bbl/d), compared to about 1.2 million bbl/d in 2011 prior to the country’s civil war, Bloomberg reported; while China buys no LNG from the U.S., it is the world’s biggest importer and the virus-related reduction in purchases will make it tougher for U.S. exporters to compete; and this winter’s polar vortex, which carried hopes to help power a surge in natural gas demand, has been MIA.

Cheniere Energy Inc. executive Corey Grindal bemoaned the lack of cold weather Feb. 5 at the NAPE Global Business Conference in Houston.

“If you would have asked me at the beginning of the winter, ‘what are the chances that southeast Asia, continental Europe and the United States all have warmer or significantly warmer-than-normal winters?,’ I would have given it a less than 1% chance,” Grindal said.

The impact will be slower growth as the world absorbs the LNG produced for cold weather that didn’t materialize, he said. But he noted the trend toward additional worldwide demand and said, “I do think the best thing to cure low prices is low prices.”

The most immediate hit from the coronavirus derives from China’s self-imposed quarantine. Air travel is extremely limited, meaning global demand for jet fuel is suddenly sharply decreased, which affects demand for the oil that is refined to produce it.

“A prolonged outbreak will certainly reduce demand for crude, particularly for jet fuel, but to what extent is still unknown,” EnVantage Inc. said in a report. EnVantage cited Platts Analytics scenarios of a 2.6 million bbl/d drop in demand for February and 2 million bbl/d cut in March. Best-case scenarios are 900,000 bbl/d in February and 650,000 bbl/d in March. Platts assumes that the virus impact will be short-lived and not extend beyond March.

In the meantime, natural gas prices are struggling mightily as both domestic and international inventories are at very high levels. The U.S. benchmark Henry Hub price slumped to a 12-month low of $1.82 per million British thermal units (MMBtu) on Feb. 3, which compared to the JKM (Japan Korea Marker) price of $3.73/MMBtu, as reported by Tellurian Inc. That’s not much of a spread to cover shipping costs.

Forward prices are so low that shut-ins at Gulf Coast LNG export facilities now seem viable, said Edmund Siau, a Singapore-based analyst with FGE. Siau told Bloomberg “there is usually a lead time before a cargo can be canceled, and we expect actual supply curtailments to start happening in summer.”

EnVantage said it expects the drilling slowdown to balance the market over the long term, but the shift toward DUCs is offsetting the slowdown in the near term.

While ethane and propane enjoyed somewhat wider spreads last week—with Mont Belvieu ethane moving back into the positive—heavy NGL dipped both in price and the spread, despite the lower gas prices. In coming weeks, EnVantage said, the price of normal butane should continue to drop.

“Cracking demand should drop as ethylene producers switch to propane,” the analysts said. “Gasoline blending demand for n-butane will end as refiners to switch to producing summer grade gasoline earlier than usual to capture higher margins.”

In the week ended Jan. 31, storage of natural gas in the Lower 48 experienced a decrease of 137 billion cubic feet (Bcf), the U.S. Energy Information Administration (EIA) reported, compared to the S&P Global Platts expectation of 126 Bcf. The EIA figure resulted in a total of 2.609 trillion cubic feet (Tcf). That is 30.8% above the 1.994 Tcf figure at the same time in 2019 and 8.3% above the five-year average of 2.41 Tcf.

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.