The SeaRose FPSO, designed to work in harsh conditions in Atlantic Canada, has been producing from the White Rose Field in the Jeanne d'Arc Basin on the Grand Banks since 2005. (Source: Husky Energy)

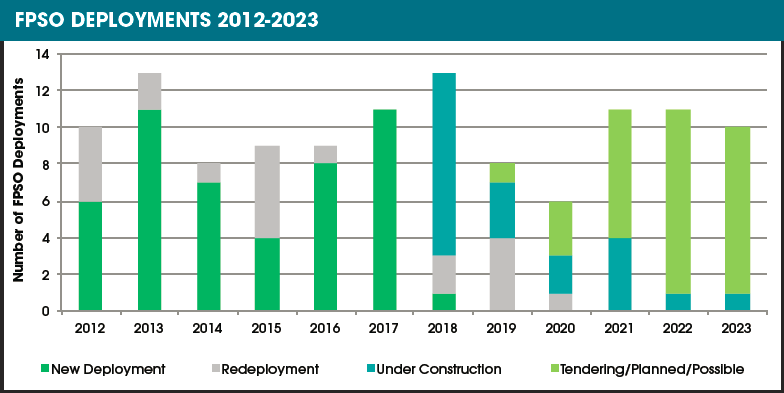

It goes without saying that the sharp fall in the oil price at the end of 2014 has had a brutal impact on the offshore oil and gas industry. The FPSO market has not been immune from the market downturn and consequently suffered from a very low level of new orders as operators held back while waiting for commerciality to improve. The year 2016 was a historically poor one. The FPSO order book did not record a single new order, and only one redeployment was announced.

Signs of revitalization

Then 2017 brought hope of a potential recovery with nine FPSO contracts granted, six new orders and three redeployments. Thus far in 2018, the revival seems to be continuing, with three contracts for new orders announced: Shell’s U.K. Penguins, Energean’s Israeli Karish/Tanin and CNOOC’s Chinese Liuhua 16-2 projects. According to IHS Markit FPSbase data, 12 FPSO awards could be granted before year-end 2018. This high number partly results from efforts made during the downturn to lower development costs. Now, with the oil price hovering around $60/bbl to $70/bbl, operators are in a better position to take final investment decisions (FIDs) on projects that were previously deemed uneconomical.

Both operators and contractors have worked to drive costs down. There appears to be stronger collaboration at an earlier stage of the contracting time line, with an increased number of exclusive FEED awards to improve design efficiency and lower costs. Since the pickup in 2017, exclusive FEEDs have resulted in awards such as TechnipFMC for Energean’s Karish/Tanin FPSO and SBM Offshore for Exxon Mobil’s Liza. A more recent example is the award from BP to TechnipFMC for an exclusive FEED contract that includes in its terms a transition to an engineering, procurement, construction and installation scope for the Greater Tortue FPSO, which will work offshore Mauritania and Senegal.

Also in a bid to cut costs, there has been a greater focus on standardization. SBM has taken the lead by developing the Fast4Ward project, which aims to reduce construction time by six to 12 months, providing operators with a cheaper and faster solution. The design consists of a newbuild with a generic double hull capable of accommodating an internal or external turret mooring system or spread mooring and standardized modules. The vessel will have production capacity of 100,000 to 250,000 bbl/d of oil and up to 2 MMbbl of storage.

SBM’s first Fast4Ward newbuild will be deployed offshore Guyana on Exxon Mobil’s Liza Field. First steel was cut on March 23 at Shanghai Waigaoqiao Shipbuilding in China. The future success of this technology is highly dependent on how well SBM performs in its delivery of this first unit. The FPSO industry is quite conservative when it comes to embracing new designs. For example, Sevan Marine has secured only six FPSOs since 2001 for its nontraditional, cylindrical-shaped hull.

Meanwhile, BW Offshore took matters into its own hands to secure contracts by becoming an operator as well as a contractor. BW acquired the Gabonese Dussafu license in late 2016 and the Namibian Kudu license in early 2017. The contractor selected an FPSO from its own fleet, the former FPSO Azurite, to be redeployed on the Dussafu project. The vessel was moved to the Keppel shipyard in Singapore to undergo minor modifications and was renamed Adolo for redeployment, scheduled for late 2018. The FID for Kudu has yet to be made, but BW is likely to provide the floating platform because it was bidding for the award prior to becoming operator.

Hope and uncertainty

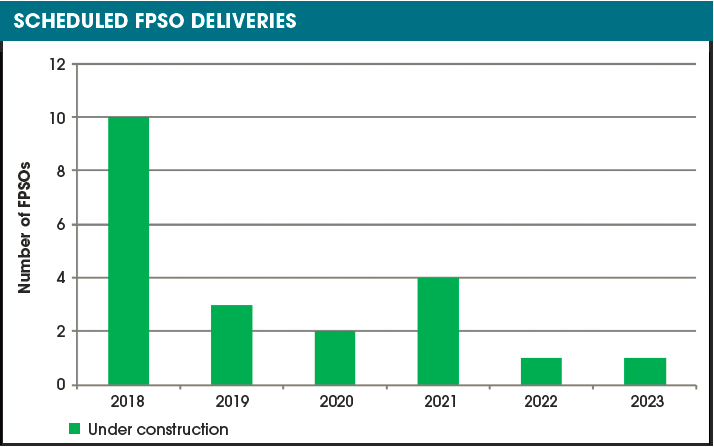

Despite industry efforts to improve viability, the scale of this downturn has resulted in a lingering high level of uncertainty. If new orders do not materialize soon, the supply of available FPSOs for work in the upcoming years could be impacted. Prior to the fall of the oil price, the order book for FPSOs held about 40 units. Since that time it has shrunk by almost half to just 21 units today, 10 of which are scheduled for delivery in 2018. Therefore, from 2019 onward, few orders are anticipated to come onstream, and the next two years could be particularly impacted as delivery timing is seen as becoming too tight.

While the order book has shrunk, the list of idle FPSOs has increased. FPSbase data show that out of the current 16 idle FPSOs, 13 came off contract during the downturn. Even with the possibility of redeploying some of these vessels, a large number of the available fleet are being sold for scrap due to a dearth of opportunities. Since the start of 2015, 10 FPSOs have been scrapped. The oversupplied redeployment market implies that owners have to be pragmatic about finding a second life for idle FPSOs.

Comparatively, however, the more competitive pricing in the redeployment market has left it less badly impacted. Six contracts have been awarded during the downturn. Usually redeployments are targeted at smaller projects, but interest for this development option is being expressed for larger-scale developments. For instance, Cairn has identified existing vessels for redeployment on its SNE project offshore Senegal. Phase 1 of the project will develop 240 MMbbl via 25 subsea wells tied back to the FPSO.

Regional demand

Some of the 12 potential contract awards stem from Petrobras’ ambitious strategic plan to boost field development activity offshore Brazil. The operator was absent from the FPSO contracting scene in 2015, 2016 and most of 2017 but is making a strong comeback, targeting as many as 18 units to come onstream before year-end 2022. Petrobras recommenced awarding FPSO contracts at yearend 2017 when it granted two leases to Modec for the Sepia and Mero fields. As many as seven FPSOs with delivery dates prior to year-end 2022 have yet to be awarded, of which five are targeted for an award this year. The high demand from Petrobras might be the opportunity for new entrants to get into the Brazilian market, such as Bumi Armada or Yinson, which have been absent from the region.

Elsewhere, foreseeable demand mostly comes from West Africa and Asia-Pacific. Demand from West Africa should remain steady as a few projects are expected to be sanctioned in the near to medium term.

First E&P has yet to announce a winner for an FPSO to operate Nigeria’s Anyala/Madu project. Also offshore Nigeria, Shell and Eni are to take FIDs for their respective Bonga Southwest/Aparo and Etan/ Zabazaba developments, large-scale projects that have not yet been awarded.

Contracts have been slow to be awarded in Asia-Pacific during the downturn but picked up in 2017 with the agreements being reached on Repsol’s Ca Rong Do (although this project has been suspended due to force majeure) and JX Nippon’s Layang project. Contracting activity has continued in 2018 with the award of CNOOC’s Liuhua 16/2 FPSO. Data indicate that another five projects could be awarded in Asia-Pacific before 2021.

On the horizon

At present, competition is fierce among FPSO owners and yards, giving operators access to attractive prices due to spare capacity. As more awards are expected to materialize, operators would be wise to hurry if they want to take advantage of the window of opportunity for low-expenditure development. Once orders start to fill the backlog and tighten yard capacity, the tables might begin to turn.

Recommended Reading

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.