(Source: Hart Energy; Shutterstock.com)

Harvest Oil & Gas Corp. landed an agreement on July 8 to sell its remaining assets as the Houston-based independent E&P and former affiliate of EnerVest Ltd. aims to begin the process of winding-up and returning capital to its shareholders.

The divestiture includes the sale of its Appalachian Basin position, which Harvest said in a statement will represent “substantially all of the assets of the company.”

Harvest agreed to sell the assets to an unaffiliated third party in exchange for $20.5 million, comprising $14.5 million of cash and a $6 million note. The holders of a majority of the common stock of Harvest have approved the transaction, according to the company’s release.

In May, Harvest voluntarily deregistered its common stock, which had been trading on OTC Market’s OTCQX U.S. Premier Marketplace.

Harvest is a successor company of EV Energy Partners LP, a former affiliate of EnerVest that emerged from bankruptcy in June 2018. EnerVest was not a part of its affiliate’s bankruptcy filing.

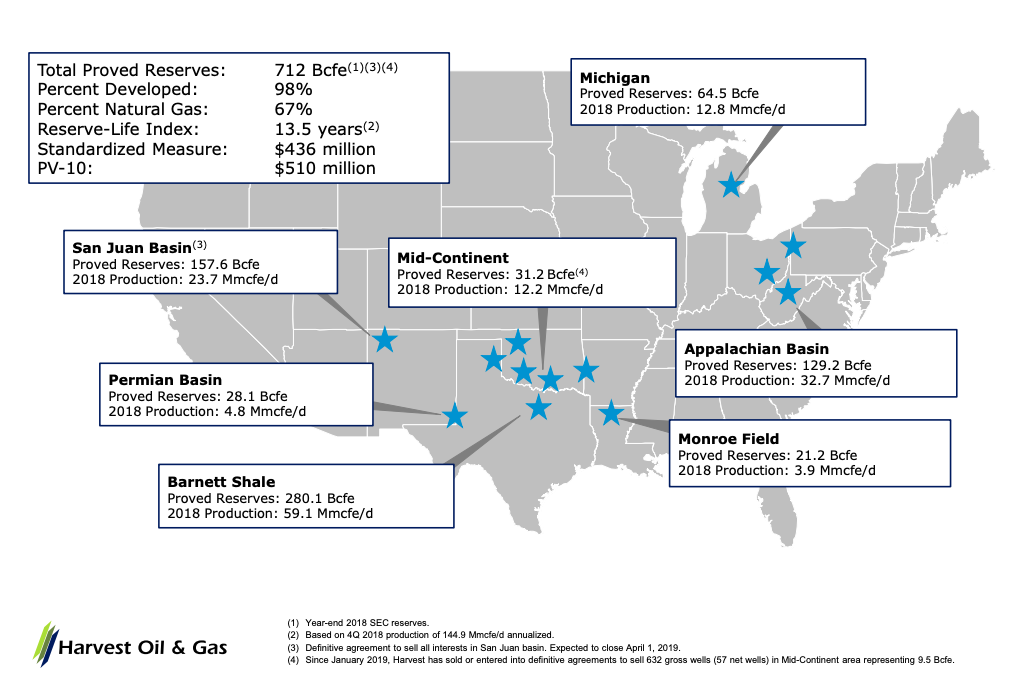

From the restructuring, Harvest inherited a multi-basin portfolio including positions in the Permian Basin and Midcontinent region, which it has since sold off, piece by piece. Most recently, the company entered an agreement in March to sell all of its oil and natural gas properties in Michigan for a purchase price of $4.8 million. The transaction was expected to close during the second quarter.

Following closing of the Appalachian Basin asset sale, expected in August, the company said it “intends to evaluate the process of winding-up and of returning capital to its shareholders.” Harvest added the evaluation will be dependent upon an analysis of the net cash available for distribution to its stockholders and the amount of net cash that must be retained to satisfy its ongoing liabilities during the winding-up process.

The Appalachian Basin asset transaction has an effective date of July 1. The definitive agreement contains various representations, warranties, covenants and indemnification obligations of the company and the buyer that are customary in transactions of this type, the company release said.

Recommended Reading

Marketed: Confidential Seller Certain Mineral, Royalty Interests in Louisiana

2024-02-13 - A confidential seller retained RedOaks Energy Advisors for the sale of certain mineral and royalty interests in Louisiana.

Marketed: Private Seller Certain Royalty Properties in D-J Basin

2024-02-13 - A private seller retained RedOaks Energy Advisors for the sale of certain royalty properties in the D-J Basin.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

Dorchester Minerals Buys Interests in Two Colorado Counties

2024-04-01 - Dorchester Minerals’ acquisition totals approximately 1,485 net royalty acres for roughly $17 million.