Additional discoveries could be in store as operators gear up for more drilling throughout the year. (Source: Shutterstock.com)

Buoyed by improved market conditions and increased capital spending on exploration, majors such as Exxon Mobil Corp., Total and Repsol are driving a pickup in global conventional oil and gas discoveries this year.

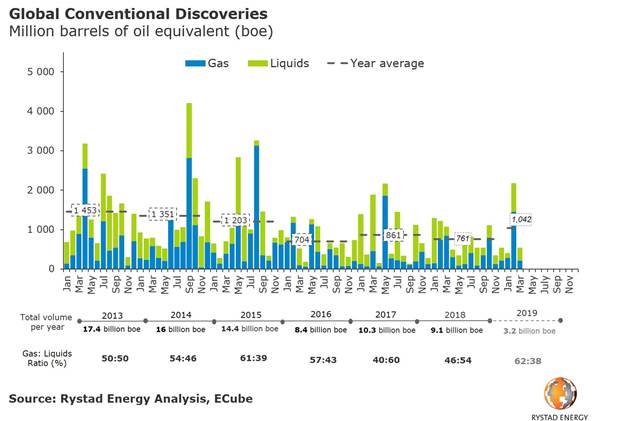

About 3.2 billion barrels of oil equivalent (Bboe) in conventional resources were discovered in first-quarter 2019, with 2.2 Bboe of that found in February alone, according to Rystad Energy.

The turnaround comes after years of exploration spending cutbacks prompted by a market downturn. The volume of conventional resources discovered had been trending down since 2013 before picking up in 2017 only to fall again the following year as conventional plays competed with unconventional shale plays, notably in the U.S.

But Rystad Energy analysts and others monitoring drilling activity, exploration spending and other trends have noticed signs of improvement.

“The exploration drilling activity bottomed out in 2017 and with improvement in market conditions operators are now reporting significant increase in their exploration drilling plans for 2019,” Taiyab Zain Shariff, an upstream research analyst for Rystad, told Hart Energy in a statement. “These include a larger number of high impact wells which if successful could yield significant resources. A renewed optimism in exploration with committed capital expenditure at key regions is already being seen in 2019, which would be the essence to reverse the trend.”

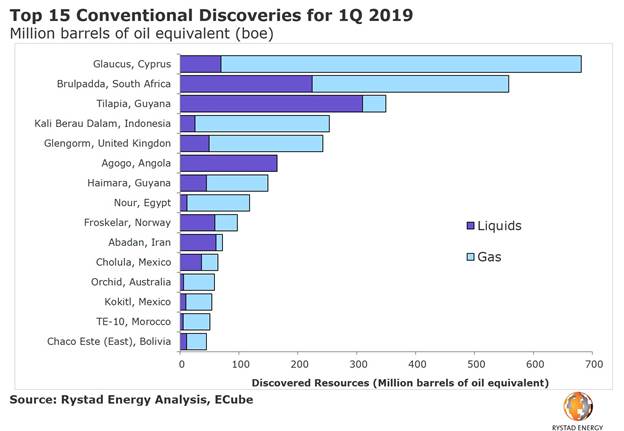

Three offshore discoveries announced in February by Exxon Mobil put the company ahead of the pack with 38% of the total discovered volumes during the year’s first quarter.

The Irving, Texas-headquartered company brought the number of discoveries on the Stabroek Block offshore Guyana up to a dozen with the Tilapia-1 and Haimara-1 wells. The duo elevated the estimated discoverable resource for the block to more than 5 Bboe.

That news was followed about two weeks later with word from Exxon Mobil of a discovery offshore Cyprus, where the Glaucus-1 well hit a gas-bearing reservoir of about 133 m in the Eastern Mediterranean Sea. The discovery, which Exxon Mobil said could have an in-place natural gas resource between about 5 trillion cubic feet (Tcf) and 8 Tcf, was the biggest find made during the first quarter.

But the U.S. major wasn’t alone in finding success with the drillbit.

European major Total opened a new oil and gas play offshore South Africa with the Brulpadda well, which hit 57 m of net gas condensate pay in Lower Cretaceous reservoirs.

Discoveries are also being made onshore. Spain’s Repsol, for example, said it made the largest gas discovery in Indonesia in 18 years. The operator, working with partners Petronas and Moeco, said preliminary estimates show the KBD-2X well in South Sumatra could have at least 2 Tcf in recoverable resources, placing it among the world’s top 10 discoveries made in the last year or so. Rystad called it the largest onshore discovery of first-quarter 2019.

The quarter also brought the largest discovery in a decade for the U.K. North Sea, according to Rystad. China National Offshore Oil Corp. and partner Total started a new chapter for the mature North Sea in January with the Glengorm discovery on the U.K. Continental Shelf. Recoverable resources are estimated at about 250 million boe.

“If the rest of 2019 continues at a similar pace, this year will be on track to exceed last year’s discovered resources by 30%,” Shariff said in a news release.

Discoveries have not been limited to certain regions, as Shariff pointed out there are several global conventional exploration hotspots. Operators are stacking up ready to drill prospective inventories in Northwest Europe, West Africa, Australia, Mexico and South America, he told Hart.

“These areas fit right into the companies’ strategical exploration plans which include a few frontier, presalt and mature areas,” Shariff continued. “Optimism from recent discoveries and geological and geophysical studies make them attractive and also backed with sustained costs. For example: Australia’s Dorado discovery, uptick in presalt exploration in Brazil, etc.”

Additional finds could be in store as operators gear up for more drilling throughout the year.

Among the wells to watch, according to Rystad, are the Royal Dutch Shell-operated Peroba well offshore Brazil, pre-drill prospective resource estimates of 5.3 Bboe; Eni’s Kekra well offshore Pakistan, pre-drill prospective resource estimates of 1.5 Bboe; and the Total-operated Etzil well offshore Mexico, pre-drill prospective resource estimates of 2.7 Bboe.

The trio is on a list of 35 high impact exploration wells that will be drilled in 2019. If operators prove successful, “2019’s interim discovered resources will be the largest since the downturn in 2014,” Shariff said in the statement.

Other wildcats to watch this year include Total’s Mailu-1 in Australia, Kosmos Energy’s Orca in Mauritania and Shell’s Gato do Mato presalt well in Brazil, he added.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

As ONEOK Digests Magellan, Sets Stage for More NGL Growth in 2024

2024-02-28 - ONEOK is continuing the integration of its newly acquired Magellan assets in 2024 as the company keeps an eye out for M&A opportunities and awaits regulatory approvals for certain projects.

Williston Warriors: Enerplus’ Long Bakken Run Ends in $4B Chord Deal

2024-02-22 - Chord Energy and Enerplus are combining to create an $11 billion Williston Basin operator. The deal ends a long run in the Bakken for Enerplus, which bet on the emerging horizontal shale play in Montana nearly two decades ago.

Dallas Fed Energy Survey: Permian Basin Breakeven Costs Moving Up

2024-03-28 - Breakeven costs in America’s hottest oil play continue to rise, but crude producers are still making money, according to the first-quarter Dallas Fed Energy Survey. The situation is more dire for natural gas producers.

US Proposes Second GoM Wind Lease Auction

2024-03-20 - Combined, the four proposed areas for offshore wind have the potential to power about 1.2 million homes if developed, according to the Interior Department.