A butane molecule represents the NGL price drop. (Source: Shutterstock, Hart Energy)

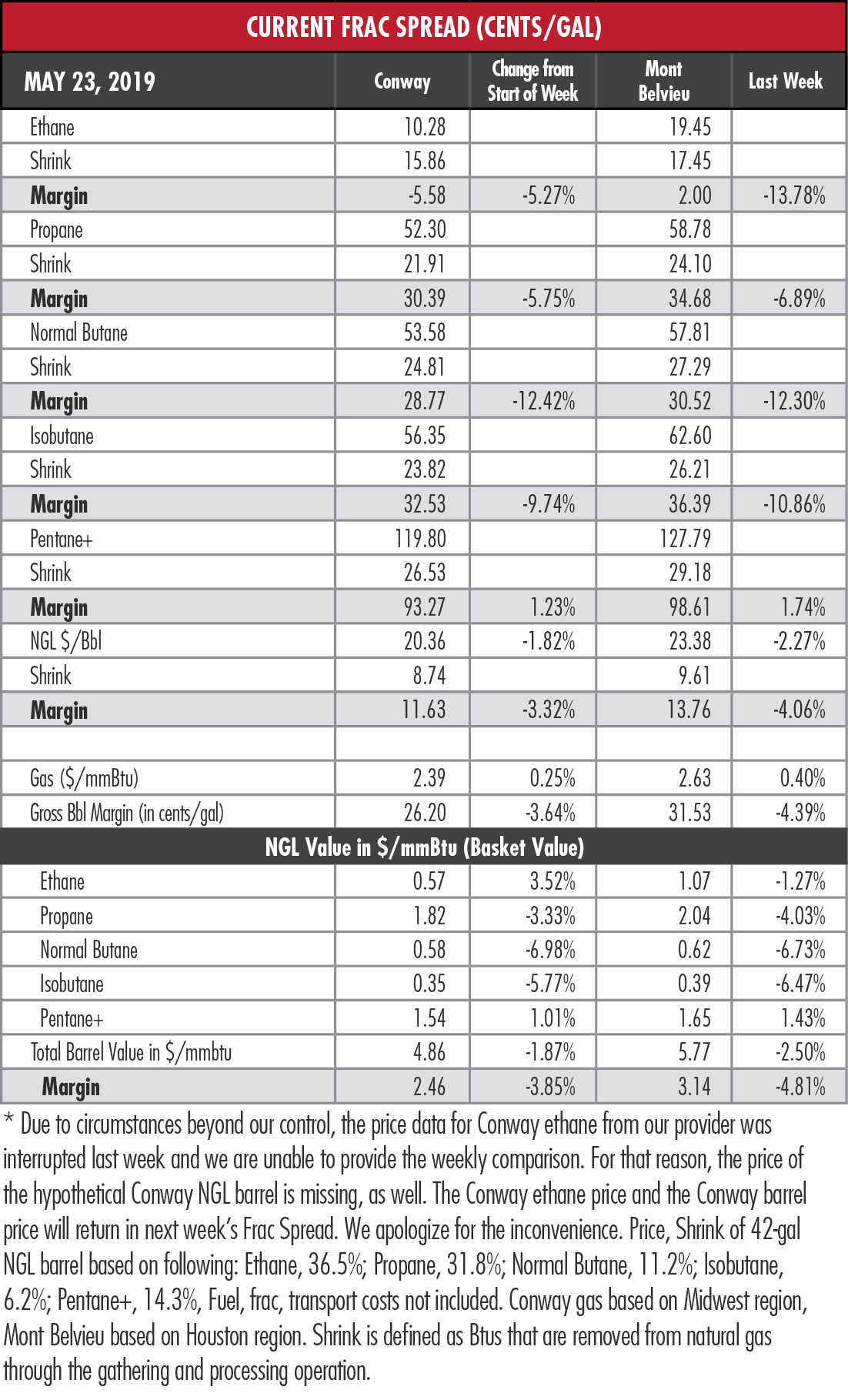

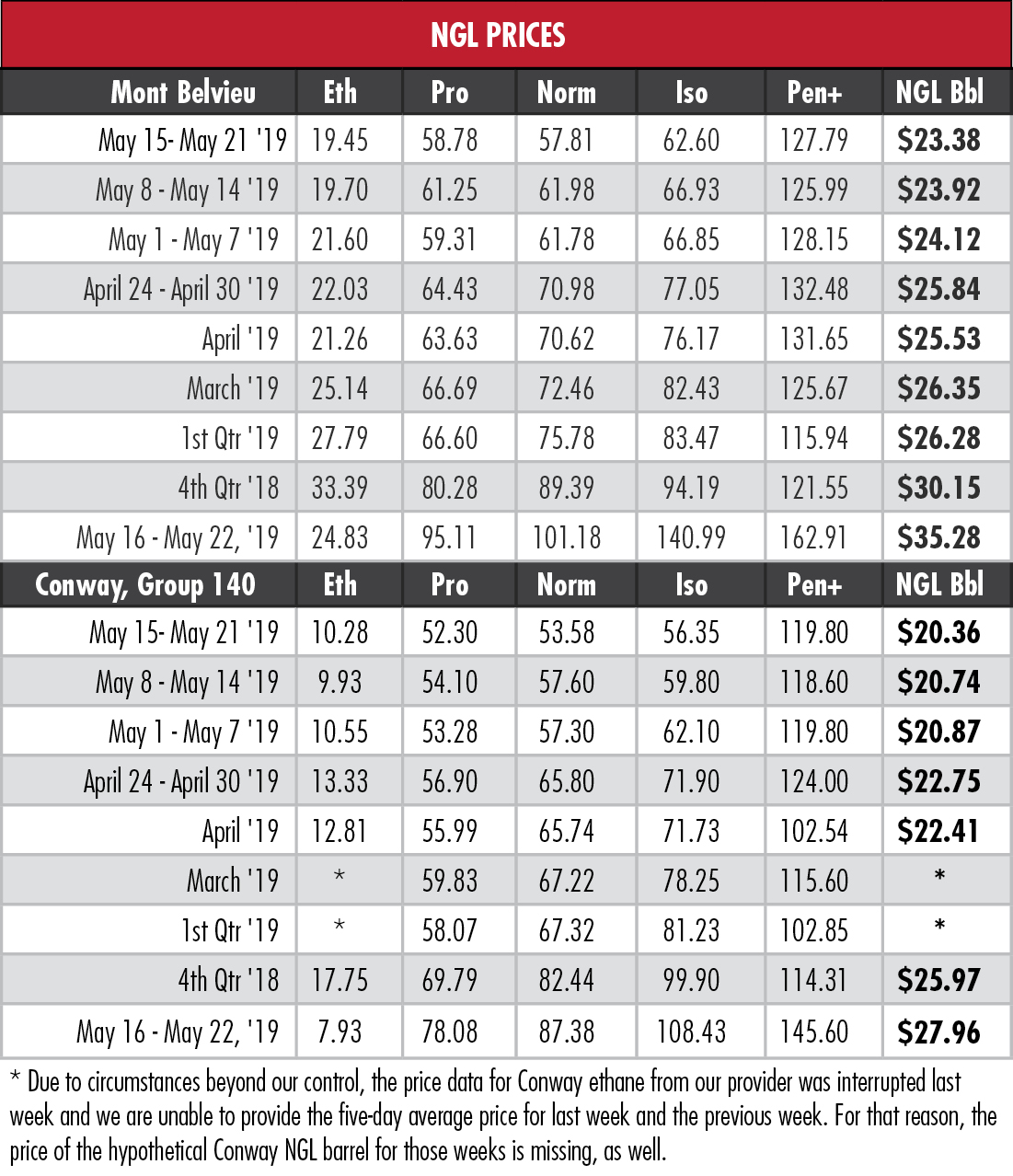

Mont Belvieu, Texas, butane tumbled 6.7% last week to a 34-month price low, and was joined by isobutane, which hit its lowest point since September 2016.

The hypothetical NGL barrel at Mont Belvieu reflected the slump by declining to a point not seen since Independence Day 2017. With the exception of C5+, margins narrowed across the board.

Normal butane is off 33% since peaking for the year at a little over 85 cents per gallon (gal) in mid-February. It is down 43% compared to the same week in 2018, and its price on May 21 was 37.5% of West Texas Intermediate (WTI) crude oil.

“N-butane is in the same boat as propane, suffering from too much supply that needs to be exported, but it must compete with propane for dock and ship space,” said an EnVantage Inc. report. Help is on the way, the analysts said, with Targa Resources Co.’s (NYSE: TRGP) Galena Park, Texas, export facility’s expansion expected to be completed by the third quarter. That will add about 100,000 barrels per day (bbl/d) of butane export capability.

“N-butane is in the same boat as propane, suffering from too much supply that needs to be exported, but it must compete with propane for dock and ship space,” said an EnVantage Inc. report. Help is on the way, the analysts said, with Targa Resources Co.’s (NYSE: TRGP) Galena Park, Texas, export facility’s expansion expected to be completed by the third quarter. That will add about 100,000 barrels per day (bbl/d) of butane export capability.

Propane’s price, below 60 cents/gal for only the second time in 2019, was down to its June 2017 level. The Mont Belvieu price has crested more than 70 cents/gal only once this year, in February, and is now 16.3% off that pace.

The U.S. Energy Information Administration (EIA) reported that propane and propylene stocks totaled 65.83 million barrels for the week ending May 17, or 60% higher than it was a year earlier. Since March 8, when winter withdrawals ended, the propane/propylene inventory has swiftly grown by 31.2%.

The U.S. Energy Information Administration (EIA) reported that propane and propylene stocks totaled 65.83 million barrels for the week ending May 17, or 60% higher than it was a year earlier. Since March 8, when winter withdrawals ended, the propane/propylene inventory has swiftly grown by 31.2%.

The overhang, EnVantage said, will continue.

“Until Enterprise’s 175,000 bbl/d export terminal expansion comes online sometime in the third quarter, it is likely the U.S. propane inventories could increase an additional 34 million barrels to 91 million barrels,” the report said. “Even with Enterprise’s terminal expansion, we see U.S. propane stocks hitting near 100,000 barrels by mid-October. Look for propane prices to remain depressed relative to WTI, between 35% and 45%.”

In the week ended May 17, storage of natural gas in the Lower 48 experienced an increase of 100 billion cubic feet (Bcf), the EIA reported, compared to the Stratas Advisors prediction of a 103 Bcf increase and the Bloomberg consensus of a 104 Bcf increase. The figure resulted in a total of 1.753 trillion cubic feet (Tcf). That is 8.5% above the 1.616 Tcf figure at the same time in 2018 and 13.5% below the five-year average of 2.027 Tcf.

In the week ended May 17, storage of natural gas in the Lower 48 experienced an increase of 100 billion cubic feet (Bcf), the EIA reported, compared to the Stratas Advisors prediction of a 103 Bcf increase and the Bloomberg consensus of a 104 Bcf increase. The figure resulted in a total of 1.753 trillion cubic feet (Tcf). That is 8.5% above the 1.616 Tcf figure at the same time in 2018 and 13.5% below the five-year average of 2.027 Tcf.

Technical issues with Hart Energy’s data provider do not allow us to provide the price of ethane from Conway, Kan., for the last week of March because of a loss of pricing data for that time period. For the same reason, we cannot compare the price of the hypothetical Conway NGL barrel to the previous week. Conway ethane prices are not available for March 2019 and first-quarter 2019. We apologize for the inconvenience.

Recommended Reading

Biden Administration Hits the Brake on New LNG Export Projects

2024-01-26 - As climate activists declare a win, the Department of Energy secretary says the pause is needed to update current policy.

Rystad Sees Little Support for Henry Hub in Coming Weeks

2024-01-26 - Rystad Energy sees little support for Henry Hub prices in the U.S. as dry gas production rises after the Jan. 17 Arctic freeze that impacted all of the Lower 48 states.

Baker Hughes Detects LNG Slowdown Solutions, Global Opportunities

2024-01-26 - Baker Hughes’ fourth quarter earnings call confronts Biden’s halt on LNG permitting with “solve itself” attitude.

Texas LNG Export Terminal Completes Required Permitting for FID

2024-01-26 - Glenfarne expects the Texas LNG project’s commercialization to be completed in the first half of 2024.

What's Affecting Oil Prices This Week? (Jan. 29, 2024)

2024-01-29 - For the upcoming week, Stratas Advisors forecast that increase in oil prices will be moderated likely due to the U.S. being cautious in response to the recent attack on U.S. troops.