President Joe Biden’s administration approved on March 13 ConocoPhillips’ Willow project on Alaska’s North Slope — a downsized version of the E&P’s multi-billion project that illustrates the growing focus governments worldwide are placing on energy security.

The approval comes from an administration that imposed moratoriums on oil and gas drilling on federal lands, only to see the price of oil and gas skyrocket. The subsequent invasion of Ukraine by Russia has altered the thinking of leads of many nation states as they look to secure energy supplies.

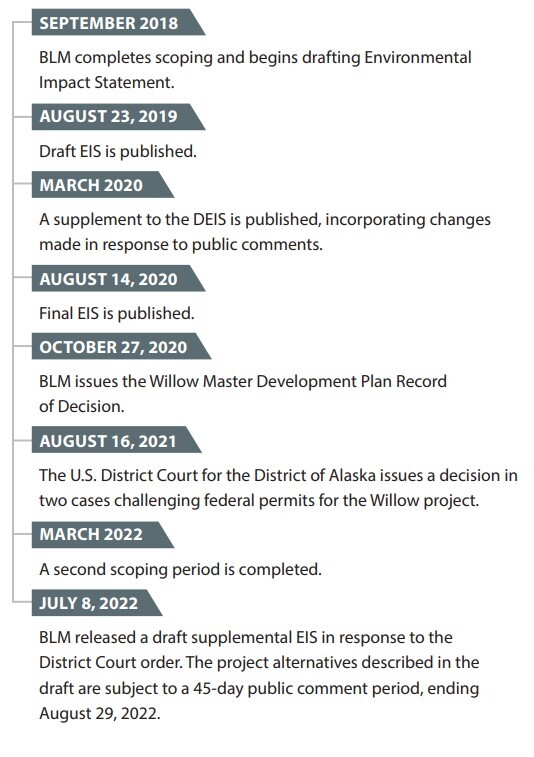

The approval comes after years of delays. The Willow Project began planning in earnest in 2018. But the company’s designs on the project have spanned five presidential administrations. The resulting decision released on March 13 by the U.S. Department of Interior (DOI) pares down the company’s requests, but undoubtedly represents a win for oil and gas producers.

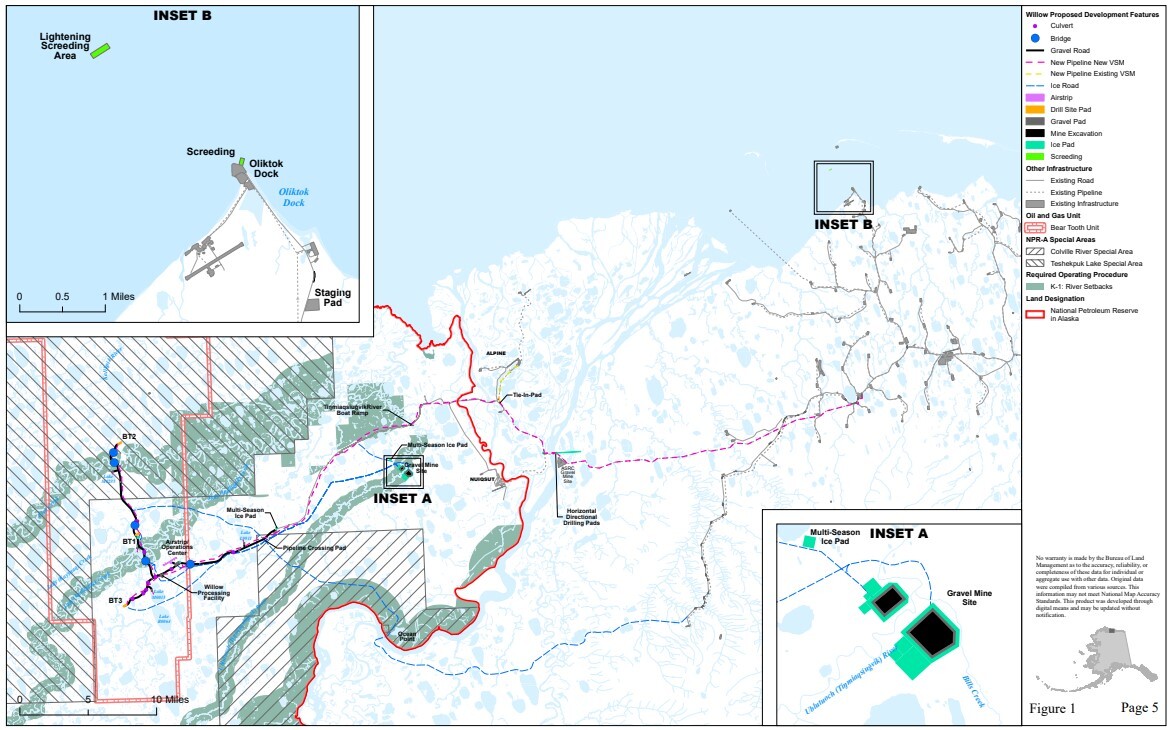

The DOI’s final approval substantially reduces the amount of surface infrastructure, including gravel roads, ice roads and pipelines and gives ConocoPhillips “the least amount of project and inject wells” at 199 approved, compared to a previous request for 251 well sites. Two of the five drill sites proposed by ConocoPhillips’ were not approved.

In a press release, DOI said the company will also relinquish rights to approximately 68,000 acres of its existing leases in the National Petroleum Reserve-Alaska (NPR-A), including approximately 60,000 acres in the Teshekpuk Lake Special Area.

ConocoPhillips relinquishment of 68,000 acres of its northernmost and southernmost leases within the Bear Tooth Unit also reduces its footprint there by one-third.

“This reduces the project’s freshwater use and eliminates all infrastructure related to the two rejected drill sites, including approximately 11 miles of roads, 20 miles of pipelines and 133 acres of gravel, all of which reduces potential impacts to caribou migration and subsistence users,” the DOI said.

The Willow project represents a massive $8 billion investment by ConocoPhillips and, the company said, the largest project in size and scale to be developed on the North Slope in more than 120 years. The project would also create roughly 2,500 construction jobs and about 300 long-term jobs.

ConocoPhillips has offered various estimates for the project’s oil production. The company’s website said Willow would produce, at its peak, 180,000 bbl/d of oil.

In November, ConocoPhillips Chairman and CEO Ryan Lance told Hart Energy that Willow is “potentially a several-hundred-million-barrel resource. The peak rate would be 160,000 bbl/d.” ConocoPhillips has said cumulative barrels of recoverable oil at about 600 MMbbl.

“This was the right decision for Alaska and our nation,” Lance said in a March 13 news release. “Willow fits within the Biden Administration’s priorities on environmental and social justice, facilitating the energy transition and enhancing our energy security, all while creating good union jobs and providing benefits to Alaska Native communities.”

Lance noted that the project had pass through five years of “rigorous regulatory and environmental review,” and that Willow is designed to support and coexist with subsistence activities with many mitigation measures built into the project design.

The project will also be a boon for the taxman. The DOI’s Bureau of Land Management estimated Willow could generate between $8 billion and $17 billion in levies for federal, state and local governments.

Despite the smaller scale of the project, environmental groups were angered by decision.

The Alaska Wilderness League expressed “deep disappointment” with President Biden’s decision to greenlight the project and called it a defining decision for his administration’s climate legacy.

In a press release, Kristen Miller, executive director of the group, said the decision was wrong for the climate and projecting biodiversity.

“The Willow project is designed to open the door to the development of billions of barrels of oil over decades,” she said. “Let’s be clear: rampant oil and gas development on our nation’s public lands must stop now. We will keep fighting the Willow project and future projects like it. And we call on the administration to change the way we manage all our nation’s public lands for climate, starting with America’s Arctic.”

DOI’s announcement came as President Biden said he would take action to designate approximately 2.8 million acres in the Arctic Ocean nearshore the National Petroleum Reserve in Alaska as indefinitely off limits for future oil and gas leasing.

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.